🌍 The rise of the new joule order #238

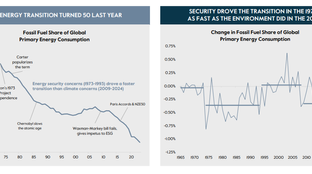

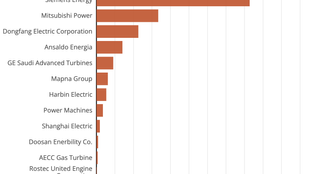

A new Carlyle report maps the macroeconomics behind the shift from climate to security

Tech companies and utilities cover their bases as data center electricity demand skyrockets

Happy Monday!

It’s Tax Day (in the US) — and for once, we’re not referring to the Inflation Reduction Act’s tax credits. But we hope you also see some returns.

Today, we’re bringing you a deep dive into data centers. The rapid rise of power-hungry AI has created a much bigger appetite for electricity and big tech and data center companies are racing to cover their bases with clean baseload power.

In other news, a carbon-heavy week with the Science Based Targets initiative (SBTi) allowing carbon credits to count Scope 3 emissions and the EU officially passing the Carbon Removal Certification Framework (CRCF).

In deals, $215m for hydrogen vehicles, $50m for utility data software; and Toyota Venture’s $150m climate fund for renewables and carbon removal.

Plus, we’re looking for more talent! Sightline is hiring for a Research Lead, Data Operations Associate, Research Intern, and more roles here.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals and announcements for the newsletter at [email protected].

💼 Find or share roles on our job board here.

As OpenAI CEO Sam Altman predicted at the beginning of the year, the future of AI depends on clean energy breakthroughs. Indeed, the rapid rise of power-hungry AI has created a much bigger appetite for electricity than our current renewable energy sources can feed — with data centers expected to double electricity demand in the next few years.

AI runs up power use in data centers, the main infrastructure for computing, because of its substantial computational demands: Data centers were traditionally built to support 5 to 10 kilowatts per rack, but AI uses 60 or more kilowatts per rack.

Major tech and data center companies now face the dual challenge of meeting this skyrocketing energy demand, while also ensuring it is met sustainably. Now, a flurry of announcements reveal how they aim to do this:

Getting out of gridlock

At the heart of this projected spike is the energy system’s dirty little secret. The grid faces major constraints trying to get new clean energy online with infrastructure challenges, interconnection delays, and permitting issues slowing down the buildout of cost-competitive renewables. A doubling of demand could result in gas peakers staying online for longer, or even new gas projects.

That won’t help big tech companies with clean energy commitments. Instead, they’re investing in both emerging technologies and relationships with utility partners to accelerate clean energy. And the one that’s particularly appealing? Nuclear.

The end goal

Data center demand provides an ideal first use case not just for SMRs, but other emerging sources of clean firm power too. Fusion and advanced geothermal promise comparable properties of >90% capacity factors, site agnosticism, and a small footprint. Data centers have provided both with their first offtake agreements, from Fervo’s first-of-a-kind geothermal project with Google to Helion’s PPA with Microsoft. LDES can also pair with renewables to balance intermittency and enhance grid stability. But the challenge for SMRs, advanced geothermal, and fusion is that none are yet ready to be deployed at scale, and will likely take years, if not decades (in fusion’s case), to get there.

While these technologies race to scale, data centers need solutions today. Existing nuclear power stations, like the one bought by Amazon, offer one clean solution. But with a lot of the US’s nuclear fleet reaching end of life, and renewables facing challenges in grid connections and capacity factor, in the near-term it may have to be gas peakers filling the gap.

🚗 HysetCo, a Paris, France-based hydrogen vehicle rental services platform, raised $215m in funding from Hy24, Air Liquide, Eiffel Investment Group, Kouros, RAISE Impact, and other investors.

⚡ Arcadia, a Washington D.C.-based energy data provider and community solar platform, raised $50m in Growth funding from BoxGroup, Broadscale Group, Camber Creek, Energy Impact Partners, G2 Venture Partners, and other investors.

🏠 CleanFiber, a Buffalo, NY-based upcycled cardboard for insulation developer, raised $28m in Series B funding from Spring Lane Capital, Climate Innovation Capital, AXA IM Alts, Tokyu Construction/Global Brain, and Ahlström Invest.

⚡ SunCulture, a Nairobi, Kenya-based solar power irrigation systems provider, raised $27m in Series B funding from Acumen and InfraCo Africa.

📦 Watttron, a Freital, Germany-based sustainable packager, raised $13m in Series B funding from Circular Innovation Fund, Cycle Capital, Demeter, and European Circular Bioeconomy Fund.

🌾 Weenat, a Nantes, France-based soil moisture sensing ag-tech platform, raised $9m in Series C funding from European Circular Bioeconomy Fund, IDIA Capital Investissement, LIBERSET, and PYMWYMIC.

🌾 Windfall Bio, a Menlo Park, CA-based methane-to-organic fertilizer manufacturer, raised $28m in Series A funding from Prelude Ventures, Amazon Climate Pledge Fund, B37 Ventures, Breakthrough Energy Ventures, Global Brain, and other investors.

⚡ Proxima Fusion, a Munich, Germany-based stellarators fusion startup, raised $22m in Seed funding from Redalpine, Bayern Kapital, DeepTech & Climate Fonds, High-Tech Grunderfonds, Max Planck Foundation, and other investors.

🥩 Liberation Labs, a Queens, NY-based precision fermentation for alt proteins platform, raised $12m in Series A funding from Agronomics and Siddhi Capital.

💨 Captura, a Pasadena, CA-based direct ocean carbon capture startup, raised another $10m in Series A funding from Japan Airlines Innovation Fund and National Grid Partners.

🍎 Reduced, a Copenhagen, Denmark-based upcycled natural flavor maker, raised $7m in Seed funding from Novo Holdings, Export and Investment Fund of Denmark, and Rockstart.

🔋 Photoncycle, an Oslo, Norway-based residential energy storage systems platform, raised $5m in Seed funding from Lifeline Ventures, Eviny Ventures, Luminar Ventures, and Momentum Partners.

🧪 Gaia Biomaterials, a Helsingborg, Sweden-based bioplastics developer, raised $5m in funding from Almi Invest.

📦 Renewaball, an Amsterdam, Netherlands-based circular tennis ball producer, raised $3m in Seed funding from Rubio Impact Ventures.

⚡ Clyde Hydrogen, a Glasgow, Scotland-based green hydrogen producer, raised $2m in Pre-Seed funding from the University of Glasgow and Zinc.

🚗 AutoNxt Automation, a Bhiwandi, India-based electric powertrain developer, raised an undisclosed amount in Seed funding from Saama Capital, Bluehill Capital, Keiretsu Forum, and Soonicorn Ventures.

🔋 esVolta, an Aliso Viejo, CA-based utility-scale energy storage developer, raised $185m in Debt funding from Nomura.

⚡ zolar, a Berlin, Germany-based residential solar supplier, raised $109m in Debt funding from BNP Paribas.

⚡ Strategic Biofuels, a Columbia, LA-based renewable diesel producer, raised an undisclosed amount of funding from Magnolia Sustainable Energy Partners.

Toyota Ventures, a Los Altos, CA-based investment firm, held a final close for its $150m climate fund that invests across renewables, carbon removal, and capture utilization & storage.

Can’t get enough deals? See full listings and deal analytics on Sightline Climate

Science Based Targets initiative (SBTi) approved a controversial new policy allowing carbon credits to count against Scope 3 emissions last week. On one hand, this major decision could reinvigorate the Voluntary Carbon Market (VCM) by validating these credits for decarbonization — but the group, known for accountability, also failed to define a methodology for verified credits. SBTi’s own staff claimed that the situation “damaged the trust of critical stakeholders,” and dozens of members called for the head of SBTi and board members to resign.

In other carbon news, the European Union officially passed the Carbon Removal Certification Framework (CRCF). This framework, a key part of the EU’s environmental plans, sets up a regulated process to certify carbon removals valid in the EU. However, in a reversal, the US Securities and Exchange Commission (SEC) paused implementation of its climate risk disclosure rule amid new legal challenges.

The EPA announced first-ever national enforceable restriction on PFAS in drinking water, backed by $1bn from the Bipartisan Infrastructure Law to aid states and territories transition. Public water systems now have a 5-year window to meet PFAS reduction requirements.

Meanwhile, the EU passed a first-of-its-kind law to cap methane emissions from fossil fuel imports, which will go into effect in 2027.

Swedish steel is going green as SSAB announced its plan to build a fossil fuel-free steel mini-mill in Luleå. By 2028, SSAB says it will replace the current blast furnace production system with two electric arc furnaces, with a capacity of 2.5 metric tons/year — aiming to reduce Sweden’s CO2 emissions by 7%.

Japanese Prime Minister, Fumio Kishida, visited the US and gave the government more than just cherry blossom trees. Kishida agreed to contribute 120bn yen ($784m) to collaborative floating offshore wind development. Kishida and the DOE also announced a strategic partnership for fusion, aimed at enhancing fusion commercialization through resource and facility sharing, including universities and national laboratories.

Biden moved to block oil and gas development across 23 million acres to boost conservation, including almost half of Alaska's emergency oil supply that was set aside a century ago. Many Alaskan indigenous communities and environmentalists have already come out in support of the decision, while oil companies holding leases in the area have leveled criticism.

Climate change is rewiring our brains’ perceptions of reality.

New report finds that to hit gigaton-scale CDR, funding must multiply … to $100 billion a year.

April's eclipse was just a shadow in Texas — solar power had already outshone coal in March.

Catan’s new board game lets you pit fossil fuels against green energy.

Wool Street? Investors are deploying sheep for more effective solar.

Roadwork ahead: Biden earmarked $830 million for climate-proofing roads and bridges.

📅 SF Climate Week: Register to join thousands of others at San Francisco Climate Week from April 21-27th and access hundreds of events centered around the clean energy transition. If you already have a full dance card, here are some highlights.

💡 QBE AcceliCITY Resilience Challenge: Apply by April 30th to join one of the startup accelerator focusing on Smart Cities, Sustainability, and Resiliency and win between $25,000-$100,000 prizes.

📅 ClimateImpact Summit: Register to attend the ClimateImpact Summit on May 7-8th in London to engage with leading experts and innovators in climate tech. (Use the CTVC discount code Climate50 to get 50% off tickets).

💡 Elemental Excelerator is opening up applications for its latest cohort – with up to $3m available per company for climate solutions with deep community impact. Applications are open now through May 31.

Research Lead, Data Operations Associate, Revenue Operations Manager, Research Intern @Sightline Climate

Private Equity Analyst / Associate @Blue Earth Capital

Mechanical Engineer; Solar Planning Lead; Direct-Air-Capture Lead @Rivian Industries

Investment Analyst @Giant Leap

Investment Analyst / Associate @Vectors Capital

Product Manager @Sealed

Founding Full Stack Software Engineer @Offstream

Coordinator, Ops & Finance, US Climate Alliance @United Nations Foundation

People/ HR Intern @Remora

📩 Feel free to send us deals, announcements, or anything else at [email protected]. Have a great week ahead!

A new Carlyle report maps the macroeconomics behind the shift from climate to security

CTVC’s dispatch from the 'Davos of energy'

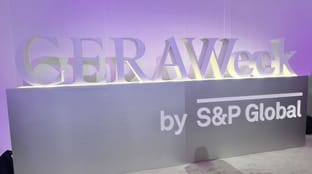

Supply shortages mean gas projects get stuck in the pipeline