🌎 IMO sets sail for net-zero #242

The International Maritime Organization's first carbon tax ships out

A climate tech year in review and USV's new climate fund

Happy Monday!

If it feels like it’s been a long year, we agree.

2020 has taught us to keep a safe distance, while bringing us all together around the glow of global Zoomscapes. This year has also shown us that hope does spring, particularly when existential risk marries economic return. We’ve seen lots of exciting technologies, solutions, and stamina applied to tackling the climate crisis and tidings of even more to come.

In this issue, we review 2020’s climate stats and learn about what drove Albert Wenger at USV to invest in climate.

It’s been quite the ride, and we’re grateful for your readership going into next year; we’ll be back in January with more carbon negative goodness. Till then, here’s to hoping for fewer lumps of coal!

Not a subscriber yet?

😷 The pandemic slashed energy demand – causing emissions to fall ~7% and US renewables production to eclipse coal for the first time

🇺🇸 Joe Biden became the 46th US President – running on a $2T clean energy plan which aims to make the energy grid carbon free in 15 years

🌐 Major countries like China, Korea, Japan, and European Union peers pledged to become carbon neutral by mid-century

🏢 The world’s largest corporates including Walmart, BP, and Morgan Stanley committed to some form of net zero within the next few decades. Meanwhile Microsoft, Unilever, Amazon, and Stripe went a step further by creating funds to invest in climate technologies

⚡🚗 2020 was the year of the EV with Tesla’s stock zooming 700%, Lyft and Uber pledging to go 100% electric, and key governments (e.g., California, China) phasing out combustion vehicles in the next few decades

💸 28 climate tech SPACs have been announced YTD, with the 10 that have already de-SPACed posting a 138% return vs the 59% return of the overall SPAC market

🌳 In 2019, $16bn was invested in climate tech (6% of total VC) outpacing the overall VC growth rate by 5x, with mobility and transport receiving the bulk 63% of climate tech funding

💡 Silicon Valley investors like USV, Sequoia Capital, Khosla Ventures, and Chamath Palihapitiya of Social Capital publicly announced interest in funding climate tech companies

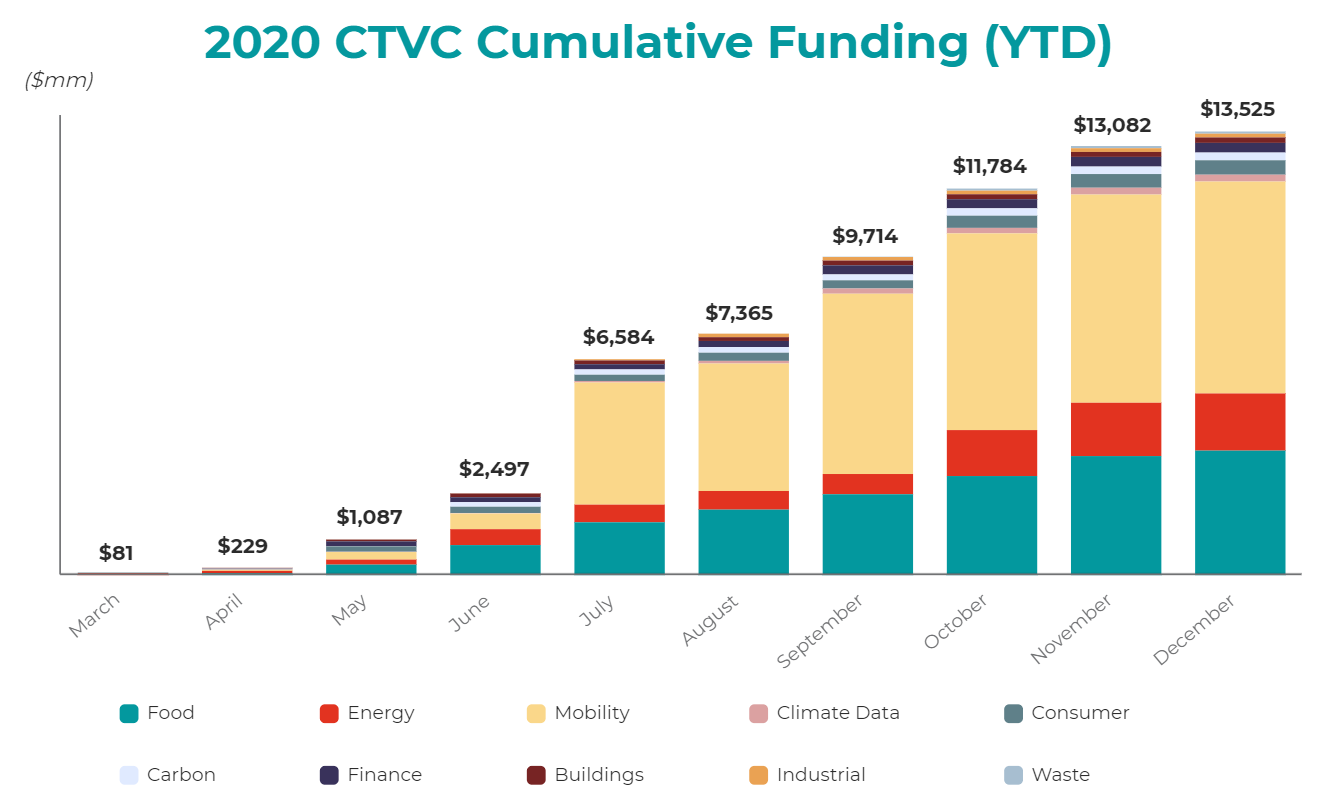

💰 300 climate tech venture deals tracked since March, amounting to ~$14bn raised

🌾 30% of deals were in Food & Ag

🚗 40% of total money raised was in Mobility & Transportation

📰 37 issues published (with 22 mentioning Tesla!)

✅ 5,000+ subscribers

💸 95 venture funds listed in our running list of climate tech VCs (look out for 2021 updates!)

Help us to draft our 2021 Resolutions! Tell us who you are and what you want to see more of in our quick end of year survey.

🚗 Sono Motors, a Munich, Germany-based solar electric car startup, raised $55m in Series C funding from WI Ventures, the Bollinger Group, and others. More here.

✈️ ZeroAvia, a Hollister, CA-based developer of hydrogen planes, raised $21m in funding from Breakthrough Energy Ventures, Amazon Climate Pledge Fund, Horizons Ventures, and Shell Ventures. TechCrunch has more here.

🔋 Group14 Technologies, a Woodinville, WA-based battery materials company, raised $17m in Series B funding from SK materials and OVP Venture Partners.

🌱 Aerobotics, a South Africa-based aerial crop intelligence startup, raised $17m in Series B funding from Naspers and other investors. More here.

☀️ SunCulture,a Kenya-based solar power startup raised $14m in Series A funding from Energy Access Ventures. More here.

☀️ Oolu, a Senegal-based solar energy startup, raised $9m in Series B funding from RP Global, Gaia Impact Fund, and others. More here.

☀️ Swift Solar, a San Carlos, CA-based solar perovskite startup, raised $8m in Series Seed II funding from Gitlab CEO Sid Sijbrandij, Good Growth Capital, Safar Partners, Climate Capital, and other angel investors. More here.

🌱 iUNU, a Seattle, WA-based greenhouse management platform, raised $7m in Series A funding from S2G Ventures and Ceres Partners. More here.

🔗 ClearTrace, a Austin, TX-based climate accounting software, raised $4m in Series A funding from Clean Energy Ventures, Brookfield Renewable Partners and Clean Energy Venture Group. More here. *Featured in last week’s issue

💨 Joro, an Oakland, CA-based carbon offsets startup, raised $2.5m in Seed funding from Sequoia Capital, and others. TechCrunch has more here.

🥛 Better Dairy, a London, UK-based sustainable dairy products startup, raised $2m in Seed funding from Happiness Capital, CPT Capital, and others. TechCrunch has more here.

BP acquired a majority stake in Finite Carbon, a carbon offset developer that had raised $12m in VC funding from BP Ventures and TL Ventures. More here.

This week we sat down with Albert Wenger, managing partner at Union Square Ventures, who Zoomed in from his “farm of the future” in Hudson Valley, Wally Farms. USV is a thesis-driven venture firm known for early-stage bets in companies like Twitter and Etsy. This November, they announced the raise of a dedicated $100-$200m climate fund. [Our interview has been edited for brevity - see the full interview on our website]

How does your personal interest in climate inform your approach to venture investing at USV?

I've been writing a book called World After Capital for six years. The book argues that we’re 20 years past the Industrial Age because society is no longer held back by a scarcity of capital. Without financial constraint, we can build new machines, buildings, and infrastructure rapidly - if we put our minds to it. What we are lacking is intentionality and attention. The next age, which I call the Knowledge Age, is all about the scarcity of attention. And Exhibit A is the climate crisis. We're not paying enough attention to it. A couple of years back, I realized that I was also guilty. It’d be disingenuous to preach about not paying enough attention to the climate crisis without making changes myself.

Can you tell us the story about Wally Farms and what it means to you?

I’m actually calling in right now from our farm in upstate New York. We’re trying to farm the future. The question that we’re after is what could land use and farm use look like 20 to 30 years from now? One element is electrifying everything. We have our own microgrid and solar array and we’re about to add battery storage. Another element is minimizing the amount of land that we use for farming, and maximizing the remainder for biomass and as an animal refuge. We’re just getting going and if people want to learn more, we’re building out the website.

What’s your investment framework for thinking about climate tech?

Our high level thesis has three parts: we invest in companies that (1) reduce emissions, (2) draw down existing emissions, or (3) provide adaptation solutions to the climate crisis. That's at the 50,000-foot level. Then we started developing more specific ideas. Relatively soon, you'll see us publishing those ideas around EV charging, or software for the grid, or different methods of emissions drawdown. It’s helpful to have a framework, and then have entrepreneurs guide or change it. The process is, of course, iterative - we find companies after publishing these ideas, but also inspire new theses by meeting divergent companies.

We believe that climate change will require a huge amount of human activation to successfully overcome. This could be humanity's finest hour. People tend to think of war when referring to “the finest hour,” where it's humans fighting against humans. This, on the other hand, is humans fighting against an existential crisis that affects everyone. In that way, we either all succeed or fail – which is quite beautiful.

You invested in Wren and Leap in January. Given all the surprises that 2020 has brought, how has your thinking on climate investing changed since then?

Starting with Leap, we've been spending a lot of our time understanding the impacts and opportunities arising from the transition to renewables. There are two characteristics that are very different from prior electricity generation (1) decentralization, and (2) intermittency. Since Thesis 1 on data, we’ve been interested in networks. Here with Leap, we saw an opportunity to assemble a network of devices acting in aggregate in power markets.

With Wren, we believe in the importance of making it easy for people to become aware of their carbon footprint. Wren makes it possible for you to compensate for your carbon impact by contributing more trees and planting more biomass. They make that easy, transparent, and fun. There are more companies going after this market now - Joro just raised from Sequoia - and it’s important that somebody succeeds. Offsetting isn't a substitute for also making lifestyle changes, rather this is in addition to making changes.

How does the current climate tech wave differ from Cleantech 1.0? How do we “do it right” this time?

So much has changed, but I point to four major differences:

🔋 First, the extraordinary progress in solar and battery technologies. In the last decade, both solar and batteries have gotten 10x cheaper. Solar is now the cheapest form of electricity that we can produce today. That’s a very different picture from the clean tech bubble of 2007.

🤔 Next is a big change in attitude. All of the survey data, like from the Yale Climate Project, shows that a majority of people now believe that the climate crisis exists, that it is caused by humans, and that it is dangerous.

🚧 There have also been significant regulatory tailwinds. On the one hand, if you look to DC, you're like, “Oh, my God! We withdrew from the Paris Accord!” But even during the Trump administration, we've seen four or five new states pass a 100%, clean grid 2050 mandate. In other countries, the regulatory push has been much stronger.

💸 Finally, there really was little debt financing available during the Cleantech bubble – meaning much had to be financed by equity. In 2020 alone, there will be $350b of green bonds issued.

When you put all of these factors together, the opportunity today is dramatically different. It's important to point out that this opportunity exists, to a large degree, because people were willing to invest and take big bets in cleantech 1.0. As the old saying about standing on the shoulders of giants goes, what is happening today is only possible because of those bets, and because some of them actually worked.

Where are the funding gaps for climate?

The biggest funding gap by far is public funding for geoengineering research. And we need a lot of it, fast. We’re very, very far behind and may need to pull the emergency brake on global warming if things really go off the rails. A lot of people get up in arms about messing with the earth’s systems, but we’re already geoengineering right now, and have been in a very uncontrollable fashion for a couple of hundred years.

Geoengineering is a little bit like chemotherapy; you would never do it if you were healthy. But when you have cancer, you would much prefer to have access to well-researched chemo versus injecting random chemicals into your body. When you evaluate the amount of money that has gone into geoengineering research and compare it to the threat that we’re facing, it’s a mismatch by many orders of magnitude. We might need aerosols, ocean blooms, you name it on the order of three, four years - not in two to three decades. So this requires governments globally to start spending billions as soon as possible. Venture capital will not bridge this massive underfunding gap.

Biden has stacked his climate team with a unified front of heavy hitters who prioritize environmental justice, innovation, and green jobs: Michael Regan @EPA, Deb Haaland @Dept of Interior, Gina McCarthy @WH Office of Climate Policy with Ali Zaidi as her Deputy, Jennifer Granholm @DOE, Brenda Mallory @Council on Environmental Quality, and many more!

Carbon accounting continues to take the spotlight. Former Presidential candidate Bloomberg calls for President-elect Biden to step up on TCFD Climate Disclosures.

On the fifth anniversary of the Paris climate agreement, Xi Jinping announced that China would reduce its carbon intensity by 65% by 2030.

Lloyd’s, the global insurance superpower, will stop new investments and insurance cover for coal, oil sands, and Arctic energy projects by 2022, and will terminate fossil fuel insurance altogether by 2030.

As Larry Fink pens letters about the link between sustainability and financial performance, BlackRock’s action on climate shareholder resolutions has not kept pace. Yet BlackRock remains firm and steadfast in its 2021 climate investment strategy.

An alliance of Europe’s largest truck makers have pledged to phase out combustion engines by 2040.

Hindenburg lights up another climate tech high flyer, poking holes in Loop’s independent review of its recycling PET plastic technology.

BNEF’s annual battery cost refresh report finds continued record-breaking battery pack cost declines in 2020, a 13% price drop from 2019 to below $100/kWh.

A cinematic universe of climate scientists and energy experts at Princeton came together to publish one of the US’s most comprehensive decarbonization studies.

Business Insider’s dropped a list of 46 climate tech startups poised to take off in the new year, full of many familiar faces like AMP Robotics, Form Energy, Kula Bio, Mori, Opus 12, Pachama, Raptor Maps, SilviaTerra, and 38 more!

Want to work on climate? Check out this helpful curation of resources from Susan Su at Sound Ventures (including CTVC!)

Forget conflict-free, the future of diamonds is carbon-negative! Aether has introduced a jewelry collection featuring the world's first and only diamonds made of 100% atmospheric carbon. Each carat removes ~2 years of an average person’s carbon footprint.

The Financial Times charts the business challenges and opportunities in reaching net-zero.

The New York Times aggregated “The Year in Climate” – the best reporting from its Climate Desk in 2020. Bookmark it for your holiday reading.

Use Code Carbon to calculate the carbon footprint of training and running machine learning models with a single line of code.

💡 The Diamond List: Through December 22nd, nominate the untapped gems in climate — underinvested early-stage companies with amazing teams and high impact businesses — to be matched with investors, angels, and philanthropists.

💡 Keeling Curve Prize: Projects with a proven track record of taking greenhouse gases out of the atmosphere can apply by February 10th to be considered for an award of $25,000.

💡 The Techstars Sustainability Challenge: Apply by March 8th to be part of Techstars’ four-month challenge, where startups will be paired with industry-leading companies to build out solutions centering around Sustainable Supply Chains.

Analyst @Energy Futures Initiative

Investment Analyst @Westly Group

Ventures Associate @ Powerhouse Fund

Associate @Touchdown Ventures

Ops & Communications Coordinator @Clean Energy Leadership Institute

Sr Associate, Venture Investing @Emerson Collective

Internship @Emerson Collective

Venture Capital Intern @Contrarian Ventures

Product Designer @Afresh

Head of Market Development @Vianova

Head of Product @Nori

Front-end Developer @Biobot

Lead Data Scientist @Kettle

Junior Project Engineer @Kanin Energy

Professor of Energy @College of the Atlantic

Feel free to send us new ideas, recent fundings, or general curiosities. Have a great week ahead!

The International Maritime Organization's first carbon tax ships out

Trump’s coal push ignores economic reality and attractive alternatives

The tariffs' toll, explained sector-by-sector