🌎 Coal hard facts #241

Trump’s coal push ignores economic reality and attractive alternatives

Happy Monday!

Yesterday marked a happy ending for Chiefs and Swiftie fans. While the 49ers didn’t strike gold at the Superbowl, last week a Bay Area startup struck copper in Zambia.

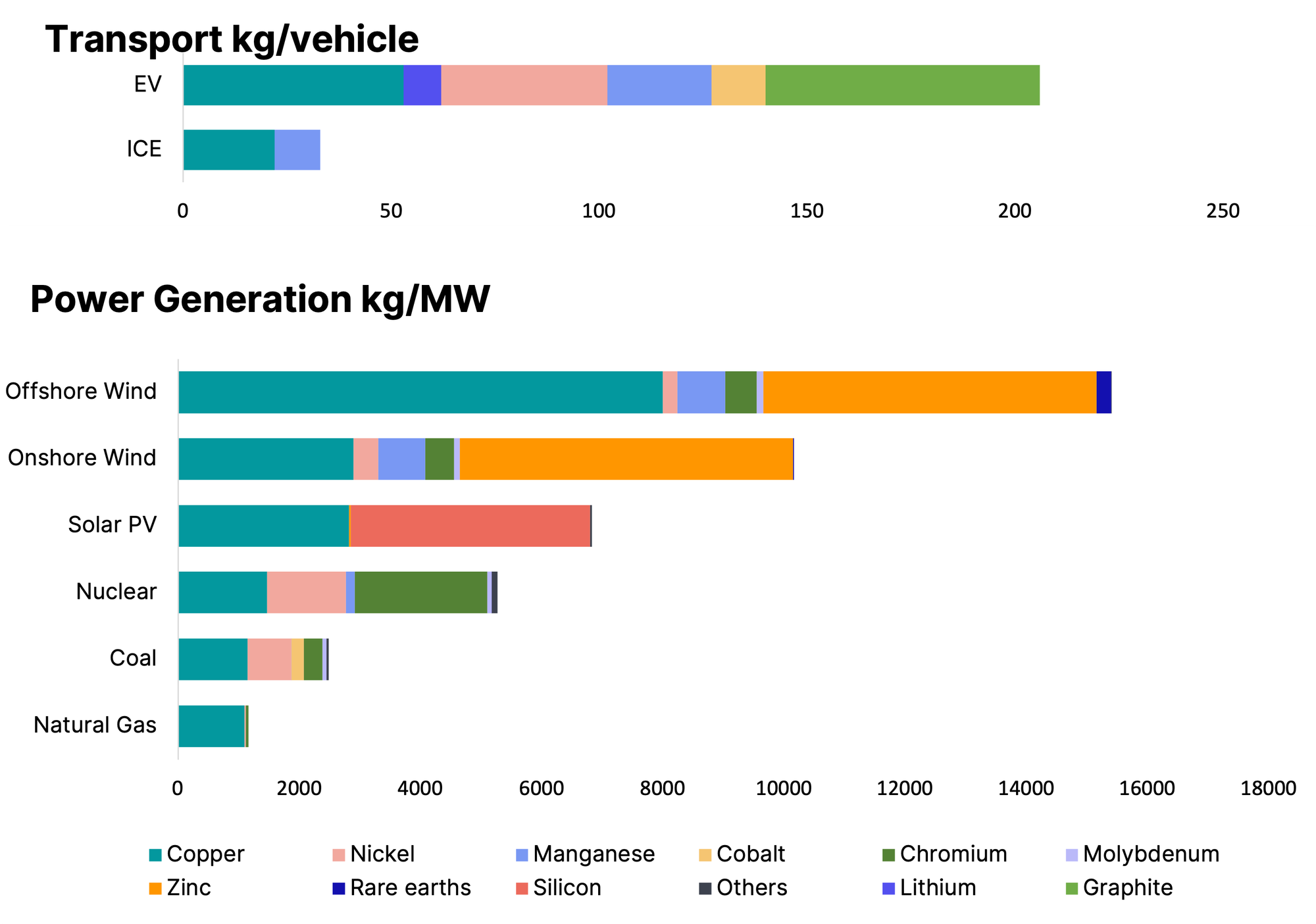

KoBold Metals discovered a major copper deposit, which could be the start to solving growing supply and demand imbalances brought on by copper’s fundamental role in the energy transition.

In other news British banks increase their green ambitions while the opposition Labour party drops theirs. The tide pulls the other way across the channel as the EU gets ambitious on its climate goals, and Ethiopia accelerates to become the first country to ban ICE vehicles.

In deals, geologic hydrogen digs up $245m, $181m across six EV deals, and Brookfield’s $10bn climate transition fund.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals and announcements for the newsletter at [email protected].

💼 Find or share roles on our job board here.

Mining startup KoBold Metals unearthed what could be one of the world’s largest copper deposits in Mingomba, Zambia last week. The company uses AI to identify high-probability areas of mineral discovery in over 60 countries (think Google Maps for Earth’s crust to locate rare earth metals). While this discovery alone won’t make a huge dent in global copper production, it is large enough to shuffle the copper pecking order.

Why is this important now?

While Kobold’s Mingomba facility won’t open for a decade, copper prices are expected to increase 75% over the next two years as demand increases and supply withers.

Demand

Supply

Copper’s silver lining

Despite copper’s importance in the energy transition, there have been few new mines in recent years, and they typically take decades to progress from exploration to production. AI’s emergence in metals discovery offers the promise of reducing exploration costs and finding higher grade ores that offer a better ROI. And Kobold’s isn’t the only one; more startups are using AI to scan the horizon for critical minerals, including VerAI, EarthAI, GeologicAI, and Ideon Technologies, to reshape the mining landscape.

⚡ Koloma, a Denver, CO-based geologic hydrogen exploration and identification platform, raised $245m in Series B funding from Khosla Ventures, Amazon, and United Airlines Ventures.

🥩 Heura Foods, a Barcelona, Spain-based alternative protein developer, raised $43m in Series B funding from ECBF, Newtree Impact, Unovis Asset Management, and Upfield.

🍎 ProducePay, a Los Angeles, CA-based fresh produce marketplace, raised $38m in Series D funding from Syngenta Group, Anterra Capital, Astanor Ventures, Endeavor8, G2 Venture Partners, and other investors.

🚗 Muffin Green Finance, a New Delhi, India-based EV financing platform, raised $17m in Series B funding from The State Bank of India, IREDA, AU Small Finance Bank, ICICI Bank, and Kotak Mahindra Investments.

🚗 Project 3 Mobility, a Zagreb, Croatia-based autonomous electric vehicle developer, raised $107m in Series A funding from TASARU, Kia, and Rimac Group.

🛵 River, a Bengaluru, India-based EV two-wheeler manufacturer and network, raised $40m in Series B funding from Yamaha Motor, Al-Futtaim Group, Lowercarbon Capital, Maniv Mobility, and Toyota Ventures.

💨 Avnos, a Los Angeles, CA-based direct air capture and water extraction developer, raised $36m in Series A funding from NextEra Energy Resources, Envisioning Partners, Rusheen Capital Management, Safran Corporate Ventures, and Shell Ventures.

⚡ Thea Energy, a Princeton, NJ-based stellarator fusion energy company, raised $20m in Series A funding from Prelude Ventures, 11.2 Capital, Anglo American, Hitachi Ventures, Lowercarbon Capital, Mercator Partners, Orion Industrial Ventures, and Starlight Ventures.

🛰 Jua, a Freienbach, Switzerland-based AI weather modeling platform, raised $16m in Seed funding from 468 Capital, Green Generation Fund, InnoSuisse, Kadmos Capital, Notion.vc, and other investors.

♻️ Greyparrot, a London, UK-based waste and recycling intelligence platform, raised $13m in funding from Bollegraaf.

⚡ Amperesand, a Singapore City, Singapore-based solid-state transformer developer, raised $12m in Seed funding from Material Impact, Xora Innovation, Foothill Ventures, and TDK Ventures.

🛵 OTO, a Mumbai, India-based two-wheeler financing platform, raised $10m in Series A funding from GMO Venture Partners, Turbostart, Prime Venture Partners, Matrix Partners, and 9Unicorns Fund.

⚡ Synaptec, a Glasgow, UK-based passive electrical sensor networks developer, raised $8m in Series A funding from Equity Gap, Megger Group, and Proserv.

✈️ Cosmic Aerospace, a Centennial, CO-based all-electric passenger aircraft developer, raised $5m in Seed funding from Pale Blue Dot, Aera VC, Course Corrected VC, Fifty Years, Possible Ventures, and other investors.

🚗 Guided Energy, a Paris, France-based electric fleet charging management platform, raised $5m in Seed funding from Dynamo Ventures and Sequoia Capital.

🚗 Snap-E Cabs, a Kolkata, India-based electric cab service provider, raised $2m in Seed funding from Inflection Point Ventures.

📦 Voidless, a Milan, Italy-based on-demand packaging solutions platform, raised $2m in Seed funding from 360 Capital and CDP Venture Capital.

⚡ Loamist, a Berkeley, CA-based biomass feedstock collection platform, raised $1m in Pre-Seed funding from Third Sphere, VoLo Earth Ventures, and WovenEarth Ventures.

Brookfield Asset Management, a Toronto, Canada-based investment firm, raised $10bn in the first close of its second global transition fund, earning the top spot as the world’s largest transition investor among private fund managers.

NIO Capital, a Shanghai, China-based investment firm, has raised $421m for its fund that invests in the automotive and energy sectors.

Mirova, a London, UK-based investment firm, raised $282m for a climate fund focusing on emerging markets.

Voyager Ventures, a San Francisco, CA-based investment firm, held a final close for their second $100m venture fund targeting investments in climate technology startups.

Rally Cap VC, a San Francisco, CA-based investment firm, held a first close of its $5m fund that invests in fintech climate companies in emerging markets.

Can’t get enough deals? See full listings and deal analytics on Sightline Climate

British banks take climate action. Barclays announces it will no longer finance oil and gas projects. According to the Rainforest Action Network, banks provided $669bn of finance to O&G projects in 2022, of which Barclays was responsible for $16.5bn, the most of any UK bank. Meanwhile HSBC announces it will start disclosing “facilitated emissions” data; emissions that come from deals they facilitate rather than the current data of just those they invest in. In 2019, 45% of HSBC’s facilitated and investment emissions would have come from facilitating.

HSBC partners with Google to provide financing to climate tech start ups, including their first deal with LevelTen Energy, following its acquisition of the UK arm of Silicon Valley Bank last year.

The EU announced its goals to cut emissions by 90% by 2040 as a stepping stone to its carbon neutrality goal in 2050. The ambitious plan would require the EU to reduce fossil fuel use in the energy sector by 80% by 2040 compared to 2021 and spend 3.2% of GDP on energy investment from 2031 to 2050. In a busy week for EU climate policy, nuclear energy received a “strategic” label making it eligible for the same benefits as renewables. It wasn't all green lights though, ESG ran into a German roadblock as the Corporate Sustainability Due Diligence Directive was delayed after Germany abstained and Italy followed suit. The law that would mandate more supply chain monitoring and emissions tracking.

Over the channel the tide is pulling in the opposite direction. The Labour Party slashes its pledge of spending £28bn ($35bn) a year on its green investment plan. Citing a worsening of the UK’s financial position since the policy was announced in 2021, the opposition party reduces the goal to £4.7bn ($5.9bn) a year in new green spending were they to win in this year’s election.

Ethiopia takes the lead as the first country to ban internal combustion engine cars. Struggling with air pollution and the price of oil imports, Ethiopia plans to bring the law into effect rapidly, utilizing the country’s near 100% renewable energy grid.

Orsted suspends dividend, cuts 800 jobs, replaces chair, and exits the offshore wind markets in Spain, Norway and Portugal. Having been hit hard by interest rates and supply chain disruption in recent years the company’s share price has fallen more than 70% since its 2021 peak.

The EPA is cracking down on air pollution. The agency announced a stricter annualized exposure mandate for particulate matter, reducing the previous standard from 12 to 9 micrograms per cubic meter of air which is estimated to prevent up to 4,500 premature deaths annually and 800,000 asthma cases.

A new way to stay on top of what’s hot with Heatmap’s Robsinson Meyer and Princeton’s Professor Jesse Jenkins new podcast.

Secret moon mining missions are not so secret anymore.

Billions of dollars later, the decline of cultivated meat.

Udderly amazing, old milk can churn out gold from e-waste.

Nio's ET7’s range leaves Tesla in the dust.

It’s an e-bike, it’s a moped, it’s a motorcycle, it’s a new EV.

Bacteria-growth leather from petri dish to fashion.

“Climategate” comes to a close as climate scientist Michael Mann wins $1m in defamation case, debunking fraud claims.

Cambodia's endangered turtle nests offer a beacon of hope for conservationists.

📅 Out in Climate Happy Hour: Register for the Out in Climate Happy Hour in NYC hosted by Acre on Feb 20th to network with other LGBTQ+ professionals working in sustainability.

📅 FusionXInvest: Register for the 2nd annual FusionXInvest, co-hosted by the MIT Plasma Science and Fusion Center on Feb 21-22nd, to gain insights from fusion companies, governments, and investors, followed by a day of site visits.

💡 Climatebase Fellowship: Apply for the next cohort of the Climatebase Fellowship by Feb 23rd for a 12-week experience designed to help jobseekers, seasoned professionals, or early-stage founders to network, and gain industry-relevant education.

💡 Energy Scaleup Program: Apply to the EnergyLab's Scaleup Program by Feb 29th, designed for startups in the energy sector, to gain the connections and exposure needed for scaling.

📅 Energy Storage Capital Challenge: Apply to The Clean Fight’s challenge by March 4th if you need help accessing capital for your first of a kind energy project.

📅 Sustainable Investing Conference: Register for the 2024 Brown University Future of Sustainable Investing Conference on March 8th for networking and panel discussions on topics such as nuclear power, sustainable fashion, and the role of AI in sustainability.

📅 MIT Energy conference: Register to attend the MIT Energy Conference on March 11-12th for a cutting-edge lineup of speakers driving the energy transition and networking opportunities. CTVC readers can use promo code MITEC2024-CTVC10 for a 10% discount on tickets.

Commercial Associate; Founder in Residence, Industrial Water Supply @Deep Science Ventures

Analyst @G2 Venture Partners

Senior Full Stack SWE @Arch

Process Engineer; Engineer, Electrochemistry & Energy storage @Marble

Finance Lead; Chief of Staff/ Ops Lead; Mechanical Engineer @Pacific Fusion

Vice President of Philanthropy @Greentown Labs

2024 MBA Summer Associate, Venture Investing @Emerson Collective

Summer Fellowship @Gigascale Capital

VP of Finance @Sublime Systems

Associate Investor; Senior Associate Investor @Westly Group

Head of Sales, Homeowners @Quilt

Analyst CIB Climate Tech @JPMorgan Chase

📩 Feel free to send us deals, announcements, or anything else at [email protected]. Have a great week ahead!

Trump’s coal push ignores economic reality and attractive alternatives

The tariffs' toll, explained sector-by-sector

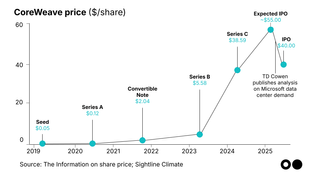

The AI company’s debut shows where the chips are falling