🌎 Tariffs, trade wars, and climate tech #240

The tariffs' toll, explained sector-by-sector

Happy Monday! In this week’s issue, we dig into the demise of the last great hope for Biden’s BBB climate policy. Tl;dr, a fickle senator walks into a feckless senate, and the planet picks up the tab.

On the heels of our midyear climate funding recap, a hot $300m for Monolith Material's clean carbon black, plus $135m and $90m for battery storage and materials, respectively. Plus, more climate dry powder including Collaborative’s new $200m SOS fund.

In the news, the US DoE injects $2.6B towards carbon capture, storage, and pipeline networks while Congress proposes a Clean Shipping Act and the US & Australia team up on a renewable supply chain that’s less dependent on China.

Thanks for reading, and hang in there!

Not a subscriber yet?

Turns out the third time is not the charm. For the third time in three decades, federal climate legislation has flopped.

After a year of back and forth, Senator Joe Manchin told Democrats he won’t support climate legislation - committing a climate “rug-pull” and single-handedly impeding Biden's BBB agenda. What started off last November as a hopeful term of sweeping climate legislative action has since devolved into roundabout negotiations that still ended in Manchin pulling the plug.

Manchin’s fickleness also caused the Biden administration to waste precious time foregoing the full force of executive authority to dance around delicate negotiations. As Bill McKibben puts it, “he got the President to strip the sticks from the bill (clean-energy pricing plan) and then he nibbled away at the carrots.”

Now that US climate legislation’s last hope may be dashed, what happens next?

While this likely won’t impact the uptick in private spending into climate, the lack of a viable public accelerant on the heels of the Supreme Court’s EPA neutering means the government is by and large taking a pass on its intent to hit climate reduction accords during a Democratic majority and presidency, leaving climate policy back in the hands of temporary executive orders.

The lack of federal support for climate investment may as well be a gift in disguise for China and its state-subsidized efforts to win on cleantech domination. Despite the US’s penchant for innovation, we’ll continue to struggle on sharpening our edge for deployment.

And finally, this makes everything more expensive. The bill’s ultimate intention was to lower long-term energy costs, one of the primary drivers of today’s inflationary environment. Climate inaction also feeds into the cyclical loop of “heatflation”, extreme weather exacerbating supply chains and ratcheting up food prices. Relying solely on private actors and local governments will be much more cumbersome and handicap the multiple decades-long build up cycles necessary to get to net zero.

⚡ Monolith, a Lincoln, Neb.-based "green hydrogen" producer, raised $300m in Growth funding from TPG Rise Climate, Decarbonization Partners, NextEra Energy Resources, SK, Mitsubishi Heavy Industries, and Azimuth Capital Management.

🔋 Powin Energy, a Portland, OR-based energy storage integrator, raised $135m in Growth funding from GIC, Trilantic North America, and Energy Impact Partners.

🔋 Wildcat Discovery Technologies, a San Diego, CA-based company developing new battery materials, raised $90m in Series D funding from Koch Strategic Platforms (KSP), Eastman Kodak and Fifth Wall Climate.

⚡ Nyobolt, a UK-based developer of ultrafast battery chargers, raised $50m in Series B funding from H.C. Starck Tungsten Powders.

💨 Terra CO2 Technologies, a Canada-based developer of a low-carbon alternative for cement production, raised $46m in Series A funding from Breakthrough Energy Ventures, LENx, Creative Ventures, and Rio Tinto.

🔋 Greener Power Solutions, a Netherlands-based provider of clean mobile battery energy storage solutions, raised $45m in funding from DIF.

🏗️ Assembly, a New York, NY-based modular construction startup raised $38m in Series A funding from Fifth Wall Climate, with additional participation from Jefferies Group, Manta Ray Ventures, FJ Labs, RSE, Signia, Gaingels, Flexport, New Vista Capital, Tectonic, Atento, Etan Fraser, and Moving Capital.

🏗️ Nexii, a Canada-based sustainable construction technology company, raised $35m in funding from Trinity Capital and Horizon Technology Finance.

♻️ Circ, a Danville, VA-based circular fashion company recycling fashion waste into textiles raised $30m in Series B funding from Breakthrough Energy Ventures, Milliken & Company, Marubeni America Corporation, Lansdowne Partners, Inditex, Envisioning Partners, Circulate Capital, Card Sound Capital, Alante Capital, and 8090 Partners.

💧 Aquabyte, a San Francisco, CA-based company developing a machine learning platform for sustainable aquaculture, raised $25m in Series B funding from Softbank Ventures Asia, Westerly Winds, The Nature Conservancy, Struck Capital, New Enterprise Associates, Costanoa Ventures, ArcTern Ventures, and Alliance Venture.

🐄 Blue Ocean Barns, a Redwood City, CA-based developer of a seaweed-based digestive aid for cattle, raised $20m in Series A funding from Valor Equity Partners and Tao Capital Partners.

🌾 Fieldless Farms, a Canada-based company developing indoor farming technology raised $17.5m in Series A funding from Forage Capital Partners, Farm Credit Canada, and Business Development Bank of Canada.

🌳 Ecotree, a France-based developer of a sustainable forestry platform, raised $12m in Series B funding from Société Générale Ventures, Financière Fonds Privés and Famae Impact, Accurafy, and Épopée Gestion.

🚢 Spinergie, a France-based maritime vessel optimization platform, raised $11m in Series A funding from Iris Capital, Swen Capital’s Blue Ocean fund, Polytechnique Ventures, and angel investors.

🌾 FAARMs, a India-based agri-tech marketplace raised $10m in Seed funding from various angel investors.

⛽ XFuel, an Ireland-based company converting biomass waste into drop-in low-carbon fuels raised $8.3m in Seed funding from Union Square Ventures, HAX, and AENU.

🐄 Rumin8, an Australia-based developer of feed supplements to reduce methane emissions from livestock, raised $7m in Seed funding from Prelude Ventures and Sentient Impact Group.

🍎 Hors Normes, a France-based food waste startup, raised $7m in Seed funding from Project A Ventures and Stride.VC.

🏭 ReMo Energy, a Boston, MA-based developer of ammonia using renewable energy, raised $5.25m in Seed funding from Darco Capital, Breakthrough Energy Ventures, and AIIM Partners.

💨 Helios, a Tel Aviv, Israel-based developer of low-carbon steel production solutions, raised $6m in seed funding from At One Ventures, Doral Energy-Tech Ventures, Metaplanet, and others.

♻️ The Cool Down, a Bend, OR-based startup that provides sustainable content and product recommendations, raised $5.7m in Seed Funding from Upfront Ventures, Swingbridge, Niche Capital, Jetstream, and Revolution’s Rise of the Rest Seed Fund.

🔋Veckta, a San Diego, CA-based onsite C&I energy marketplace raised $3.3m in Seed funding, from VoLo Earth Ventures, Triple Impact Capital, She’s Independent, SeedFolio, Nomadic Venture Partners, and Cove fund.

💨 CleanO2 Carbon Capture Technologies, a Canada-based carbon capture technology company, raised $2m in Seed funding from Regeneration.VC, Export Development Canada, Duke Street Investments, TIRI Group, and Local Investment YYC Cooperative.

🔋 SiTration, a Cambridge, MA-based startup pioneering novel separation processes for battery recycling, raised $2.4m in Pre-seed funding from Azolla Ventures and E14 Fund.

🌍 Carbon Equity, a Netherlands-based climate investing platform raised $1.8m in Seed Funding from Wi Venture, SkyNRG, AENU, and 4impact.

⚡ Sunfire, a Germany-based developer of green hydrogen electrolyzers, raised an undisclosed amount of funding from Amazon’s Climate Pledge Fund.

Collaborative Fund raised $200m for their Collab SOS fund, aiming to invest in Series A and B sustainable companies across materials, ingredients, energy, and supply chain.

Systemiq Capital raised $70m for their second fund focused on developing efficient and sustainable cities.

Vektor Partners, a London-based VC firm focused on sustainable mobility startups, raised $126m for its debut fund.

Sensata Technologies completed its $580m acquisition of Dynapower, a South Burlington, Vt.-based provider of energy storage and power conversion systems, from Pfingsten Partners.

Partners Group acquired a majority stake in Budderfly, a Shelton, Conn.-based energy management startup, for more than $500m.

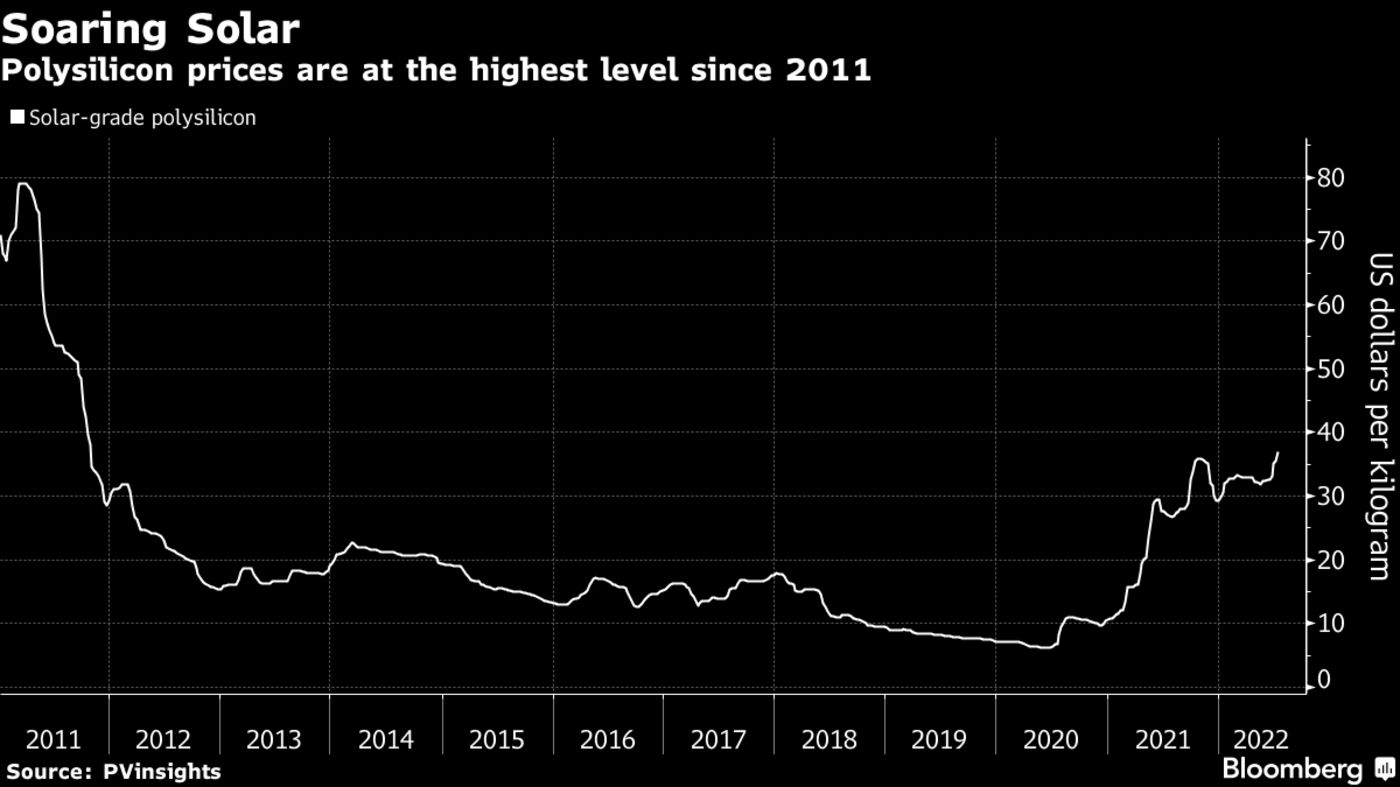

Prices of polysilicon, a key input to solar panels, has skyrocketed to its highest level since 2011 causing a price ripple through the solar market. Meanwhile, to combat solar supply chain woes, the US and Australia will team up on a net zero technology acceleration partnership in a bid to forge a renewables supply chain less dependent on China, currently responsible for ~80% of solar manufacturing.

The US Department of Energy commits $2.6B in funding opportunities for carbon capture and storage demonstration projects, as well as studies to expedite the building of CO2 pipeline networks.

Microsoft is going all in on DAC, signing a 10-year carbon removal agreement with Climeworks to remove 10,000 tons of CO2 emissions.

The Clean Shipping Act was proposed in Congress in a bid to accelerate the decarbonization of maritime vessels away from highly polluting diesel fuels. The clock is likewise ticking down to Jan 1, 2023 when the IMO’s Carbon Intensity Indicator and associated teeth will bite down on maritime emissions.

Unprecedented temperatures over 40°C prompted the UK’s first-ever red weather warning which “poses danger to life.” This week’s heat blows through the nation’s current record of 38.7°C, in a country wholly unprepared with a defense of onions and gazpacho. Meanwhile scorching heat waves are also rippling across China, breaking records across 71 national weather stations.

In Germany, ministers are revamping their national climate plan after missing targets. With transportation and housing sectors lagging behind their climate goals, ministers committed to $250m investment to introduce more bike lanes and energy efficient buildings–but climate activists claim the plan is too vague.

Carbon markets gone wild. Incorporating the carbon services of wild animals into the financial markets has double bottom line potential, according to Nature.

Canoo’s this? Walmart orders 4,500 electric vans on its road to zero-emissions by 2040.

The Keeling Curve Prize announced 10 winners bending the curve on emissions, including CTVC fan faves Nitricity, Symbrosia, BasiGo, and Air Company.

The era of heatflation has arrived.

Carbon removal stakeholders talk barriers to scaling the industry.

Must click climate(ish) clickbait: Top 5 Hottest Birds in the Sky.

The greenwashing police prepare to hit the grocery aisle. The FTC will revise its Green Guides to defend consumers from misleading “sustainability” claims.

John Doerr’s Speed & Scale launches a tracker to show us our progress toward net zero on a global scale. Check out our interview with the authors.

The only journalist to have interviewed Osama bin Laden after the terrorist attacks of 9/11 makes the case that climate change is a bigger threat to Pakistan than terrorism.

Tune in to McKinsey’s podcast to hear Ilan Gur’s perspective on the science-to-market gap from his vantage point as the CEO of Activate.

This LA Times article picked up heat over the weekend about solar panel recycling challenges - a discussion we’re certain to hear more about in the coming months.

🗓️ YC Tech Talks: Tune in on July 20 as 5 YC founders in the climate space give 5-minute tech talks on a technical challenge they're solving.

💡 Industrial Energy Efficiency Accelerator: Applications are open for Phase 4 of the BEIS IEEA which helps demonstrate power and resource saving technology in the real world. Apply for £150,000 to £1m per project by Sept 19.

Senior Investment Professional, Princeville Capital

Lead Mechanical Engineer @Carbon Ridge

Climate Growth Equity Analyst/Associate @Blue Earth Capital

Climate Investment Director @Biorecro

Public Partnerships Manager @Circuit

Carbon Removal Marketing Manager @Biorecro

Product Marketer @macro-eyes

Carbon Data Analyst @Watershed

Client Success Director, Enterprise Accounts @Omnidian

Carbon Project Lead, Global @Earthshot Labs

Lab Technician @Ark Biotech

Computational Chemist @Smarter Sorting

Head of Software Engineering @Sofar Ocean

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

The tariffs' toll, explained sector-by-sector

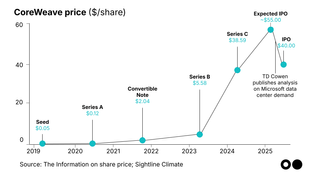

The AI company’s debut shows where the chips are falling

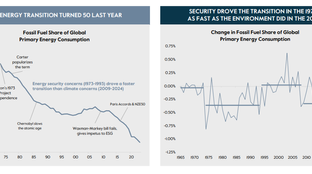

A new Carlyle report maps the macroeconomics behind the shift from climate to security