🌎 Tariffs, trade wars, and climate tech #240

The tariffs' toll, explained sector-by-sector

Happy Monday!

It’s beginning to look like the most wonderful time of the year.

We hope you’re settling into your EOY reflections (or mad deal dash) and have space in your inboxes and hearts for our final issue on Friday to cap off the year. Look forward to 2024 predictions from many of your favorite clairvoyant climate voices. And below we start the week off with a walk down memory lane of the year’s top CTVC headlines.

In news this week, COP28 wraps up with a landmark agreement on transitioning away from fossil fuels, DOE announces a new office focused on AI, and over 2M Teslas were recalled.

In deals, $93M for heat pumps, $54M for supply chain procurement, and $44M for housing retrofits.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals and announcements for the newsletter at [email protected].

💼 Find or share roles on our job board here.

As our beloved industry matures, our hope for when climate tech grows up is for it to “become boring.” Getting boring means mass adoption, when daily implementation goes almost unnoticed. But we’re not there yet, with some big steps forward and big slides backwards in headlines this year.

By leaps and bounds, the most headliney-headline was (still!) the Inflation Reduction Act. Should we call 2023 the Year of IRA deployment? Disbursement and implementation of IRA shaped both the week-to-week and annual climate tech narratives.

With next year’s election, the storyline will undoubtedly change tune. And throughout it all, the real story – the science – remains stark. We’re not getting any cooler.

💸 The Inflation Reduction Act, Bipartisan Infrastructure Deal and CHIPS act dispersed game-changing sums, including $3.5B for grid enhancements and $7B for hydrogen fuel hubs. Since the IRA passed, 265 clean energy and manufacturing projects worth $100B+ have been announced.

🏦 The Loans Program Office kept busy. Shah and the gang announced their biggest loan ever, a $9.2B conditional commitment to Ford’s battery manufacturing program.

🧑💻 COP28 was climate tech-ier than ever. Plus, signatories agreed to ‘transition away’ from fossil fuels and the UAE unveiled Alterra, a $30B climate fund with a dedicated focus on emerging economies.

🔋 Renewables + storage turned out to be price competitive against fossil fuels after Lazard’s Levelized Cost of Electricity analysis included intermittency costs for the first time.

💪 Climate joined the labor movement. The United Auto Workers won concessions from automakers during a prolonged strike spurred on by worries over the EV transition.

💨 Private equity and O&G bet big on climate tech’s next frontiers: DAC and lithium. Blackrock injected $550M into Oxy’s DAC plant and ExxonMobil unveiled its first-ever lithium mining operation.

🔑 Climate tech startups hit key milestones - including but not limited to - Fervo’s FOAK enhanced geothermal project operational in Nevada, Brimstone’s third-party approval of its carbon-negative cement, and Heirloom’s first commercial DAC plant.

🧑🚒 We just lived through the hottest year on record. Disaster seemed to be everywhere. The optimistic take is that the calamity is drawing more problem-solvers into climate tech than ever. Come on in, the water’s warm!

🤕 SPACs were plagued by bankruptcy. Proterra, the dominant electric bus maker, was just one high profile example.

👻 Spooky season for clean energy stocks. The S&P Global Clean Energy index dropped 30% YTD weighed down by higher interest rates and supply / demand imbalances.

❄️ Macro market cools climate tech venture. Climate tech venture capital dropped 40% in H1’23 but climate-focused funds have still been steadily stacking the green, with at least $33B of investable dry powder ready to deploy in climate tech startups. (Check back in in Jan to see the full 2023 update)

🌬️ Murky macroeconomic waters engulfed offshore wind, with the end of the year bringing multiple high-profile Atlantic coast project cancellations.

🛢️ Oil and gas doubled down on its core business. $100B of deals went down in the Permian basin and Shell abandoned a $100M per year carbon credit pipeline.

🍃 Credit registration body Verra’s CEO resigned following a bombshell Guardian exposé, marking a perilous year for carbon. Key market supply and demand indicators ended the year down.

🇬🇧 UK Prime Minister Rishi Sunak led a campaign against some of the country’s most essential climate policies.

☢️ US nuclear power saw mixed results. The first American power plant in 7 years came online and fusion hit a major milestone, but NuScale’s cancelled Utah SMR project left us feeling a bit uneasy.

And just for fun…

😠 The silliest debate of the year award goes to 🥁… gas stove regulation! Some lawmakers clung for dear life to their gas-burning ranges, igniting a social media meltdown.

Got other major headlines we missed? Send us a note!

🏠 Aira, a Stockholm, Sweden-based home energy efficiency platform, raised 1B SEK ($93M) in equity funding from Altor, Collaborative Fund, Creades AB, Kinnevik, and Lingotto.

🌱 Tacto, a Munich, Germany-based supply chain procurement platform, raised €50M ($54M) from Index Ventures, Sequoia Capital, Cherry Ventures, and UVC Partners.

⚡ Exponent Energy, a Bengaluru, India-based fast charging EV battery developer, raised $26M in Series B funding from Eight Roads Ventures, Lightspeed, YourNest VC, 3one4 Capital, AdvantEdge VC, , and TDK Ventures.

⚡ Powerside, an Alameda , California-based innovative power quality solutions developer, raised an undisclosed amount of Growth funding from Energy Growth Momentum.

🏠 Ecoworks, a Berlin, Germany-based carbon-neutral housing retrofit platform, raised €40M ($44M) in Series A funding from World Fund, Haniel, ISAI and KOMPAS VC.

🔋 Fourth Power, a Boston, Massachusetts-based utility-scale thermal energy storage developer, raised $19M in Series A funding from DCVC, Breakthrough Energy Ventures, and Black Venture Capital Consortium.

🔋 Ion Storage Systems, a Beltsville, Maryland-based solid state li-ion batteries developer, raised $15M from NOVA by Saint-Gobain

⚡ Quaise, a Cambridge, Massachusetts-based geothermal drilling technology developer, raised $13M.

🏠 Tetra, a Boston, Massachusetts-based heating and Cooling System developer, raised $11M in Seed funding from Greycroft, Gutter Capital, Lerer Hippeau, and 1sharpe Capital.

⚡ Plan-B Net Zero, a Zug, Switzerland-based integrated green energy solutions developer, raised €9M ($10M) in Seriejs A funding from Yamato Capital AG.

🌊 Hydrogrid, a Vienna, Austria-based planning hydropower plants developer, raised $9M in Series A funding from Inven Capital, SET Ventures, CNB Capital, and SET Ventures.

⚡ Metafuels, a Zürich, Switzerland-based e-SAF from methanol developer, raised $8M in Seed funding from Contrarian Ventures and Energy Impact Partners.

⚡ Aether Fuels, a San Francisco, California-based sustainable aviation fuel developer, raised $9M in Seed funding from Doral Energy-Tech Ventures, Foothill Ventures, JetBlue Ventures, Xora Innovation, and TechEnergy Ventures.

⚡ Solhyd, a Leuven, Belgium-based hydrogen production from solar energy developer, raised €6M ($7M) in Seed funding.

💨 Arbonics, a Tallinn, Estonia-based carbon platform for landowners, raised €6M ($6M) in Seed funding from NordicNinja VC, Plural, and Tilia Impact Ventures.

🔋 Relyion, a San Jose, California-based second-life battery management platform, raised $4M in Seed funding from Planeteer Capital and Active Impact Investments.

💨 NeoCarbon, a Berlin, Germany-based direct air capture for cooling towers developer, raised €3M ($3M) in Seed funding from RAISE Ventures, Antler, PropTech1 Ventures, and Speedinvest.

⚡ ANNEA, a Hamburg, Germany-based renewable energy optimisation platform, raised €3M ($3M) in Seed funding from Voyager Ventures, Innoport, and Faber Ventures.

⚡ Louelec, a Montréal, Canada-based electric carsharing fleet management platform, raised $3M from Desjardins.

💨 Ecobase, a Tallinn, Estonia-based european forestry carbon projects platform, raised €3M ($3M) in Seed funding from Combiwood Grupp.

📦 Woola, a Tallinn, Estonia-based wool-based packages developer, raised €3M ($3M) from Metaplanet Holdings, Lemonade Stand, and Future Ventures.

🌱 Montamo, a Berlin, Germany-based digital trades industry innovator company, raised €2M ($2M) in Pre-Seed funding from Project A Ventures.

🚗 4QT, a Zürich, Switzerland-based electric drives for heavy equipment developer, raised CHF2M ($2M) in Pre-Seed funding from Unruly Capital, Tiny Supercomputer Investment Company, Climate Capital and Ciri Ventures.

🌾 Seasony, a Copenhagen, Denmark-based vertical farming automation developer, raised €2M ($2M) from North Ventures and EFIO.

🌱 Gentian, a London, England-based biodiversity monitoring through AI platform, raised $2M in Pre-Seed funding from Ecolab, Techstars, Blu Venture Investors, gener8tor, PAX Momentum, and Undivided Ventures.

🔋 Cling Systems, a Stockholm, Sweden-based battery recycling platform, raised $1M in Seed extension funding from Trucks VC and First Venture.

🔋 Enerpoly, a Stockholm, Sweden-based zinc-ion battery manufacturer, raised $8M in Grant funding from the Swedish Energy Agency.

⚡ MetOx, a Houston, Texas-based high-temperature superconducting wire manufacturer, raised an undisclosed amount in Strategic funding from Koch Disruptive Technologies, Piedmont Capital Investments, DNS Capital, and Safar Partners.

Singular, a Paris, France based early-stage VC invested in climate-themed startups, raised €400m for its second fund.

Playground Global, a Palo Alto, California based early stage investment fund, raised $410m for its third fund, focused on early-stage deep-tech and science startups.

Sandbrook Capital, a Stamford Connecticut based private investment firm, raised $1.5B for it’s Climate Infrastructure Fund.

Ara Partners, a Houston, Texas based private equity firm, has raised over $3B for a third fund to invest in decarbonizing industrial sectors like green fuels, metal recycling and low carbon chemicals.

BoxGroup, an NYC- and SF-based early-stage venture firm, raised $212M each for two new funds: BoxGroup Six, a pre-seed and seed-stage generalist fund; and BoxGroup Picks.

Apax, a London, England based private equity firm, raised $900M for its Global Impact Fund, targeting companies focused on environmental and social issues.

Segue Sustainable Infrastructure, an SF-based renewables investor, raised $153M for its second capital pool for domestic renewable energy and storage projects.

BNP Paribas, a Paris, France based global bank, announced the launch of its Climate Impact Infrastructure Debt fund.

Can’t get enough deals? See full listings and deal analytics on Sightline Climate

As COP28 wraps up, a landmark agreement calling for the transitioning away from fossil fuels was released. The final agreement, dubbed “The UAE Consensus” included provisions recognizing the need to scale “abatement and removal” technologies like carbon capture. However, the text contains a lot of ambiguous language about this transition, and was based on an earlier draft with no mention of phasing out fossil fuels. Only time will tell if these words will turn into action.

COP29 was announced and will be held in Baku, Azerbaijan. Although there are only a few countries that have the capacity to host such large gatherings, critics bash the decision as Azerbaijan is a massive O&G exporter and methane emitter and back-to-back petro state chosen as the host country.

Clear(er) skies for IRA SAF tax credit. The US Treasury and IRS released guidance for how they will calculate lifecycle emissions for SAF tax credit eligibility, using the DOE GREET model which puts less emphasis on land use and more on soil carbon. This decision, favoring corn ethanol over CORSIA standards, aligns with the upcoming launch of LanzaJet's Freedom Pines facility, showcasing ethanol-to-jet technology. [More on high-flying fuels here]

DOE launched a new office for Emerging Critical Energy Technologies. The office’s goal is to implement AI, biotechnology, quantum computing and semiconductors into the Departments wide range of assets and leverage their expertise to accelerate progress in these critical sectors.

Nuclear makes a resurgence. Poland approved decisions-in-principle for six SMR plants made up of 24 BWRX-300 reactors. Breaking a 50-year trend in the US, the first non-water nuclear reactor, the Hermes, is approved. This milestone comes as part of the DOE's Advanced Reactor Demonstration Program, paving the way for advanced reactor technologies similar to SMRs. Meanwhile, Microsoft is experimenting with generative AI to speed up the nuclear permitting process.

Over 2M Teslas were recalled this past week due to a safety issue with the autopilot feature. Tesla has pushed a solution that does not require a visit to a dealership or garage and allows users to update their software automatically, but is still referred to by US regulators as a “recall”. This is the largest recall for the auto manufacturer in its history, but thanks to modern technology users won’t go through much of a hassle to implement the update!

In more auto industry layoff news, GM’s Cruise slashed more than 900 jobs. Cruise is recalling robotaxis using autonomous vehicle technology, and announced it would be pausing driverless operations for review by independent experts. This news comes in the wake of an incident involving a pedestrian getting injured due to a Cruise vehicle earlier this year.

Major carbon removal developments in recent weeks follow a new sentiment: Buy now or pay a lot later! Carbon capture startup Climeworks, secured its largest deal to date to sell 80,000 metric tons of carbon credits to BCG over 15 years. This was following Microsoft’s big purchase of 1.5 million tons of carbon credits from Brazilian startup Mombak just last week in reforestation projects.

The one COP28 agreements cheat-sheet to rule them all, grouped by topic.

Just saying… we scored 100% on this quiz for climate nerds ;)

Speaking of report cards - a status report for the UK power sector, and interactive reports for all 50 US states’ opportunities for CO2 removal.

Costa Rica’s green halo may be losing its luster.

Warm welcome to Cascade Climate, a nonprofit focusing on catalyzing open-system climate interventions - starting with enhanced rock weathering.

Fired-up for fusion? Check out this podcast series to hear from investors and leaders in fusion.

Put the pedal to the metal and drive into the BloombergNEF Zero-Emission Vehicle Factbook.

In the spirit of not-having-to-feel-guilty-about-everything, Christmas tree farms may actually help wildlife!

17,000 jobs - including 22% of California’s solar jobs - get axed due to solar incentive reduction.

In a warming world, use it or lose it when it comes to California water.

Iceberg cowboys lasso icebergs to tow from the Arctic to the equator for drinking water.

💡 Cradle to Commerce: Apply by Dec 20th to Cradle to Commerce, a program connecting inventors and entrepreneurs passionate about climate tech with partners in national labs, test beds, and commercialization.

💡 RESPOND Accelerator: Apply to the RESPOND Accelerator by Dec 17th, to receive support for your early stage climate startup protecting nature, transforming industries, or updating operating systems.

💡 Brinc CDR Accelerator: Apply to Brinc’s Carbon Removal Accelerator to receive funding, resources, and access to a global network for your climate tech startup by Dec 31st.

💡 AirMiners Launchpad: Apply by Jan 11th to AirMiners Launchpad to advance your knowledge, skills and product development in the carbon removal industry.

💡 NASA MSI Incubator: Applications are open for NASA’s Wildfire Climate Tech Challenge, seeking climate tech solutions for wildfire prevention. Applications close Feb 2nd.

Account Executive @Sightline Climate

Senior Associate, Investments @Supply Change Capital

Visiting Partner @Gigascale Capital

Internal Analyst @Pale Blue Dot

Director of Finance @Infravision

Senior Cloud Software Engineer @Quilt

Business Development Manager @Scale Microgrids

Communications & Market Engagement Director @Third Nature Investments

📩 Feel free to send us deals, announcements, or anything else at [email protected]. Have a great week ahead!

The tariffs' toll, explained sector-by-sector

The AI company’s debut shows where the chips are falling

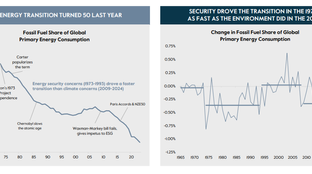

A new Carlyle report maps the macroeconomics behind the shift from climate to security