🌎 NY Climate Week debrief

Takeaways from five days of hallway and main-stage conversations at NYCW

Investment theses of a new boundary-pushing fund with Energy Impact Partners’ Shayle Kann

With a fresh $200m+ fund focused on frontier deep decarbonization solutions, Energy Impact Partners is betting big on entrepreneurs discovering secrets about nature to help save it. This week, we passed the mic over to Shayle Kann, a climate tech veteran who leads EIP’s new Frontier Fund and moonlights as podcast host of Catalyst. Shayle’s a former market analyst himself, and has earned a loyal following for his ability to synthesize and frame complex climate topics. On brand, he presents a 5-part series of guiding challenges to deep decarbonization with examples of early stage climate startups that are pushing the frontier on each challenge.

As our readership knows, the field is starting off 2022 flush with new climate-curious funds and dry powder. Likewise, EIP already backs later-stage energy and cybersecurity cos from a treasure chest of $2b+ in AUM, of which a majority of capital comes from strategic LPs including utilities, industrials and energy companies. The new Frontier Fund is a harbinger of successful investing shops pushing earlier and deeper into decarbonization. As the field heats up in the race to cool down our planet, funds must differentiate through specialization and clear articulation of their founder value prop. With no further ado, over to Shayle!

[Disclaimer: Kim is an investor at Energy Impact Partners with Shayle]

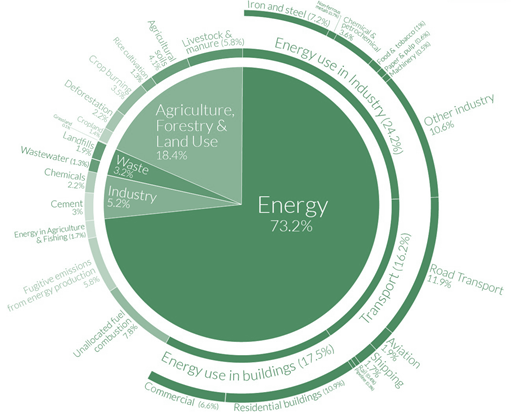

The challenge with truly tackling climate change - and, conversely, the most attractive thing about “climate tech” - is how pervasive GHG emissions are throughout the global economy. They come from almost all human activity, which means the process of deep decarbonization (i.e. solving for the areas that will help us truly achieve net-zero, not just the things that start us down the right path) will require a dramatic transformation of many of the largest sectors in the world.

That’s great when you’re looking for a total addressable market you can measure in the trillions, but it’s tricky when you want to figure out where to focus. So we’ve spent a lot of time trying to boil the massive challenge of deep decarbonization down to something digestible, both for us as investors and for anyone who feels overwhelmed by the magnitude of the task at hand.

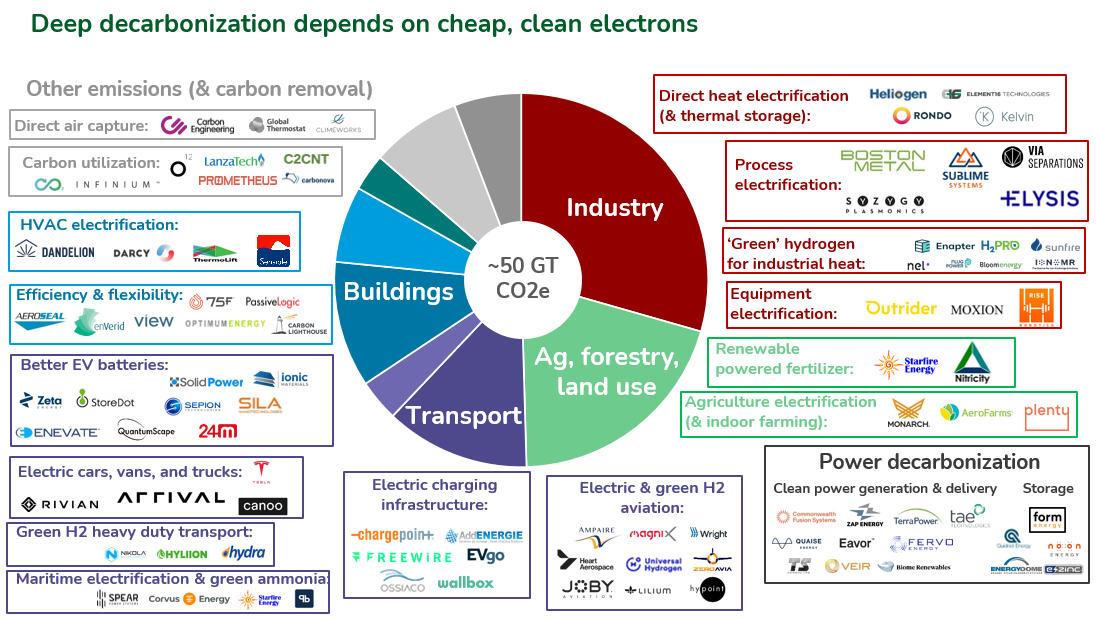

And so, the Five Core Challenges of Deep Decarbonization:

They help define our investment focus for the EIP Frontier Fund, but more importantly for me, they give me guardrails on how foundational a climate tech innovation might be. We’re looking for big swings at these big challenges. They’re far from a perfect representation of the task at hand, but I think if we solve them, we’re pretty damn close.

Almost ¾ of global greenhouse gas emissions can be traced back to energy. Every strategy for climate change mitigation has to place significant focus there.

And it starts with electricity. Electricity alone is around ¼ of global emissions, and it’s where we’ve made the most progress towards scalable, economic solutions to decarbonize (predominantly wind, solar, and lithium ion batteries). But there is a very long way to go, and every time we solve one challenge (“how do you make renewables cheap?”), we create another (”how do you deal with multi-day weather events?”).

Our first investment in our Frontier Fund over a year ago was in Form Energy, which is building an entirely new kind of battery - one that can deliver multiple days of energy storage at a tiny fraction of the cost of lithium ion.

As we look further out into the future, some places in the world will struggle to build enough cheap, clean renewables for a variety of reasons including land availability and transmission constraints. Those places will need extremely energy-dense, zero carbon power. Enter nuclear (next-gen fission and first-gen fusion) as an attractive contender if the technology pans out. We’ve invested in Zap Energy on the fusion side - get ready to remember the phrase “sheard-flow plasma confinement in a z-pinch reactor”. We remain excited about next-gen geothermal, distributed hydropower and a basket of other future sources of clean, flexible baseload power.

Achieving cheap, reliable, clean electricity is also The Great Unlock for so many other sources of energy-driven emissions. Today electricity only makes up ~20% of our final energy consumption. But if we’ve solved electricity, that share should double, or more. Obviously we’re already headed down that path with passenger vehicles, but the opportunities to electrify extend much further.

Of course, the opportunity for massive electrification just makes the energy decarbonization challenge even harder. We’ll be decarbonizing the grid while doubling its size over the next 20-30 years. The magnitude of that transition is hard to fathom.

The list starts with steel, cement, chemicals and aluminum - but it can go on much longer. Industrial processes are a huge driver of global emissions (over 30% of GHG emissions come from manufacturing), and every major-emitting sector is starting to experience meaningful pressure to decarbonize.

What’s exciting to me about that pressure is that it’s coming from all corners - activists, yes, but also employees, shareholders, and customers. Expect to see zero-carbon products popping up all over the place in the coming years, from the cars we drive to the clothes we wear.

Generally speaking, I think of three categories of solutions to industrial emissions.

All of these are going to need to work in concert to solve the intractable problems of industrial deep decarbonization.

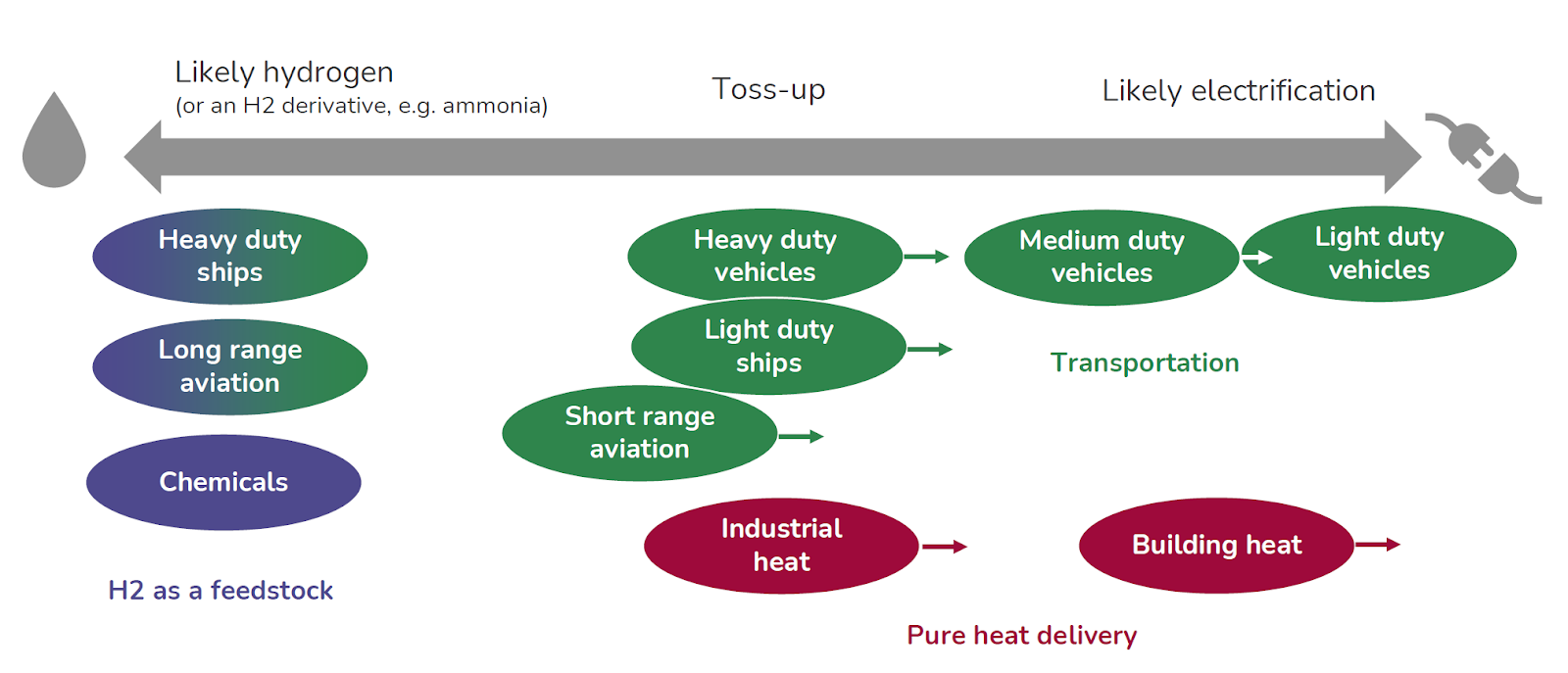

We move a lot of big things (both people and goods) long distances these days. And there’s no realistic future in which that changes enough to bend the curve on transportation emissions alone. So the solutions that have real potential to decarbonize mobility usually fall into one of two categories.

First are fuel-switching solutions such as transportation electrification, starting with passenger vehicles. At this point we know the end-state: virtually all passenger vehicles will be electric, full stop. But what we don’t know yet, and where there remains a ridiculous amount of entrepreneurial opportunity, is how to get there faster and overcome the biggest barriers to adoption - range, charge time, user experience, minerals shortages, etc. Every one of these categories will spawn multiple billion-dollar companies in the next five years (and some already do).

Of course, some areas of transport are going to be easier to electrify than others, and there’s a battle brewing in the heavy-duty world between electricity and clean fuels (bio-based as well as hydrogen, ammonia/methanol, etc.). It’s exciting, for example, to see companies like Zeroavia and Universal Hydrogen pushing the boundaries on H2 aviation.

Beyond fuel-switching, there’s a whole category of mode-changing innovations in transportation. Should we ship goods over oceans via smaller hydrofoils? Should we replace coastal trips with electric seaplanes? Can we re-engineer cargo logistics to minimize truck miles? Are eVTOLs a realistic climate solution?

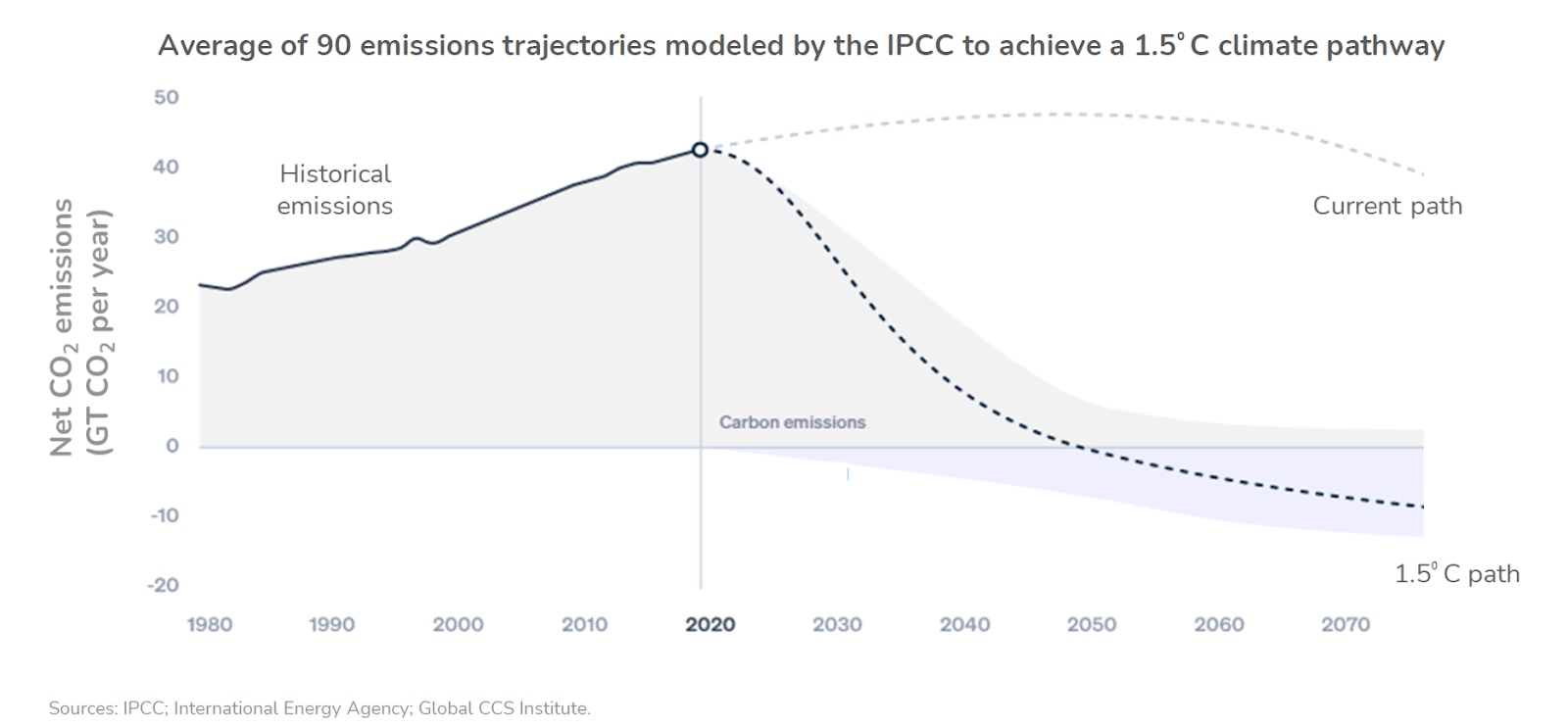

This one is both very simple on its surface and extremely complex in its details. The simple version is we’re not going to hit, or even approach, net-zero on a global basis by mid-century without developing a massive market for carbon management - capture/removal, storage, transportation, finance, etc. Simple math: we need to remove 10 gigatons per year by 2050 (and capture more from point sources, like our portfolio company Carbon America does). At $100/ton, that’s a trillion dollar market.

The complexity comes from the removal impact and economics (ex. policy). Which pathways for carbon management have the greatest capability to scale to the size of the problem, economically?

This is the scale of what we’re trying to rebalance:

How do you build a business in advance of the policy lever that will be needed to cement the market’s longevity? The entrepreneurs tackling both of these challenges are the ones who we want to partner with.

If you ever forget why GHG emissions are so intractable, just look back at Maslow’s famous hierarchy of human needs. At the bottom of the pyramid of humanity’s most basic needs are two major categories of emissions: food and shelter.

Food - and more broadly, agriculture - is a big one. There’s a ton of exciting innovation going on in the world of alternative or cell-based protein and dairy. But equally important (and less appreciated today) is the emissions side of ag. Take nitrogen fertilizer as an example. Between its production and application (the latter of which causes massive emissions of N2O, the worst greenhouse gas you haven’t heard of), it’s responsible for more than 6% of global CO2e. It’s also perhaps the most important product in the world and helps feed more than half of humanity. We invested in Nitricity to disrupt and decarbonize that hundred-year-old market. There are also dozens of exciting innovations to reduce demand for synthetic nitrogen, increase soil carbon uptake, and monitor soil carbon content.

And then there’s shelter. Buildings have emissions embedded in their structures (cement, steel, aluminum, etc.) and emanating from their energy use (both directly, like boilers for heat, and indirectly, like electricity consumption). But the built environment world has woken up fast to the demand for ESG and sustainability (see: booming demand for EIP portfolio company Measurabl) and solutions abound. Better building materials, building energy management, HVAC systems, backup generation/storage, and on and on.

My friend Rob Hanson, the CEO of Monolith, recently said something like “in climate tech, your moat is knowing secrets about nature that others don’t.” That’s the goal here. Just as it takes a certain mindset to build a company based on a fundamentally new understanding of nature, so does it take a different mindset to invest in those innovations.

That’s what we’re trying to find through the Frontier Fund: entrepreneurs who are discovering secrets about nature to help save it.

If you’re an entrepreneur building revolutionary technologies that will form the building blocks of the net zero economy, reach out to Shayle and Kim! If you’re excited about investing in frontier deep decarbonization, join the team.

Takeaways from five days of hallway and main-stage conversations at NYCW

What ~300 exits over 3 years show about funding today's climate tech cohort

Fewer dollars, more climate innovation in 2022 climate tech market report