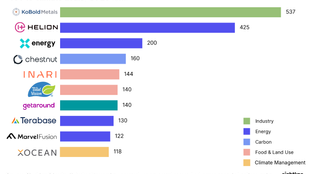

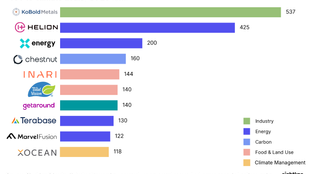

🌎 Q1 2025 roundup: top deals, exits, and new funds

Investors hope to set off a chain reaction with new nuclear funding

Sightline's 2024 state of climate funds and dry powder report

It’s the most wonderful time of the year — the holiday season is here, and so is Sightline Climate’s new report, the 2024 Climate Capital Stack and Funds.

This past year, the climate tech sector has transformed. So has its money. We follow this transformation to show you how capital is flowing into climate solutions – who’s raising funds, where capital is concentrated, and what it means for players across the climate tech ecosystem. (Speaking of the future, don’t forget to give us your take on what’s to come in 2025 in our 🔮20-Question Oracle Survey!)

That includes:

Today’s newsletter has all the high-level highlights, the Christmas Card TLDR of the report. But if you want all the nitty-gritty details and juicy dressings (all 60+ pages), download the full report to get our most in-depth look at the climate capital stack and new funds yet.

🤓 As part of this report release, Sightline clients can also access the live climate funds data on the Sightline platform (plus the underlying data pack here). If you’re interested in becoming a client, request a demo here.

💰 New climate AUM increased 20% YoY, bringing total AUM raised since 2021 to $164bn. Things are looking better than the market expected, but it’s mostly driven by a few climate mega-funds (e.g. TPG, Brookfield) coming back for more.

📈 In 2024, the stack of investable dry powder accumulated to $86bn. While investors started to chip away at the mountain, lowering it from 2023’s high, funds are deploying slower than they used to, and with considerably more discipline.

🏗️ Infrastructure funds made up almost 60% of the new climate AUM raised this year, a sign that climate investment is maturing, and that LPs are seeking out safe havens for their assets that provide sustainability upside.

📉 18% fewer funds invested in a climate deal this year. Sector tourists have pulled back in order to retreat to more familiar software and AI-powered pastures, but dedicated climate funds remain – especially with Growth, PE, and Infra plays coming onto the scene as the climate tech cohort matures.

Dry powder stacks up as investment pace slows. Investors are becoming more selective, with 2024's dry powder reaching $86bn thanks to their cautious deployment strategies amid challenges like valuation uncertainties, IPO market constraints, interest rates, and geopolitical tensions.

Infra funds evolve climate tech preferences, but the Scale Gap is still real. The new generation of infra funds spinning up, especially across emerging and growth infra theses, signal a much broader acceptance of climate tech plays outside of the traditional renewables norm, but the more mature capital stack layers of growth / PE and infra aren’t directly filling in the gaps for the next phase yet.

With Growth / PE sticking to well-trodden business models. PE funds have generally been retreating from riskier hardtech plays and first-of-a-kind (FOAK) investments back towards their comfort zones in mature sectors and incremental transition strategies, leaving a critical funding void for scaling breakthrough technologies.

🔌 “The world of 2025 is hungry for electrons. Data centers, EV adoption and mass electrification demand more electricity. And they will be fed by a larger, enhanced and much smarter grid.” - Martin Richards, Global Head of Climate Tech and Sustainable Finance Origination, HSBC

⚖️ “2024 was a year of hunkering down – shoring up balance sheets, managing opex and getting ‘fit’ for more sustainable growth.” - Lila Preston, Head of Growth Equity, Generation

💪 “Consolidation seems inevitable in many sub-sectors, it will hopefully build much more robust businesses over the medium-term.” - Stephan Feilhauer, Partner, Antin Infrastructure Partners

⚙️ “In 2025, I think we’ll get the most bang from the investment buck by shifting from a funding paradigm that considers only First-of-a-Kind (FOAK) to one focused on the first Ten-of-a-Kind (TOAK).” - Vanessa Chan, Chief Commercialization Officer, US Department of Energy

⛰️ “In 2024, awareness of the “missing middle” of capital became more pronounced as the climate tech industry continued to mature.” - Jeff Johnson, General Partner & Head of Climate, B Capital

⚡ “The availability, price, and emissions impact of power will permeate nearly every conversation (both in climate tech and in AI) in 2025. This will be a boon for some companies, and a huge challenge for others.” - Shayle Kann, Partner, Energy Impact Partners

In a global investment environment marked by fluctuating interest rates and increased scrutiny of valuations, dry powder and newly launched fund AUM serve as powerful barometers for future funding. So while funding in the first six months of 2024 was down 20% from H1’23, and deal count dropped 26% compared to the same time frame, climate-focused funds have still been steadily stacking their dry powder.

We’ve tracked 334 new climate investment funds raised since January 2021 creating fresh stockpiles of capital to deploy into companies and projects. We last released updated new fund numbers at the beginning of 2024, and for the first time, we’ve also included climate-focused infrastructure funds in the dry powder count.

We can see that investors are becoming more deployment-shy than ever, as exits grow harder to come by and LPs hold their pocketbooks closer to the chest. They’re upping the bar for deals – a sign that the sector has evolved beyond the oft frenzied funding strategies of the 2020-21 ZIRP era. The year-to-date 2024 climate dry powder numbers now illustrate a cool-off, with slower deployment leading to dry powder piling up, to the tune of $86bn total for new climate plays. Still, a more disciplined approach suggests a new era where capital efficiency matters as much as potential impact.

$86bn in investable dry powder across VC (including CVC), Growth Equity / PE, and Infra. Dry powder has come down from its peak of $93bn in Q3’24, thanks to this acceleration and signs of slowing fundraising filtering through. But investors are also slowing their (deployment) roll to save up on existing powder, creating a funding reality check. Slower deployment could spell better discipline (and hopefully, returns).

+20% rise in new AUM, and the year isn’t over. $164bn of assets under management (AUM) has been raised for climate from 334 VC, Corporate VC, Growth, Infra, and Private Equity funds since January 2021, with a surge in 2022 thanks to climate mega funds — up 20% from last year’s total of $39bn, almost matching 2022’s record. Things are looking better than the market expected, but it’s mostly driven by a few climate mega funds like Brookfield and TPG coming back for more.

In an era of tougher raises, Infrastructure shines through. All of Brookfield’s last three generalist infrastructure funds have raised more than their targets. Its Fund III raised 50% more than its target of $4bn, and even with increasingly ambitious goals, the funds have outperformed, with Fund IV raising 18% more than target, and Fund V 20%.

A cloud hangs over early-stage venture funds, with a 9% decline in new climate-focused VC funds between 2023 and 2024 after the sunny 2021-22 boom. It could be a sign that climate tech is maturing — with Growth Equity and PE playing bigger roles — or LPs are prioritizing fund managers with longer deal track records.

PE platforms expand climate investment offerings. Major firms like Apollo, KKR, TPG, and General Atlantic are launching climate funds, attracting limited partners (LPs) seeking trusted managers and low-risk technologies such as wind, solar, and batteries. Investment continues to favor mature climate tech sectors with proven business models, particularly software and service providers demonstrating substantial revenue and profitability.

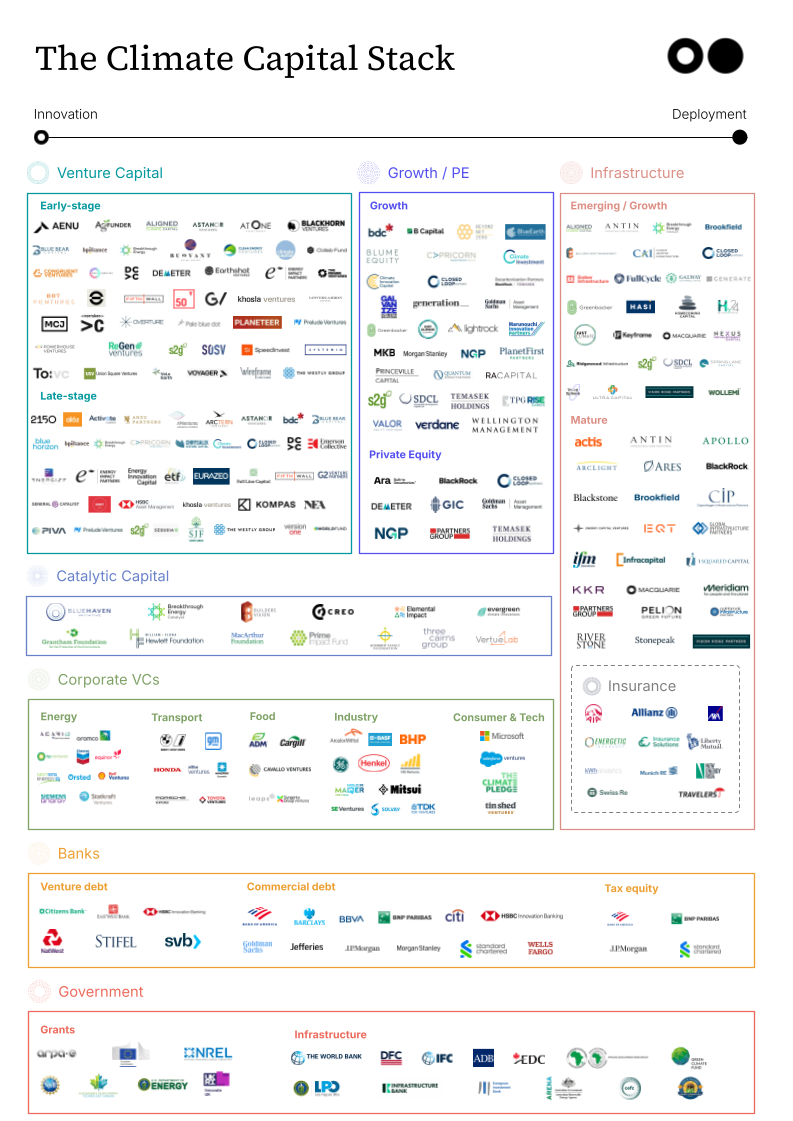

Behind fund data is an entire ecosystem of climate capital. Dry powder, AUM, and deployment numbers show the shape of the capital available, but don’t reveal the layers underneath – leave that to The Climate Capital Stack.

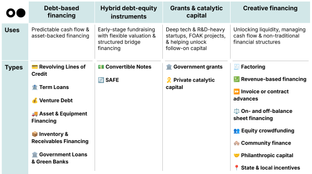

As climate tech companies started in the late 2010s have started to mature, so has the capital stack supporting them. Early-stage companies focused on R&D and pilot projects are often capitalized with VC money and grants. But as they progress – depending on their technology, business model, geography, etc. – they need capital that better suits their needs. Luckily, beyond VC, there's a growing emphasis on later-stage and project financing, not to mention banking and insurance. While investor categories may blur, understanding their investment approaches matters more than strict definitions.

Get the report here for a comprehensive look on the profiles across the capital stack — including key players, types of financing, case studies, and challenges and opportunities in 2025.

And last but not least … for a deeper look on how the Climate Capital Stack stacks up in terms of investment preferences and attributes, take a peek at the cheat sheet below.

🎁 Now that’s a wrap on the TLDR! For the full report, download it here. And special thanks to HSBC Innovation Banking for supporting this report.

NOTE: You may notice that some of our numbers are larger in this update than previous editions. We constantly update the dataset to have the most accurate data possible, including adding post-dated deals. Explore our methodology in the “Methodology” section in the Climate Capital Stack and Funds report.

Have a different take on what’s driving these trends? Or questions about our analysis? Drop us a note at [email protected] if you’re looking to dig deeper into the 2024 climate capital stack trends.

Investors hope to set off a chain reaction with new nuclear funding

A Q&A with Precursor's David Yeh and Mark1's Julian Ryba-White, new strategic partners in the ecosystem

What’s actually working while the rest of the climate capital stack stutters