🌎 Climate brick by brick #194

A new framework for scaling climate tech companies, just in time for Earth Day

Happy Monday!

TSwift isn’t the only one setting records.

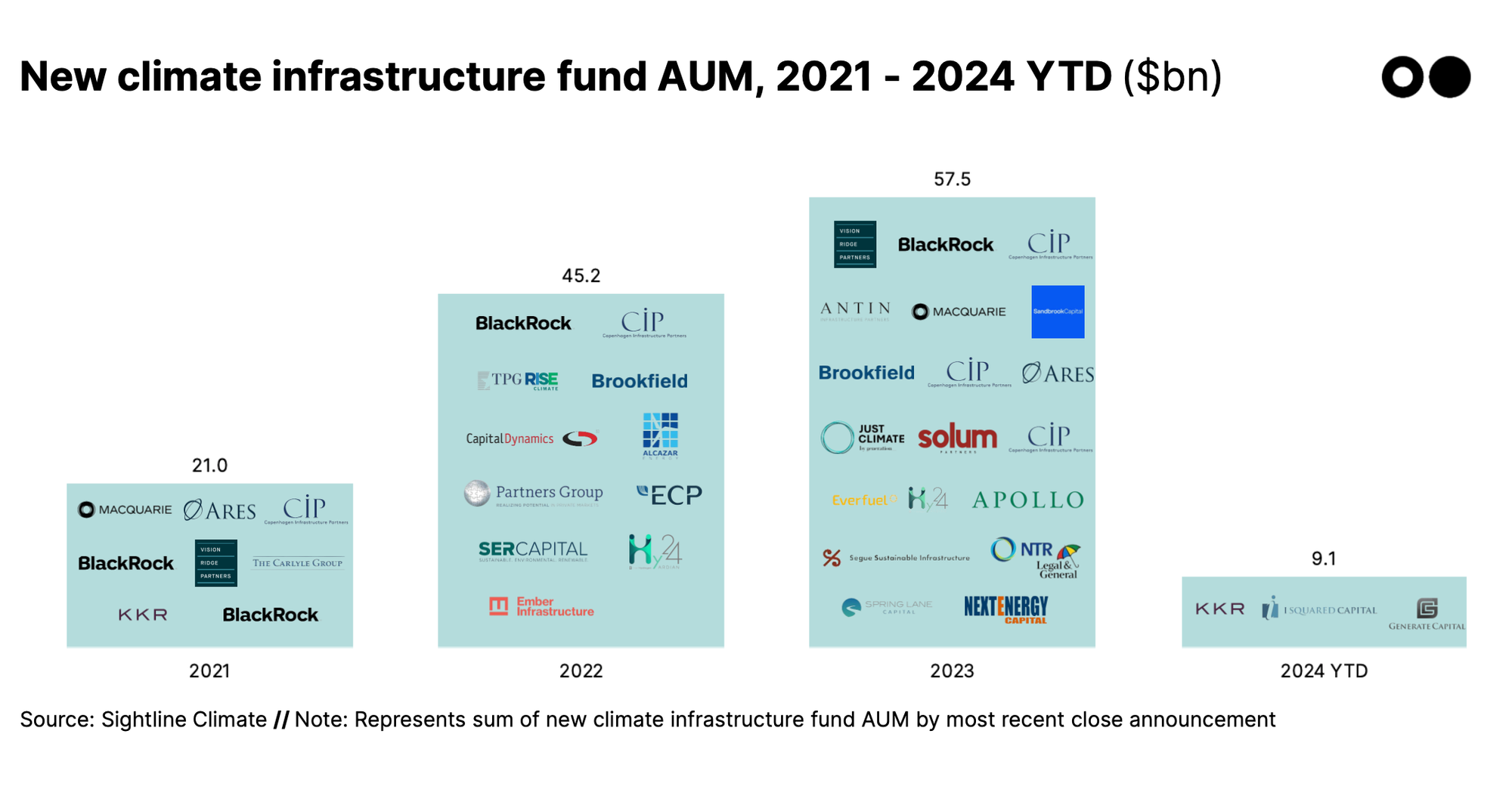

In 2023, private equity investors raised a record $57bn in new capital earmarked for climate infrastructure. A month in, 2024 is already off to a solid start with a month of acquisitions and $9.1bn in new infrastructure funds, including Generate Capital’s $1.5bn equity top-up. With some technologies already big and mature enough, and others on their way, climate tech is getting called-up to the private equity major leagues.

In other news, Saudi Arabia shelves its plans to expand oil production, Exxon’s activist investors drop their motion in the face of being sued, and Podesta is appointed to take over from Kerry.

In deals, $250m for electric buses, planes, and automobiles, $100m for carbon accounting software, and $23m for nuclear waste transmutation.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals and announcements for the newsletter at [email protected].

💼 Find or share roles on our job board here.

Scaling climate tech comes down to getting steel in the ground. To do that, as we’ve outlined previously, the climate capital stack is moving beyond venture, into platforms whose goal is solely getting things built – infrastructure funds. Much like when we started tracking VCs four years ago, what began as just a few climate-interested investors has grown to several institutional investors raising infrastructure vehicles earmarked for climate and sustainability.

Based on data from Sightline Climate, investors have raised $130bn over the last three years, with infra AUM almost tripling last year compared to 2021 (in large part thanks to Brookfield’s $28bn record-setting raise).

It’s only a month in, but 2024 is already on track to be a banner year for infra with $9.1bn raised so far (15% of the peak raised in 2023). New climate infrastructure funds are making headlines with a wave of announcements of acquisitions and new raises by some of private equity’s biggest players. Blackrock bought Global Infrastructure Partners (GIP) for $12.5bn and General Atlantic bought Actis for an undisclosed amount, while Generate Capital, Apollo, KKR, and Macquarie all raised new multibillion dollar funds.

Where is the money going?

Traditional infrastructure investors, like GIP, Actis, and KKR, are responding to renewables and sustainable energy assets, such as utility-scale solar, wind, hydrogen, and energy storage, reaching sufficient scale and maturity to meet their big ticket size. Growth infrastructure players like Generate are targeting projects, like community solar or anaerobic digesters, that, while mature, don't meet the scale requirements for traditional infra investors. [See our methodology for Growth and Traditional infra investors here].

Why now?

Climate tech is entering a new era of demand and scale, and market trends are steering PE towards the reliable returns that real assets can offer.

So what?

The Global Infrastructure Hub estimates a $15tn global infrastructure spending gap by 2040. The recent uptick in funds is an encouraging sign PE can make a major dent in the overall gap, driven largely by three advantages.

First-of-a-kind (FOAK) facilities and projects are still mostly off infra funds’ radars, so don’t expect infra dollars to creep into emerging tech just yet. But a groundswell in climate infra capital could lay the groundwork for investment supporting solutions ready to scale.

🚗 Zum, a Redwood City, CA-based electric school bus developer and service provider, raised $140M in Growth funding from GIC, Climate Investment, Sequoia Capital, and Softbank Vision Fund.

✈️ Heart Aerospace, a Göteborg, Sweden-based electric regional aircraft developer, raised $107M in Series B funding from Air Canada, Breakthrough Energy Ventures, EQT Ventures, European Innovation Council, Lowercarbon Capital, and other investors.

🌱 Watershed, a San Francisco, CA-based carbon tracking and reduction platform, raised $100M in Series C funding from Greenoaks Capital, Emerson Collective, Kleiner Perkins, Sequoia Capital, and other investors.

🏭 Boston Metal, a Woburn, MA-based decarbonized steel developer, raised an additional $20M in Series C funding from Marunouchi Innovation Partners.

🚗 Tau Group, a Torino, Italy-based EV motors developer, raised an additional $12M in Series B funding from CDP Venture Capital and Santander InnoEnergy Climate Fund.

🧪 Xampla, a Cambridge, UK-based single-use plastic alternative developer, raised $7M in Series B funding from Amadeus Capital Partners, Cambridge Angels Group, Cambridge Enterprise, Ciech Ventures, Horizons Ventures, and other investors.

⚡ Transmutex, a Genève, Switzerland-based nuclear waste transmutation technology develper, raised $23M in Series A funding from Steel Atlas, Union Square Ventures, and At One Ventures.

⚡ Crux, a New York City, NY-based IRA tax credits marketplace, raised $18M in Series A funding from Andreessen Horowitz, Lowercarbon Capital, New System Ventures, Overture VC, and Three Cairns Group.

🥩 Planet A Foods, a Munich, Germany-based cocoa-free chocolate developer, raised $15M in Series A funding from World Fund, Cherry Ventures, Feast Ventures, Mudcake, Nucleus Capital, and other investors.

💨 CarbonPool, a Zürich, Switzerland-based carbon credit insurance provider, raised $12M in Seed funding from Heartcore Capital, Vorwerk Ventures, HCS Capital, and Revent.

💨 Bluelayer, a Berlin, Germany-based carbon project management software platform, raised $10M in Pre-Seed and Seed funding from Point Nine.

🔋 Haven Energy, a Los Angeles, CA-based residential energy storage platform, raised $7M in Series A funding from Giant Ventures, Lerer Hippeau, Raven One Ventures, Comcast Ventures, LifeX, and other investors.

🐄 Aquaconnect, a Chennai, India-based AI-driven aquaculture advisory platform, raised $4M in Series A funding from S2G Ventures.

⚡ Mobile Power, a Sheffield, UK-based pay-per-use battery sharing platform, raised $3M in Seed funding from Beyond the Grid.

⚡ Clevergy, a Madrid, Spain-based energy consumption optimization platform, raised $2M in Seed funding from Zubi Capital, Finaves, and Earth.

📦 Alt.Leather, a Melbourne, Australia-based plant-based leather alternatives developer, raised $1M in Seed funding from Startmate, The Alice Anderson Fund, The Austin Group, and Wollemi.

🛵 Drop Mobility, a Toronto, Canada-based electric micro-mobility solutions developer, raised an undisclosed amount in Series A funding from Decathlon Capital Partners.

🔋Greenleaf Energy Solutions, an Oxford, CT-based solar installer was acquired by Facility Solutions Group for an undisclosed amount.

KKR, a London, UK-based investment firm, raised $6.4bn for its latest Asian infrastructure fund which invests in sectors including energy.

Generate Capital, a San Francisco, CA-based infrastructure firm, raised $1.5bn to invest in low-carbon infrastructure.

Speedinvest, a Vienna, Austria-based investment firm, announced the close of its $377m fund that invests across the early-stage including climate startups.

ArcTern Ventures, a Toronto, Canada-based investment firm, raised $335m for its third fund that invests in early growth-stage climate companies.

Mirova, a London, UK-based investment firm, raised $280M for its emerging markets-focused climate fund.

Giant Ventures, a London, UK-based investment firm, raised $150m for a climate-focused growth fund aimed at Series B companies.

Future Energy Ventures, a Berlin, Germany-based investment firm, raised $118m for its fund that will invest in digital and software solutions for the climate transition.

Practica Capital, a Vilnius, Lithuania-based VC firm, announced the close of its $86m fund that invests in early-stage industrial and deeptech startups.

Can’t get enough deals? See full listings and deal analytics on Sightline Climate

Saudi Aramco, the world’s largest oil exporter, ditched plans to raise their oil output. Dropping the multi-billion dollar expansion programme is a significant policy shift for the Ministry of Energy, but experts suggest this may be a question or not now, rather than never.

Exxon Mobil investors dropped emissions reduction motion following being sued by Exxon. With Exxon showing no signs of wanting to drop the case, activists fear the case may deter similar forms of shareholder activism. Meanwhile Exxon and Chevron offload Californian oil assets, collectively taking a $5bn write-down, after decades of steady decline.

In a ray of sunshine for solar, the largest solar storage project in the US went online in California. The Terra-Gen plant holds a capacity of 875MW and 3GWh of storage and is expected to power over 238,000 homes. Meanwhile in The Netherlands, Google signs its largest power purchase agreement for offshore wind, buying 478 MW of electricity to provide clean power to its data centers and offices.

John Podesta named as John Kerry’s replacement. Podesta,previously in charge of overseeing implementation of the IRA, will take on the role as a White House senior advisor rather than a special envoy in the State Department

The US Senate Energy Committee announced a hearing to scrutinize Biden’s LNG pause last week, led by Senate Energy Chairman Joe Manchin. While Biden halted new LNG export approvals for environmental assessment, GOP lawmakers contend it jeopardizes energy security for US allies.

Chinese companies invest $7bn in Congo’s Sicomines copper and cobalt mines. The deal sees China maintain its grip on Congolese cobalt and copper in exchange for an increase in infrastructure development spending and the DRC receiving 1.2% in royalties.

Marking the largest investment in place-based research in the US, the National Science Foundation (NSF) established 10 Regional Innovation Engines to nurture technical innovation and economic activity. With each center receiving a $15m investment up front, the program may invest nearly $1.6bn over the next ten years.

Nat Bullard’s must-read 200-slide annual report on the state of decarbonization.

More annual report goodies. Volta Foundation released their annual battery report.

40% of China’s economic growth in 2023 was fueled by clean energy.

Record $1.8 trillion in global clean energy investment still falls short of what’s needed.

Wind farms may ruffle some feathers, but they're still a breeze compared to other hazards.

Pandora, the world's largest jeweler, now exclusively sources recycled metals, but is it as shiny as it sounds?

Africa’s e-bike journey hits a speed bump.

Scientists say a giant space umbrella might be the cool idea we need.

Posh to slosh, rising temperatures turning Snow Polo in the Swiss Alps to Slush.

Coldplay and Live Nation listen to the scientists and try to fix you up greener concerts.

The sun's poles are set to switch.

Its koalas vs coal in Queensland.

📅 UK CCUS Summit: Register for the 5th UK CCUS & Hydrogen Decarbonisation Summit on Feb 6-8th for an exploration of hydrogen’s potential for advancing the UK's green energy goals.

📅Want To Be Part of a Blue Tech Start Up?: Register to join Salter’s Duck and OceanEnergy’s event in San Francisco February 15th.

💡 NASA Challenge: Apply to NASA’s Wildfire Climate Tech Challenge by February 16th for an opportunity to join a startup incubator program and a $100,000 prize; the challenge is open to students and employees of Minority Serving Institutions (MSIs).

💡 CDR Accelerator: Apply to the Black & Veatch’s IgniteX Carbon Dioxide Removal Accelerator by Feb 19th for an opportunity to win up to $35,000 in non-dilutive grants, a potential equity investment of $50,000 - $100,000, and mentorship.

💡 Bezos Earth Fund: Apply to the Bezos Earth Fund by March 1st for up to $4,000 in prizes for novel CDR idea submissions.

💡 New Energy Nexus Challenge: Apply to the Energy Storage Capital Challenge by March 4th for support from industry experts and decision-makers across the capital stack to advance the development of innovative energy storage projects in New York State.

📅 Stanford Innovation Summit: Register to join the Stanford GSB Climate Summit, "Navigating Change: Accelerating Climate Solutions on a Global Scale” on March 6th for an exchange of diverse insights, ideas, and networking opportunities.

💡 Third Derivative Accelerator: Apply to join Third Derivative’s 18-month climate tech startup accelerator program by March 26th for support connecting with committed investors, corporate partners, market experts, and mentors in the Third Derivative network.

Mechanical Designer, Chief of Staff/ Operations Lead, Finance Lead @Pacific Fusion

Compliance Analyst, Senior Associate/Vice President; Private Equity @Energy Impact Partners

Finance & Strategy Manager @Pachama

Founding Account Executive @Pika Earth

Analyst CIB Climate Tech @JPMorgan Chase

Data Scientist, Head of Engineering, Senior Software Engineer @Thalo Labs

Associate @Ezra Climate

Summer Fellowship @Gigascale Capital

Sr. Associate/ Associate Principal @CrossBoundry Group

Senior Vice President, Transportation & Waterfront @New York City EDC

Portfolio Manager, Sustainable Investment @CalSTRS

📩 Feel free to send us deals, announcements, or anything else at [email protected]. Have a great week ahead

A new framework for scaling climate tech companies, just in time for Earth Day

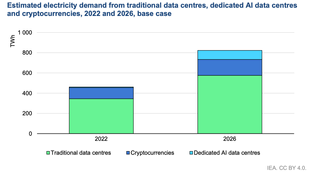

Tech companies and utilities cover their bases as data center electricity demand skyrockets

A new green bank to finance climate projects