🌎 Coal hard facts #241

Trump’s coal push ignores economic reality and attractive alternatives

Building back better than expected, climate faces fewer relative cuts

Happy Monday!

While Zuck markets a future of alternate realities, good news for this ‘verse comes in the form of more funding than expected in the Build Back Better program with just a 1% cut from initial funding projections (vs. other programs facing 60% and more).

We breakdown the top spend priorities including clean energy tax credits, resilience investments (heyo, climate corps!), tech and supply chain investments and industrial decarbonization with the big caveat that there’s still lots more legislative wrangling to go.

In this weeks’ other happenings, big fundings for batteries, e-scooters, and carbon accounting as well as World Fund and the Benioffs putting in $600m+ in funding towards climate.

Also in pop-ups, great little tidbits from an Australien COP ad and McKinsey clapping back against its own employees’ reticence to work with big polluters.

Thanks for reading!

Not a subscriber yet?

The White House announced the rough outline of a $1.75T social spending framework for Biden’s Build Back Better (BBB) agenda. The package includes $555b for clean energy and climate investments. The reconciliation bill is (confusingly) separate from the bipartisan infrastructure bill. However, the House decided to delay voting on the infrastructure bill until the Build Back Better Act is passed.

Climate initiatives. Of the $555b earmarked for climate investment, the reconciliation package tackles four key areas, each of which have several particularly exciting developments (which we mark with sparkles, of course):

💳 $320b for clean energy tax credits – expanding clean efforts in utility-scale and residential generation, transmission and storage, passenger and commercial vehicles, and manufacturing.

✨ The House draft provides a major expansion of EV purchase incentives, including a $4,500 credit boost – for a $12,500 total – for union-made US EVs.

✨ The bill renews solar and wind tax credits to their full amount, extends it to residential solar, and - most importantly - creates a new standalone storage investment tax credit.

☔️ $105b for resilience investments – addressing extreme weather (e.g. wildfires), legacy pollution in communities (e.g. climate justice), and a Civilian Climate Corps (e.g. green jobs).

✨ The bill includes $9b for the Environmental Quality Incentives Program, which incentivizes sustainable farming practices, and $4b for the Conservation Stewardship Program.

☀️ $110b for clean energy tech, manufacturing, and supply chain investments – targeting new domestic supply chains and technologies (e.g. batteries) and boosting existing industries’ competitiveness (e.g. steel).

✨ The framework includes a 70% increase in CCS payment for factories and fossil plants to capture carbon, enough to incentivize industrial players to deploy new CCS technologies.

💸 $20b for clean energy procurement – incentivizing government procurement of next gen technologies (e.g. long-duration storage, small modular reactors).

✨ The proposal emphasizes supply chain resiliency across all industries, including renewable manufacturing and agriculture.

Hard-to-abate industries. To kickstart industrial sector decarbonization innovation, BBB sweetened the prize by: (1) devoting $5b for net-zero retooling and retrofitting carbon-intensive domestic factories, (2) promising $4b of purchases as the first customer of US-made zero-emissions products, and (3) increasing the reward for capturing and storing >75% of their own carbon emissions – from $50 to $85/ton.

History in the making (pending approval). While the total size of the bill is half that of the initial goal set by Democratic leaders, lawmakers trimmed less than 1% in climate spending (from $600b to $555b), making the framework the biggest climate investment in US history. If passed, according to The Atlantic, the reconciliation package’s price tag is nearly “the combined net new spending in former President Barack Obama’s stimulus plan and the Affordable Care Act… and raises enough new revenue to offset the losses from former President Donald Trump’s $1.9T tax cut.”

There is also no certainty whether influential Senators Joe Manchin (D-WV) and Kyrsten Sinema (D-AZ) will give the package their stamp. The current dollar value, though, is much closer to the Senators’ desired price cap.

The White House characterized the proposal as the largest climate-related spending bill in U.S. history and said the measure would reduce more than a gigaton (1b metric tons) of GHG emissions by 2030. That might be true. However, some say the absence of the clean electricity standard will cause the US to fall short of its goal to cut carbon emissions 50% by 2030.

Lots more potential cuts remain in the back and forth before it’s passed, though climate’s initial staying power hopefully augurs at least some of this will impact our humanverse.

🔋 ProLogium Technology, a Taiwan-based lithium battery cell maker, raised $326m from dGav Capital, Primavera Capital, SB China Venture Capital, and others.

🛴 Tier Mobility, a Germany-based e-scooter company, raised $200m in Series D funding from SoftBank Vision Fund 2, Mubadala Capital, RTP Global, Novator, White Star Capital, Northzone and Speedinvest.

🚲 Rad Power Bikes, a Seattle, WA-based ebike company, raised $154m Series D funding from Fidelity Management & Research, T. Rowe Price, Counterpoint Global, Vulcan Capital, Durable Capital Partners LP, and TPG’s The Rise Fund.

💨 Persefoni, a Tempe, AZ-based climate and carbon accounting management platform, raised $101m in Series B funding from Prelude Ventures, TPG’s The Rise Fund, Clearvision Ventures, Parkway Ventures, Bain & Co, Électricité de France, Sumitomo Mitsui Banking Corporation, The Ferrante Group, Alumni Ventures Group, New Valley Ventures, NGP Energy Technology Partners, and Sallyport Investments.

💨 Infinium, a Sacramento, CA-based low carbon electrofuels company, raised $69m in funding from Amazon’s Climate Pledge Fund, NextEra Energy Resources, AP Ventures, 8090 Partners, Mitsubishi Heavy Industries, and Pavilion Capital.

🐔 Daring Foods, a Los Angeles, California-based plant-based chicken producer, raised $65m in Series C funding from Founders Fund, D1 Capital Group, Naomi Osaka, Cameron Newton, Steve Aoki, and Chase Coleman.

⚡ Sun Mobility, an India-based EV energy infrastructure startup, raised $50m in funding from Vitol.

🌲 Kebony, a Norway-based environmentally friendly modified wood producer, raised $35m in funding from Jolt Capital, Lightrock Goran, MVP, FPIM, PMV, and Investinor.

🌱 BrainBox AI, a Canada-based autonomous building technology company, raised $24m in Series A funding from ABB, Esplanade Venturesm, and Desjardins Capital.

🌱 ClearFlame Engine Technologies, a Geneva, IL-based green engine technology company, raised $17m in Series A funding from Breakthrough Energy Ventures, Mercuria, John Deere, and Clean Energy Ventures.

🌱 Shiru, an Emeryville, CA-based biotech startup creating novel plant-based ingredients, raised $17m Series A funding from S2G Ventures, The W Fund, SALT, and Veronorte, Lux Capital, CPT Capital, Y Combinator, and Emles Venture Partners.

⚡Resilient Power, a Atlanta, GA-based EV charging company, raised $5m in Seed funding from Energy Transition Ventures, Amazon’s Climate Pledge Fund, GS Futures, and the corporate VC arm of GS Group from Korea.

☔ Sust Global, a UK-based climate risk data startup, raised $3.2m in Seed funding from Hambro Perks, Vala Capital, Powerhouse Ventures, Thirdstream Partners, and angel investors.

⚡Xeal, a Los Angeles, CA-based EV charging stations technology firm, raised $11m in Series A funding and a previously unannounced $3m in Seed funding from ArcTern Ventures, Moderne Ventures, LPC Ventures, Harrison Street, Hunt Companies, Align Real Estate, Ramez Naam, and Pasadena Angels.

⚡ River, an India-based EV 2 wheeler startup, raised $2m from Maniv Mobility and TrucksVC.

🌱 CMC Machinery, an Italy-based sustainable packaging maker, raised an undisclosed amount in funding from Amazon’s Climate Pledge Fund.

⛵ Arc Electric Boats, a Los Angeles, California-based startup focused on electrifying boating, raised an undisclosed amount of funding from Dreamers VC, Thirty Five Ventures, and Combs Enterprises.

World Fund is launching a new fund with over $400m in funding, targeting decarbonization technology startups.

Marc and Lynne Benioff of Salesforce announced they are dedicating $200m to combating climate change, with $100m going to the Benioff Time Tree Fund and the other $100m going to Time Ventures to invest in climate tech startups.

Envisioning Partners launched a $60m Climate Solutions Fund, the first ever fund in South Korea dedicated to climate tech investments.

Al Gore’s Generation Investment Management is launching a new climate focused asset fund, Just Climate.

Sono Group, a German solar-powered EV company, filed for an IPO.

Just four months out of bankruptcy, Hertz drove market frenzy after announcing an order of 100,000 Teslas, increasing Tesla’s market cap to $1T. Here’s some simple math, the $115b market cap increase compared to the $4.2b revenue from Hertz is a whopping ~27x greater than the sticker price of the cars!

Facing rolling blackouts at home during the recent energy shortage, China stays their course on their decarbonization goals, refusing to accelerate China’s net-zero pledge, a huge disappointment ahead of COP26.

When did fossil fuel companies know about the risks of runaway climate change? At least as early as 1959. During a must-watch congressional subcommittee hearing, Big Oil Executives downplayed their role in climate change and refused to slow their funding to trade groups like the American Petroleum Institute which runs pro-oil ads and lobbies against GHG reductions. But who really performed worse, big oil execs or the Republican congressmen?

Last year, Engine No. 1 successfully manhandled Exxon, now it’s Shell’s turn—this time from activist investor Dan Loeb at Third Point. With a $750m stake in Shell (equivalent to 0.4% market cap), Loeb plans to strong-arm Shell to break off its liquified natural gas and renewables company from its oil business in an attempt to increase returns and shield itself from climate risk.

McKinsey got called out by 1,100+ employees for its role in worsening the climate crisis. Employees asked management to stop their practices, like advising 43 of the 100 largest polluters — the response was a version of ‘no.’

Ahead of COP26, the Australien Government releases a surprisingly honest ad about the non-policies it’s taking to Glasgow. This is fake news that we can get behind. Just mind the language.

Putting their money where their mouth is, MUUS Asset Management took out a full page ad in The Washington Post in support of a carbon tax and dividend plan.

According to new PitchBook analysis, climate tech startups (over 200) raised almost $13bn in Q3, making it a record already with time to spare.

First Gates, now Fink. The message is clear: Want returns? Invest in climate tech.

Waste not, want not. Researchers at WPI find that recycled cathodes make better lithium batteries, all thanks to big, flexible pores.

Nonprofit Beyond Plastics calculates that emissions from the plastic industry could outpace coal by 2030. The Plastics Industry Association fires back.

A 101 from 1 of the best. The founder of Nest guides startups on how to work on climate change.

The Interchange podcast will have some different voices soon, as Shayle Kann and the dream team have their last show on the platform.

After interviewing 6,000 kids, Lego compiled a manual with 10 instructions for how to build a better world.

🗓️ McKinsey x COP: Tune in to this livestream during COP26 (Nov 1-12th) for daily discussions with leaders on the ground, including lots of conversations on climate finance and tech.

🗓️ Climate Con 2021: Join on Nov 9th-11th for a virtual gathering to discuss what the heck we’re going to do about climate change. Sessions like Imagine alternate futures and Put your money to work will explore the roles we can play, and the world we can create if we actually do something. Plus some pretty awesome folks are participating including Bill McKibben, Saul Griffiths, Alexandria Villaseñor, Alex Blumberg, and companies like Blocpower, Living Carbon, Carbon Collective, and many more.

VC Analyst, Climate Fund @Toyota Research Institute

Biotech Economics Analyst @Nature’s Fynd

Analyst @Yale Carbon Containment Lab

Device Software Engineer @Yardstick PBC

Lead Mechanical Engineer @Yardstick PBC

Founding Software Engineer @Bluebird Climate

Senior Process Engineer @CarbonBuilt

Customer Success Manager @ClimateView

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

Trump’s coal push ignores economic reality and attractive alternatives

The tariffs' toll, explained sector-by-sector

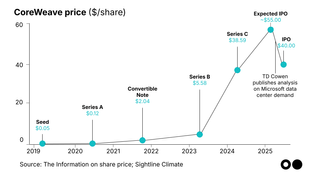

The AI company’s debut shows where the chips are falling