🌎 Coal hard facts #241

Trump’s coal push ignores economic reality and attractive alternatives

Happy Monday! In this week’s issue, we go deep on California’s interim edict to go 100% off gas by 2035 — it’s ground-breaking, but opens up a thicket of regulatory, accessibility and production concerns that will need dealing with.

In this week’s deals, we’re starting to see the echo of the US summer slowdown though Lunar Energy leads with $300m for home electrification, alongside $200m for lithium battery manufacturing, and $138m for geothermal energy.

In the news, Pakistan receives 400% more rain than the 30 year average leading to devastating flooding, federally funded research is now published into the open, and droughts in China lead to energy shortages which lead to slowed production for key materials (with some considering using coal to produce EV batteries).

Thanks for reading!

Not a subscriber yet?

California is putting the electric pedal to the metal, officially voting to ban the sale of gasoline cars by 2035. The California Air Resources Board (CARB) issued the ground-breaking rule on Wednesday, setting interim targets requiring zero emission vehicles to make up 35% of new vehicles by 2026, 68% by 2030, and 100% by 2035. Today, the share of EVs in new vehicle sales is 16% in California and 6% nationwide.

California’s new rule presents a stick along with the IRA’s EV carrots. Where other countries like the UK and Canada have set goals for phasing out gas vehicles, California is the first to set a hard and fast mandate. Any automaker that wants to sell into the largest automarket in the US must meet California’s targets - or face a hefty fine up to $20,000 for every car that falls short.

While automakers are already off to the races on shifting to EVs, there are 3 major speed bumps that could hamper California’s ambitious rule:

Speed limits on supply. Even billionaire Tom Steyer is on the waiting list for an EV. With supply chain shocks hitting critical minerals and semiconductors, prospective EV buyers should expect to wait at least 8 months on average to get behind the wheel. Expect the supply constraints to continue, especially with the multitude of domestic manufacturing and sourcing caveats behind the IRA’s new incentives.

Electric doesn’t come cheap. Although inflation is hitting vehicles across the board, EVs run 40% more expensive at ~$66K a pop. Automakers are looking to release more affordable electric options, but with critical battery minerals like lithium skyrocketing 4X in the last year, automakers still need to make their margin. The new $7,500 IRA tax credit may be a friendly buffer, but comes with challenging strings attached.

Supercharging EV charging. But cheap, available EV supply still might not get consumers to make the switch. Charging infrastructure also needs to keep up to quell range anxiety jitters. California has ~80K shared EV chargers installed today, which would need to 15X within the next decade to hit the minimum 1.2M chargers anticipated by the new mandate. Not to mention expanding DC fast chargers, 16% of which are concentrated in LA county alone today.

Despite all these speed bumps, this isn’t the first time California has had to jump the starting line to set the pace. When California innovates, other states follow suit - and the 16 other states which have adopted California’s emission standards may be next.

🏠 Lunar Energy, a San Mateo, CA.-based home electrification startup, announced that it's raised $300m in funding over the past two years from Sunrun and SK Group.

🔋 Nexeon, a UK-based lithium battery manufacturer, raised $200m in Series D funding from Daishin Securities, Gly Capital Management, Ischyros New York, Shinhan Investment, and Ingevity Corp.

⚡ Fervo Energy, a Houston, TX-based geothermal energy developer, raised $138m in Series C funding from DCVC, CPPIB, Liberty Energy, Macquarie, Grantham Foundation, Impact Science Ventures, Prelude Ventures and insiders Capricorn, Breakthrough Energy Ventures, Congruent Ventures, Helmerich & Payne, 3x5 Partners, and Elemental Excelerator.

💨 Carbon Direct, a New York, NY-based carbon management firm, raised $60m in funding from Decarbonization Partners and Quantum Energy Partners [See our Friday feature Q&A with Carbon Direct’s CEO!]

⚡ Gridvision [prev. eSmart], a Norway-based developer of AI solutions for virtual energy infrastructure inspection, raised ~$40m in Series B funding from Equinor Ventures, Kongsberg Group, Nysnø Climate Investments, Energy Impact Partners, Future Energy Ventures, and Arosa Capital.

🐟 Sea6 Energy, an India-based ocean farming startup, raised $18.5m in Series B funding from BASF Venture Capital GmbH and Aqua-Spark.

💨 Econic Technologies, a UK-based developer of catalysts and processes transforming CO2 into polymers, raised $12.2m in Series D funding from CM Venture Capital, GC Ventures, and ING Sustainable Investments.

🔋 Zitara, a San Francisco, CA-based battery management software company, raised $12m in Series A funding from Energy Impact Partners, NextView Ventures, Collaborative Fund, and Trucks VC.

🔥 Dryad Networks, a Berlin, Germany-based provider of sensor networks for wildfire detection, raised $10.5m in Series A funding from eCAPITAL, Toba Capital, TIME Ventures, and Semtech.

🌱 Worldfavor, a Sweden-based business sustainability data platform, raised $10.2m in Series A funding from SEB Private Equity, Brightly Ventures, and Spintop Ventures.

⚡ Gradyent, a Netherlands based energy analytics platform, raised $10m in Series A funding from Capricorn Partners, Eneco Ventures, ENERGIIQ, and Helen Ventures.

🍄 Mycel, a South Korea-based startup making fungi-based biomaterials to replace meats and leather products, raised $10m in pre-Series A funding from Korea Development Bank, Industrial Bank of Korea, Hyundai Motor’s Zero 1 Fund, Stone Bridge, We Ventures, and Spring Camp.

🛵 Ultraviolette, an India-based electric motorcycle company, raised $10m in Series D funding from EXOR Capital.

💨 Clarity Movement, a Berkeley, CA-based air quality monitoring company, raised $9.6m in Series A + funding from Amasia, the Active Fund, Spero Ventures, SOSV, Launch Fund, and The Climate Syndicate.

🪱 Loopworm, an India-based insect biotech startup, raised $3.4m in Seed funding from Omnivore, WaterBridge Ventures, Titan Capital, and angel investors.

⚡ IONATE, a UK-based control technology for power systems startup, raised $3.9m in Seed funding from Cycle Group, IQ Capital, Old College Capital, Smartworks Innovation, and Zero Carbon Capital.

🍴 Clean Kitchen Club, a UK-based plant-based restaurant chain, raised $2.3m in Seed funding from angel investors.

💨 Mantel, a Boston, MA-based carbon capture startup, raised $2m in Seed funding from The Engine and New Climate Ventures.

🌾 IBISA, a Luxembourg-based agri-insurtech startup, raised an undisclosed amount in Seed funding from Ankur Capital.

⚡ EINHUNDERT Energy, a Germany-based digital service partner for scalable tenant power, raised an undisclosed amount in Series A funding from Triodos Energy Transition Europe Fund.

“The IRA repeatedly defines greenhouse gas as a form of air pollution,” giving (back) the EPA new power to curtail emissions. The climate law essentially nullified the Supreme Court's decision in June that the EPA can’t regulate carbon under the Clean Air Act, since it’s not a pollutant. The agency is preparing to curb a wide array of emissions types, from tailpipes to gas wells. Game, Set, Match.

The USDA announced a new program this week that will invest up to $300M in a new Organic Transition Initiative. The US has faced criticism for lagging behind European plans to expand organic agriculture in order to reduce greenhouse gas emissions and mitigate climate change.

“Nature will finally be reflected on our nation’s balance sheet.” The Biden Administration released a readout of this summer’s Natural Capital Roundtable, which called for a Natural Capital framework for private and public investors alike.

The Biden’s Administration is dropping the paywall. The White House Office of Science and Technology Policy (OSTP) mandated that all federally funded research must be immediately available to the public at no cost. The climate impact runs the gamut from earth observation monitoring to new capture capture technologies.

Severe drought across China is drying up hydropower used to power manufacturing, while simultaneous low water levels are slowing production for EV lithium and solar panel materials. This climate-induced drought forces factories to run on coal or else turn off manufacturing required for the green economy. Cue the feedback loop.

Also, droughts across the US are drying up the food supply, leading to concerns about inflation.

A devastating flood in Pakistan hit 30m people with the two most-affected provinces receiving 400% more rain than the 30 year average.

The UNFCCC appoints a new Executive Secretary from small island nation Granada. Simon Stiell will play a key role at COP27 in November where climate reparations, a method for polluting countries to pay damages to small island developing states, are an anticipated hot topic.

Amazon announced a green hydrogen agreement with Plug Power for the supply of nearly 11,000 tons/ yr of green hydrogen starting in 2025 for 30,000 forklifts.

Divesting from the divestors. Texas is cracking down on investment firms that "boycott" fossil fuel companies, even if they manage billions of dollars in fossil fuel company investments. Texas Comptroller Glenn Hegar yesterday released a list of 10 financial firms and 348 funds on his hit list. West Virginia pulled a similar stunt last week.

Speaking of Texas, apparently everything is bigger there. Occidental and subsidiary 1PointFive announced the world's largest Direct Air Capture new facility in Texas that will capture up to 500,000 mT CO2/ yr at launch, with the potential to scale up to 1,000,000 mT/ yr. That’s 125x the capacity of current industry leader Climework’s Orca plant on opening day.

“According to the International Energy Agency, 60% of the technologies that are needed in a net-zero world pathway are not yet commercially available.” We love RMI’s analysis here, which calls out that battery recycling, hyperloop, and mineral storage have a long way to go.

John Oliver takes on carbon offsets.

Carrots or sticks? Re-evaluating the economics of a carbon tax.

At Ohm on the water. A study from UC Berkeley concludes that up to 40% of global containerships at sea could be electrified by the end of this decade.

Drones are attempting to making it rain in China.

The unexpected side effect of a changing climate? Hidden treasures reappearing.

Striking before and after images of 6 major rivers drying up around the world.

Writing Al Gore-thms. Check out Ali Ahmadalipour’s list of 200 climate tech startups hiring for technical data science roles.

Who wants some Airheads? Researchers develop a new kind of wind turbine blade that can be recycled into gummy bears and other sweets and sports drinks.

💡 Frontier RFP: Submit your pre-application by Sept 2nd for consideration in the $925m Frontier’s next carbon removal purchase Fall 2022 cycle.

🗓️ Carbon to Value Panel: Join in-person in SF on Sept 7th for discussions and networking with a panel of startups including Twelve, Mars Materials, Blue Planet Systems.

🗓️ Blackhorn Ventures Talent Session: Early-stage startups compete with everyone for talent. Tune in on Sept 12th to hear from Blackhorn Ventures, TrueSearch, and Ford experts and get your burning questions about developing, maintaining and retaining talent answered.

🗓️ For ClimateTech: Register to join this virtual conference on Sept 13th–15th and meet founders, leaders, and industry experts to discuss opportunities and challenges in early-stage climate innovation.

💡 Industrial efficiency funding: Apply by Sept 19th to Phase 4 of the BEIS IEEA which support partnerships between power and resource technology startups and industrial companies with £150k to £1m grants.

🗓️ London Climate Tech Investor Forum: Join in-person in London on Sept 22nd for an opportunity for UK climate tech investors and fundraising innovators to network and connect.

🗓️ ClimateTech Conference: Join the MIT Technology Review on Oct 12-13th on the MIT campus and online for a conference about technology solutions to climate change.

VP of Operations @Transect

Chief of Staff @Sublime Systems

Analyst/ Associate @Decarbonization Partners

Analyst @Lowercarbon Capital

VP, Science and Technology @Galvanize Climate Solutions

Senior Thermal Engineer @Amogy

Product Manager, Climate & Energy Roadmap @XPrize

Global VP of Bioproduction @Loam Bio

Founding Engineer @Sustainfi

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

Trump’s coal push ignores economic reality and attractive alternatives

The tariffs' toll, explained sector-by-sector

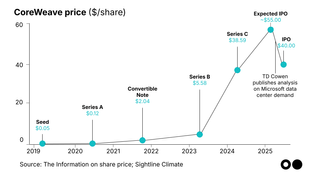

The AI company’s debut shows where the chips are falling