🌎 Meet the FOAK folks

A Q&A with Precursor's David Yeh and Mark1's Julian Ryba-White, new strategic partners in the ecosystem

The Chilean startup raised a $30M Series B round to scale mining tech that improves the efficiency of copper extraction

The energy transition is a metals transition, and electrification is copper’s time to shine. It’s as integral at the macro scale (when building solar panels, wind turbines, and transmission lines for the grid) as it is on a personal level (when driving your EV or reading your favorite newsletter on your phone or computer). But rising demand for copper is coinciding with declining supply, creating necessity for a production sprint in a slow-moving industry. Rather than building many new mines in order to increase output, which takes lots of time and money, advanced mining tech startup Ceibo aims to improve the efficiency of extraction from existing mines. Based in Chile, the world’s top producer of copper, the company just announced a $30M Series B round, led by Energy Impact Partners (EIP). We caught up with CEO Cristóbal Undurraga (who has been visiting copper mines since grade school) about Ceibo’s strategy for entering an old-school industry, plans for scaling, and fundraising during an investment crunch.

How did your background and career experience lead you to found Ceibo?

Ceibo evolved from past experiences and ventures. Initially, we aimed to cross the fields of biology and mining. Then that evolved into more of a tech-focused group, driven by the realization that servicing the mining industry is really challenging.

Being based in Chile, it’s very hard not to be somehow connected to mining. We produce around ¼ of all the copper in the world. From family ties, I’ve been visiting mines since I was 10 years old. With my engineering background, I’ve worked in mines and on different mining projects. When you’re here, you also see the impact of the industry, and it’s frustrating. I’ve been working in technology all my life—how come we haven’t found better ways to do this? So that’s how I came into it. We need to make it better and we have the technology to make it better.

What has it been like building a tech startup in the mining industry?

Mining is a very traditional and conservative industry. The pace is slow and it’s difficult to enter. The sheer scale of mining operations, with trucks on wheels four meters tall moving hundreds of tons of material, makes it difficult to apply the typical startup approach of starting small and growing. The minimum viable product in mining had to align with the massive size and demands of the industry.

We realized our solution for copper production faced time-consuming development processes. To establish a track record in scaling technology, we first developed a dust suppression product that gained traction and became a successful business in its own right. This allowed us to create a solid foundation and was our beachhead into the industry as we continued our copper recovery research.

How does copper production work today?

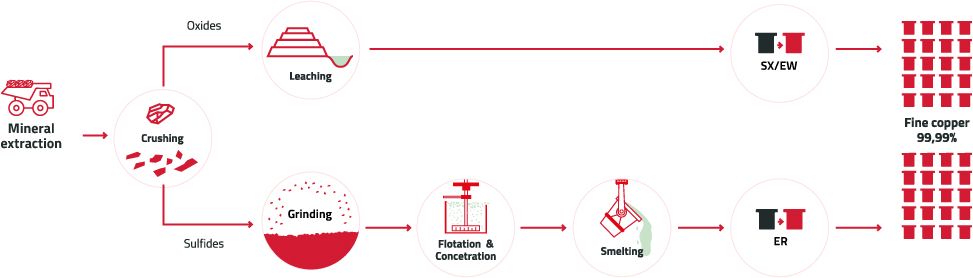

Copper extraction primarily involves two technologies: leaching and concentration. Leaching involves crushing the rock and building a heap, which is then irrigated with a chemical solution to dissolve the copper. The resulting solution is rich in copper ions, which are then deposited onto plates using electricity. Concentration involves crushing the rock into a very fine powder and then introducing chemical reactions to create a foam with a 30% concentration of copper. That concentrate is then shipped to a smelting facility, usually in Asia, and refined into the final copper product. The leftover materials from this process are typically stored in tailings ponds, which look very pretty but have negative environmental impacts.

The concentration method accounts for ~70-80% of the world’s copper output. China possesses around 50% of the global smelting capacity, making it a significant bottleneck in the production process. After smelting, the purified copper is supplied to original equipment manufacturers (OEMs) or intermediate producers of copper wire.

Why is copper so critical to the energy transition?

Approximately 45-50% of copper is used in "moving electrons," which includes wiring in buildings and the electrical grid. Another 12% is used in electronics, while the remaining copper is dedicated to construction, such as pipes. Copper has some very particular physical and electronic properties. It’s malleable, superconductive, and relatively cheap, which is what makes it so critical.

An EV uses ~3x more copper than internal combustion engine (ICE) vehicles. Not only do EVs need copper for their batteries and electrical systems, but the generation of the electrons needed to charge them also relies on copper-intensive components like solar panels and wind turbines. Transferring that electricity through the grid and the charging station infrastructure also involves significant copper usage. As we transition towards relying more on electricity than fossil fuels, we’ll need an enormous amount of copper.

How will the industry be able to meet that increased demand for copper?

The copper industry faces a problem of increasing demand and decreasing output. Mining companies all over the world have announced lower-than-expected output as they venture deeper into the ground. As you dig down to deeper ores, the mineral groups containing copper get more complex, making it more complicated to extract, and copper concentrations get lower. The average ore grade, which measures copper content per ton of ore, has declined from 1.2% 20 years ago to 0.6% today. This means double the amount of ore is now required to produce the same quantity of copper.

As demand for copper increases, projections indicate a shortfall of 7 million tons within the next 10 years and 20 million tons within the next 20 years. Basically, the industry needs to double its output in two decades, which is a significant challenge considering the complexities and timeframes involved in physical industries. And that’s on top of declining ore quality, which drives higher energy consumption and more waste during the extraction process. To address these challenges, the industry is pushing for larger-scale projects that require substantial capex, lengthy permitting cycles, and greater water resources.

How does Ceibo’s tech approach this challenge?

We’re working on a chemical technology for leaching primary sulfides. Leaching technology has traditionally been used to extract copper ore from the superficial layers of the earth. However, over 70% of the copper reserves on the planet are located deeper in the ground and composed of more iron and sulfites, which makes them more difficult to extract and requires processing them via the concentration route.

Our technology is able to use leaching with a recovery rate of 70-75%, compared to ~20% for traditional methods. This makes extraction of copper from deeper ores economically viable while leveraging existing infrastructure that would otherwise become idle. And our technology is relatively easy and affordable to implement. While some adjustments are necessary when transitioning to different chemical reagents, no new plants or facilities need to be constructed. We don’t need more water or electricity.

Additionally, our technology allows for on-site production of the final product, which not only presents economic benefits, but also has geopolitical implications. It can assist countries like the US, Mexico, and Canada, which possess significant copper resources, in reevaluating closed mines or previously challenging projects.

What is the plan for this $30M in funding from your Series B? How are you thinking about scaling?

The resources we’re raising now are for scaling our chemical leaching technology by generating substantial intellectual property and advancing physical projects. The first project is a prototype plant—our labs, under our terms. Large mining companies have shown interest in scaling our technology, so the second project is a demonstration plant built at a mining site and run with mining industry standards. We’ll also pursue commercial alliances with smaller operators so we can reach the market sooner and gather valuable data to build a strong pipeline of projects all over the world.

Who are your target customers or early partners? What does your business model look like?

Today, our main customers are going to be the mining companies. However, we are also engaging in discussions with offtakers that purchase copper. These offtakers play a significant role in the supply chain because they require a stable and consistent supply of copper to meet their own future feedstock needs. There is also growing interest in greener copper, although it is not yet considered a commodity. The concept of environmentally-friendly copper—produced using solar energy, recycled materials, and minimal water consumption with a low CO2 footprint—aligns with the sustainability goals of various stakeholders. There may be a price premium for that down the road, but we don’t base our business model on price premiums.

Were there key challenges that made this sort of innovation unachievable previously? Or has there just not been much industry interest in this type of tech in the past?

I think mining companies have primarily been focused on handling the immediate challenges of decreasing ore quality at the same time that they’re seeking to become ESG compatible. While the industry has made efforts to invest in research and development, I am a little bit critical of the amount of resources and energy devoted to R&D. But significant innovations often arise from startups rather than established giants. It’s difficult for smaller companies and startups in the natural resource industry, though, because it’s slow and expensive. It's not only about how good your technology is, it’s also how persistent you are.

Collaboration is an essential aspect of any industry, and it’s hard to get between companies that are competing with each other for resources, talent, and funding. This is where we can play a role. Because we're not competing against them, we can work with them and help them.

What was it like raising a funding round in this economic environment? What makes your team of investors a good fit for Ceibo?

Eight years ago, when I was initially discussing copper with Silicon Valley investors, I was met with skepticism. People were more focused on Bitcoin mining. Then a few years ago, lithium became a topic of interest. All of a sudden last year, investors wanted to talk to us about copper. At the same time that much of the venture world was suffering because of the investment crunch, we found ourselves in a rare position. Industrial companies wanted to invest in tech that would enable their long-term survival, and we were at the right place with the right technology at the right time. And we had already built credible networks, preparing us for this moment.

You need a village to raise a kid and you need a village to raise a mining technology company like ours. Other successful climate tech companies have built robust networks of technology experts, investors, industry specialists, and asset owners. We are honored by the trust placed in us and the investments into a startup based in Chile, which may be perceived as an "out of bounds" location for many investors.

We now have an interesting crew as part of our Series B—it's a family portrait that brings a lot of value. We have EIP that has a decarbonization perspective. Then you have Khosla Ventures, more radical innovators and industry disruptors. They have been betting on us for many years, recognizing the importance of minerals as foundational for tech advancement. We have Aurus, a local fund with a lot of experience in tech mining companies. Another notable addition is CoTec, a Canadian group with deep mining industry expertise, specifically focused on mining technologies. We also have asset owners, including Audley which owns Capstone Copper, with mines in the US, Chile, and Peru, and Orion, a large private equity fund.

Who are the other key actors will you need to work with as you scale?

The whole mining industry needs to work more closely with environmental authorities to expedite projects that are more responsible and more sustainable. It’s not only an economic consideration, but a broader question of how we can align our activities with environmental priorities.

Ceibo will be hiring later this year and hopes to attract talent from around the globe. Keep an eye on their jobs page for those upcoming opportunities or drop them a line to share your interest in the future of copper extraction.

A Q&A with Precursor's David Yeh and Mark1's Julian Ryba-White, new strategic partners in the ecosystem

A Q&A with the DOE LPO director Jigar Shah and Solugen CEO Gaurab Chakrabarti

The White House’s new announcement clears the air about the voluntary carbon market