🌎 Get ready with me: Government grants edition 💅💵

A founder’s guide to winning non-dilutive funding with Elemental Excelerator

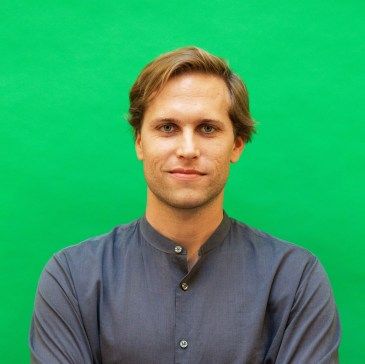

This week we sat down with James McGinniss, CEO and Co-Founder of David Energy, to learn more about distributed energy resources (DERs) and how David Energy plans to transform the Goliath electricity grid.

This week we sat down with James McGinniss, CEO and Co-Founder of David Energy, to learn more about distributed energy resources (DERs) and how David Energy plans to transform the Goliath electricity grid. Described by Bloomberg as “a new kind of energy company,” David Energy is a retail electricity supplier that leverages customer’s onsite energy assets such as smart thermostats, batteries, and EVs into electricity markets via their software platform. By intelligently adjusting customer demand in real-time via these assets, David Energy is able to deliver cheaper and cleaner electricity contracts than incumbent suppliers. Fresh off a new $4.1m Seed raise and $15m working capital facility announced last week, we sat down with the chief slingshotter himself to learn more about James’ and David Energy’s approach to creating a bidirectional grid.

Why did you start David Energy?

Since high school, I’ve been fascinated with the energy transition. It’s wild to think that back then we were talking about peak oil supply. Now, we’re talking about peak oil demand.

I studied physics and math during undergrad and then I got a masters in mechanical engineering. I was thinking about a PhD in battery storage science, but quickly became obsessed with the problem of how to operate the grid with majority renewable energy and how that would change electricity markets.

David Energy emerged out of wanting to solve the real-world problem of reaching an 80%+ renewable energy grid. My co-founders and I always wanted to build technologies to address the problem of how intermittent resources like solar and wind will lead to volatility in the supply of electricity – we need power when the sun isn’t out and the wind isn’t blowing. We took the retailer approach to manage these assets in part because the way this problem expresses itself is via price fluctuations in real time electricity markets. We used to have tight control of supply with no view into demand. Now, we have a lot more control over demand which we think gives us the ability to run the grid off cleaner and cheaper renewables.

What are DERs? How are they changing the way the energy market functions?

DER stands for Distributed Energy Resources. They’re a broad bucket of devices such as generators, solar batteries, smart thermostats, electric water heaters, and heat pumps. Any energy device that’s installed in a home or building is distributed in nature – either producing, storing, or controlling energy.

As we integrate more solar and wind into the supply-side of energy, customers on the demand-side need to be much more responsive and flexible because clean energy availability fluctuates. We view DERs as part of the key suite of technologies that will allow us to adopt a highly renewables-dependent grid.

Many customers in the US are completely new to having a choice over their energy retailer. What does an “energy retailer” do and how are retailers different from utilities?

There is a lot of confusion around the difference between utilities and retailers.

On one side of the energy market, you have wholesale. Generators, like big power plants, bid their power in at a certain price. On the other side of the market, you have retail energy providers that sign contracts with customers for that power (i.e., they buy power on behalf of customers). Retailers ship the energy on wires and infrastructure that are typically owned by utilities – causing most people to think that utilities are their power provider. Confusingly, in certain cases they can be. Across 20 states with “de-regulated markets,” retailers are allowed to provide power, not just vertically-integrated utilities. In deregulated markets, providers send power on utility wires that they don’t own just like UPS and Amazon ship packages on roads.

What approach does David Energy take? And how does David Energy stand out from traditional retail providers?

Our name “David Energy” comes from the story of David and Goliath. We want people to be able to make their own decisions about where they get their energy. Our mission derives directly from what DERs provide: cleaner, cheaper, more resilient, and empowering energy. We hope this amounts to a massive cultural awakening in energy, where people have preferences on which companies they get their energy from, as well as a shift in the perception of what an electricity provider is.

Traditional retail energy providers and utilities operate like Goliath on a massive scale of gigawatt-magnitude coal, nuclear, and hydro plants and with limited software. They buy power in one location and sell it elsewhere, taking a margin on the spread between the two and using utility infrastructure to ship the electricity from location A to B. The explosion of DERs like smart thermostats, battery storage, heat pumps, electric vehicles, advanced backup generators, and smart meters means much more data but also potential for individual customer control of the grid. We saw a massive divide between customers with DERs and the traditional power providers who didn’t know how to serve them.

We’ve built a technology platform that integrates with and controls these DERs. As a vertically-integrated company, where we are also the retail electricity and demand response provider, we’re able to leverage those assets directly in the wholesale market and provide our customers cheaper power. We have granular visibility into customer demand, which we can shape in real time using the DERs to be smarter about how to get power from the market.

For example, power prices are generally ~$30/MWh day to day, but on the hottest days in Texas prices can go up to $9,000/MWh. These 300x price surges are happening more frequently (like, right now!) with climate change (e.g. in California during wildfires). In these high price moments, David Energy can tell a battery to discharge, auto-adjust thermostats, and delay an EV from charging until later to generate cheaper rates for the customer. We built David Energy to be a vertically integrated model combining the software with being a retail energy provider so customers get one simple, all-in-one product.

What challenges keep traditional energy providers from being able to do what you do?

The primary challenge is that energy is extremely commoditized. Everyone buys from the same 10 power desks and has the same access to the market every day. It’s hard to have an edge on price. Typically, for a $80/MWh deal the retailers might differ in price by $0.50-$1.00, which the customer hardly cares about. They’re having a tough time switching to a service-based approach because (1) they’re not especially software savvy and (2) they built their business model around old methods of buying and selling power. For these power sellers, customer acquisition and churn are high which they can’t really fix.

We also expect to start buying power from some of our customers. If they are using solar, for example, we can buy back excess power and funnel it to our other customers. Currently, energy retailers are allergic to solar customers. They use a one-way model of the grid, so they’re confused how to sell the excess solar power. We’re building our model around a bidirectional grid and offering customers a service instead of just a power contract.

How do you fit within the DER landscape? Who are your potential collaborators vs competitors?

Our only natural competitors are retail energy providers. We currently profit through a mix of SaaS and demand-response revenue but now that we have launched as a retailer, in the next 2-5 years we anticipate most of our revenue will be driven by margins on purchased power.

We want to collaborate with other DER providers and softwares because, even if we have some overlapping capabilities, David Energy can provide the demand-response and power contract to get the customer cheaper power. Our best-fit partners would be solar, battery, or microgrid developers. They’re designing, building, and financing projects, but they need a demand-response provider to actually monetize their assets. Historically, to deliver on a DER project you’d need a demand-response provider (like CPower), MACH Energy or Schneider to provide the software to monitor the HVAC system, Geli or Stem would do the battery management, and another company would do the power contracting. We combine all of these roles under one roof, from the demand-response provider to the holistic energy management software platform. When it comes to data silos, the whole is truly greater than the sum of the parts. We aim to be a one stop shop for our customers.

Who are your target customers and how do they use your product?

We’re starting primarily in commercial and industrial buildings – typically 50,000-100,000 sq. ft. – that have an existing building management system. We do work with one project developer supporting residential and eventually will expand in that direction. To integrate with our product, we install a small piece of hardware into these building management systems, somewhat like a Nest, so that big buildings can access our data and controls. We’ve designed our product such that we can build an API to pull and report data on any type of asset that we’re integrating with. We’re also hooked into the smart meter so we have all this real-time data coming in on the front-end. On the back-end, we’re integrated at the market level which allows us to do all the demand-response and energy buying for our customers. Customers get 10% savings on their bills with a lot more transparency via a software product that is easy to use.

What’s David Energy’s customer proposition?

Our product offering isn’t just a cheaper power contract, but also enables more transparency around energy bills and real-time controls, bringing the whole suite of energy operations under one roof. We see DERs provide four distinct values to customers:

If a natural disaster like a wildfire or hurricane occurs and the grid goes down, for example, you can have power and more control over where it’s directed with DERs (e.g., to WiFi or to charge your car). Right now, it’s typically an all or nothing model. At a larger scale, the government could have the same option like telling DERs to charge electric snow plows and streetlights in the case of a snowstorm outage.

Individuals are empowered to make decisions about their energy that they never had before. As opposed to just paying the bill or calling during an outage, DERs allow for a more direct relationship between energy providers and their customers.

What’s your go-to-market approach?

We do work directly with building owners, but sell primarily through energy brokers and project developers. Because the retail energy space is highly competitive, commercial owners will have brokers who often times also act as their sustainability consultants. They’ll send out an RFP to 4-6 power providers every 12-36 months – a lot like health insurance. We try to work with brokers who are aware of sustainability initiatives and incentives that can add value to their customers. That’s a channel we wouldn’t have access to if we weren’t a power provider. The other primary channel is going through the other direction by partnering with solar and battery project developers and integrating on top of their solutions.

Tell us more about the FERC’s Order 2222 and its impact on DERs?

Currently, DERs are haphazardly compensated utility-to-utility. Some markets don’t even have demand response programs. Payment typically happens via what’s called net-metering, where the utility gives you credit for your exported excess power. Net-metering was a great tailwind for the market, but because the utility is the sole offtaker there’s a cap on the power consumed and produced.

The FERC ruling forces recognition of DERs as wholesale market participants for energy capacity and demand-response, and essentially pulls the DER compensation mechanism out of the hands of the utility. This is a huge tailwind for us and for the future of the grid we envisioned when we started David Energy. It’s all coming true right on schedule. The Order gives DERs access to all markets, like the one that currently exists in New York, and allows us to branch out into new target states, like Massachusetts, Connecticut, and Texas. This new Order will create more robust and fair markets, spur innovation, and allow customers to get more value out of their system.

You just announced a highly anticipated Seed round! Congrats! Who participated in the Seed?

Thanks! We raised a $4.1m Seed led by incredibly knowledgeable Rick Zullo at Equal Ventures who – despite being a software VC – is a real energy market expert! Additional seed investors include Operator Partners (led by Zach Weinberg and Nat Turner), BoxGroup, Greycroft, Sandeep Jain and Xuan Yong of RigUp, returning angel investor Kiran Bhatraju of Arcadia, and Jason Jacob’s MCJ Collective rolling fund.

How does the $15m working capital facility from Hartree Partners support the equity Seed round?

We’ve signed a working capital facility with Hartree – which is a wholesale power desk. The way retail energy providers operate, they need to sign facilities with power desks to both buy their power and act as lending partners. At David Energy, we will look at customer data over the last 12-24 months, predict their usage, and buy that power in advance. We are essentially buying hedges through the power desk. They are then lending us that power, and eventually we will pay it back to that power desk when the customer pays us. This is the backbone of every retailer, because there is a ton of cash turnover every month venture capital equity should not be used to fund. It was pretty difficult for us because, looking at some of the major providers, they’re built on the old world model I mentioned earlier (i.e., one-way flow). It was important to find a group that is aligned with us on the future of energy markets (i.e., bidirectional flow). So they’re really a partner, not just a lender.

Curious about how you too can wield the slingshot? David Energy is hiring a VP of Engineering. To explore partnership opportunities, reach out here. Those curious to dive deeper into IOT connected energy devices are welcome to join the DER Task Force, which James organizes. Lead investor, Rick Zullo at Equal Ventures, open sourced an insight studded deep dive into DERs prior to investing.

Interested in more content like this? Subscribe to our weekly newsletter on Climate Tech below!

A founder’s guide to winning non-dilutive funding with Elemental Excelerator

Infrastructure investing for impact with Banyan Infrastructure's Amanda Li

Venturing into nature with Diego Saez-Gil at Pachama