🌎 Overheard at SFCW #242

Hot takes (and our new survey!) from SF Climate Week

Methane emissions from energy production rose again in 2022

Happy Monday!

Methane is back in the spotlight this week as analysis of last year’s CH4 emissions from the energy sector shows fossil fuel companies are unwilling to do the bare minimum when it comes to abatement of “the other greenhouse gas.”

In other (greenhouse gas) news, the DOE will spend $2.5B on carbon capture pilot and demonstration projects. Battery recyclers plan to expand capacity in North America. And Texas is set to surpass California as the top state for solar.

This week in deals, UK-based startups EO Charging and Geopura land $80M for EV fleet charging and $44M for hydrogen fuels, respectively. Plus, $23M for AI-optimized greenhouses and $21M for AI-optimized battery packs.

ICYMI during the Friday inbox flurry, we dropped an analysis of the past 3 years of climate exits. You don’t want to miss this one. Feedback? Shoot us a note with what you think.

🙏 Thanks to the 1,048 (!!) of you who already filled out our reader survey. To everyone else, we’d love to get to know you better!

Thanks for reading!

Not a subscriber yet?

📩 Submit deals, announcements, events & opportunities, or general curiosities for the newsletter here.

💼 Find or share roles on our job board here.

Despite a big focus on addressing the global methane problem in the fall of 2021, CH4 emissions aren’t yet trending down.

Methane emissions from the energy sector rose slightly in 2022, according to a new report from IEA. Energy is the second-largest source of methane emissions created by human activity (behind agriculture), accounting for nearly 40% of the total each year.

While the intensity of methane emissions from oil and gas production has fallen by ~5% since 2019, overall emissions from the energy sector are still increasing— illustrating the need for the O&G industry to take a more aggressive, zero-tolerance approach to curbing methane emissions.

Importance of CH4: Over a 20-year period after release, methane is 84x more potent than CO2 when it comes to trapping heat. Methane currently accounts for more than 25% of global warming, but its lifespan once in the atmosphere is much shorter than CO2 at ~10-12 years. That means rapidly cutting methane emissions could immediately slow our planet’s warming.

In 2021, 100 countries joined the Global Methane Pledge and committed to reducing methane emissions by 30% from 2020 levels by 2030. Last year, the passage of the IRA included the first-ever fee on a greenhouse gas in the US, charging O&G companies for methane emissions.

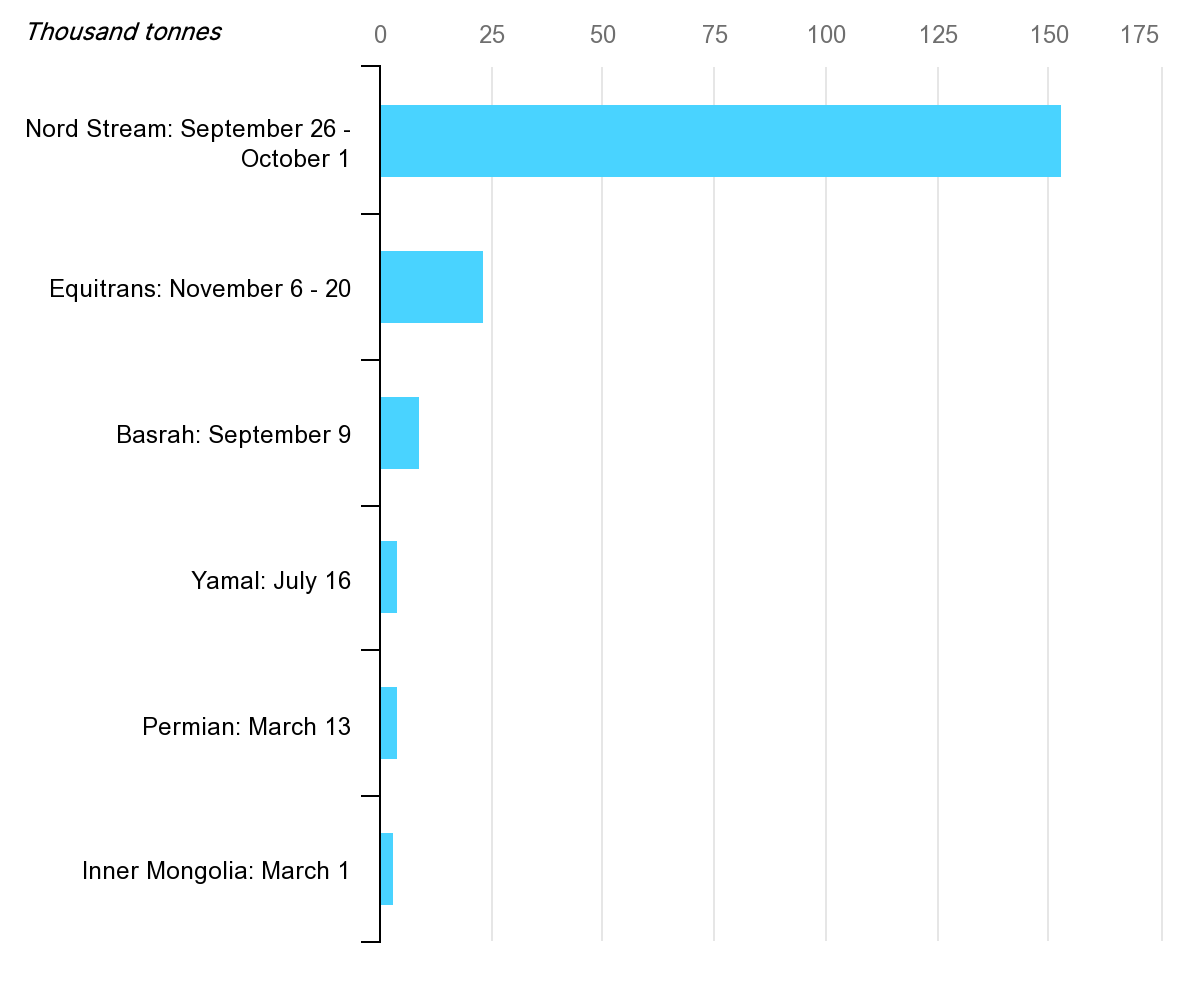

Not just leaks: Although major events like the Nord Stream pipeline incident are dramatic examples of methane leaks, normal O&G operations release about the same amount of methane as a Nord Stream-sized disaster into the atmosphere every day on average. Better monitoring for smaller-scale oil and gas leaks and repairs to leaky equipment could reduce methane emissions in the sector by 75%.

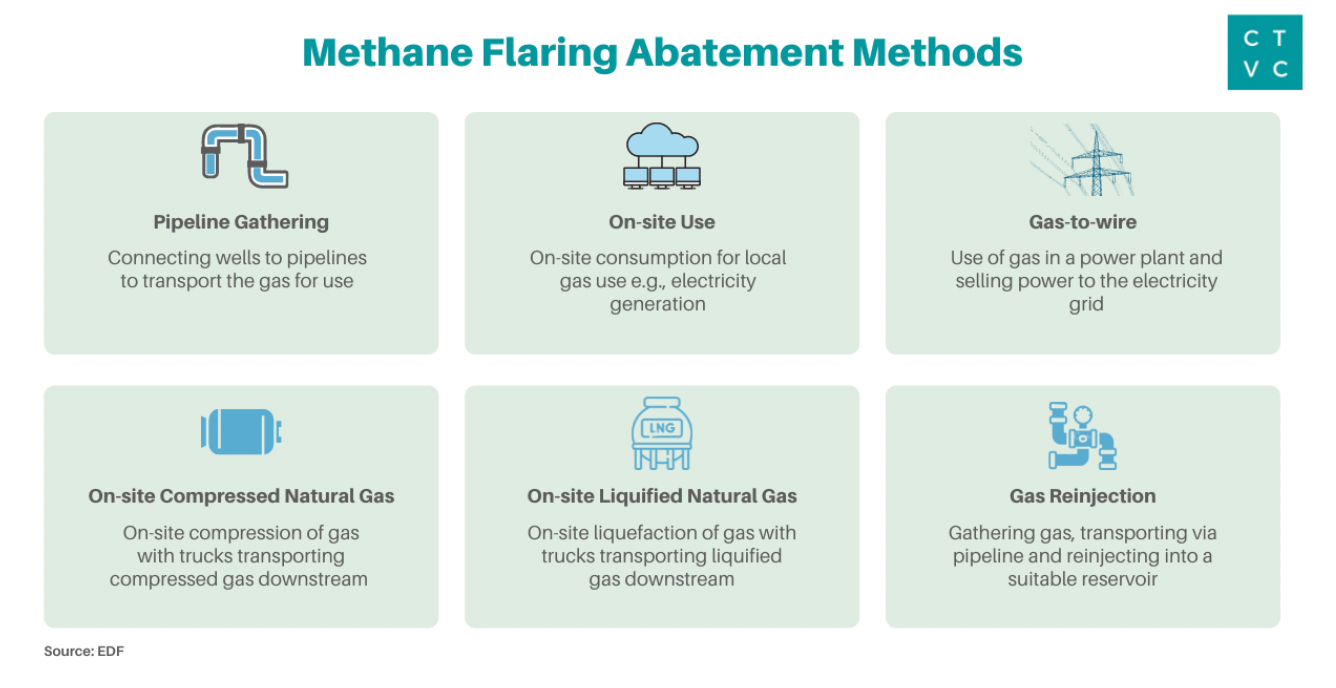

Adopting regulations to stop non-emergency flaring is the No. 1 action governments could take to reduce O&G methane emissions. Measures to reduce flaring and emissions could bring ~200 billion cubic meters of otherwise-wasted natural gas—more than the EU’s imports from Russia prior to the invasion of Ukraine—to markets each year. Avoiding this waste would shave 0.1 °C off of the global temperature rise by mid-century.

Coal is also the hidden culprit for methane emissions, releasing 40 Mt of methane emissions in 2022. Coking coal, used mainly in steel production, makes up about 25% of current coal emissions—another reason it’s urgent to solve steel emissions. While curbing coal consumption is one of the most effective methods to cut these emissions, applying existing abatement measures to coal mines could reduce their methane emissions by 55%.

O&G receipts: The rise in methane emissions from coal and natural gas last year happened amid record O&G profits.

Cutting methane emissions is not only one of the quickest ways to slow warming, but also one of the cheapest. Because the cost of tech aimed at avoiding methane emissions is actually less than the potential revenue generated from capturing that additional gas, ~40% of methane emissions from O&G operations could be abated with zero net cost to the industry.

Reducing methane emissions by 80% would cost the O&G industry ~$100B—less than 3% of the fossil fuel industry’s profits from 2022 alone. Meanwhile, O&G companies are spending only a small portion of that cash on acquisitions aimed at decarbonization: Shell, BP, and other energy companies were among the top acquirers of climate tech companies (like EV charging and renewable natural gas startups) in our analysis of climate tech exits since 2020.

⚡ EO Charging, a Stowmarket, UK-based provider of EV charging solutions for fleets, raised $80M from Vortex Energy and Zouk Capital.

⚡ Geopura, a Nottingham, UK-based producer of hydrogen-based zero emission fuels, raised $44M from GM Ventures, Barclays, Swen Capital Partners, and Siemens Energy Partners.

🏠 Aeroseal, a Dayton, OH-based provider of air duct and vent sealing technology, raised $30M in Series B funding from OGCI Climate Investments.

🌾 Source.ag, an Amsterdam, Netherlands-based AI greenhouse, raised $23M in Series A funding from Astanor Ventures and Acre Venture Partners.

🔋 Electra Vehicles, a Boston, MA-based battery pack optimization software platform, raised $21M in Series A funding from United Ventures, Club degli Investitori, LIFTT, Blackberry, and Stellantis.

⚒️ Aquafortus, a Mangere, New Zealand-based company mining metals from brines, raised $17M in Series A funding from Burnt Island Ventures, DCVC, Envisioning Partners, Intrepid Financial Partners, K1W1, New Zealand Growth Capital Partners, Novo Holdings, and Universal Materials Incubator.

🧪 Loliware, a San Jose, CA-based company making seaweed-based materials to replace plastics, raised $15M in Seed funding from 5 Pillars Capital, Alumni Ventures, CityRock Venture Partners, Clay Rockefeller, Ehukai Investments, Geekdom Fund, and L Catterton.

🏠 Gridium, a Menlo Park, CA-based company developing decarbonization software for commercial real estate, raised $14M in Series A funding from Lincoln Property Company, and Navitas Capital.

🥩 Paleo, a Leuven, Belgium-based producer of plant-based food ingredients, raised $13M in Series A funding from Beyond Impact, DSM Venturing, Gimv, Planet A Ventures, SFPIM, and Siddhi Capital.

🥩 Future Fields, an Edmonton, Canada-based developer of cell-based protein, raised $11M in Series A funding from AgFunder, Amplify Capital, Bee Partners, Builders VC, Climate Capital, Green Circle Foodtech Ventures, Milad Alucozai, Siddhi Capital, and Toyota Ventures.

🔋 XL Batteries, a Brooklyn, NY-based startup developing flow battery long-duration energy storage, raised $10M in Seed funding from Xerox Ventures, Catalus Capital, and SIP Global Partners.

💨 Oka, a UK-based carbon credit insurance platform, raised $7M in Seed funding from Aquiline Technology Growth and Firstminute Capital.

🚗 Hypercraft, a Provo, UT-based developer of turn-key electric drive systems, raised $7M in Seed funding from RevRoad.

💨 Kita, a London, UK-based provider of carbon insurance products, raised $5M in Seed funding from Carbon13, Chaucer Group Ltd, Climate VC, Hartree Partners, Insurtech Gateway, and Octopus Ventures.

🌱 Carbon Maps, a Paris, France-based climate management platform for the food industry, raised $4M in Pre-Seed funding from Breega and Samaipata.

🧪 Wild Microbes, a Cambridge, MA-based startup using microbes to create sustainable products, raised $3M in Pre-Seed funding from Climate Capital, Freeflow Ventures, Agronomics, and Fall Line Capital.

🏠 Green Fusion, a Berlin, Germany-based company working on intelligent building energy systems, raised $3M in Seed funding from BitStone Capital, Brandenburg Kapital, High Rise Ventures, Vireo Ventures, Wi Venture, and Übermorgen Ventures.

♻️ TOPOLYTICS, an Edinburgh, United Kingdom-based verifiable data platform for waste, raised $2M from UK Research and Innovation.

⚡ eDRV, a San Francisco, CA-based API platform for EV charging, raised an undisclosed amount in Seed funding from Automotive Ventures, Connect Ventures, and NP-Hard Ventures.

💧 Ecospears, an Altamonte Springs, FL-based environmental remediation company, raised an undisclosed amount in Seed funding from venVelo.

🧪 P2 Science, a Woodbridge, CT-based developer of bio-based feedstocks into speciality chemicals, raised an undisclosed amount in Series C funding from Lewis & Clark AgriFood, Heritage Group Ventures, Chanel, Elm Street Ventures, SaferMade, BASF Venture Capital, Connecticut Innovations, Advantage Capital and others.

💨 Aqualung Carbon Capture, an Oslo, Norway-based membrane carbon capture and separation technology, raised an undisclosed amount of funding from Denbury Resources.

PearlX, a Charlottesville, VA-based rental electrification platform, was acquired by Antin Next Generation Infrastructure for an undisclosed amount.

Honeycomb Battery, a battery technology subsidiary of Global Graphene Group, announced a SPAC merger with Nubia Brand International Corp.

Great River Hydro, a hydroelectric infrastructure platform, was acquired by Hydro-Quebec.

United Airlines raised a $100M fund to invest in sustainable aviation fuel.

Rgreen Invest and Echosys Invest raised a $92M Afrigreen Debt Impact Fund to invest in solar development in Africa.

Sasol Ventures, a Zürich, Switzerland-based investment firm, raised a €50M fund to invest in innovative industrial tech companies in energy, water, materials, agriculture and IoT.

Contrarian Ventures, a Vilnius, Lithuania-based investment firm, raised a €25M fund to back the next-generation energy companies.

The E.U. is closing in on a trade agreement with the U.S. for battery materials, potentially giving European companies access to benefits included in the IRA.

The U.S. DOE announced $2.5B in funding for carbon capture programs focused on de-risking transformational carbon capture technologies and scaling them commercially. Meanwhile, more than 20 companies launched the Carbon Removal Alliance as a coalition to lobby the U.S. government for even more policies to help commercialize the nascent technology.

Thailand is banning plastic waste imports beginning in 2025 as officials seek to halt a flood of refuse polluting the country’s air and water. Developing countries, particularly in Southeast Asia, have been a “dumping ground” for foreign nations’ trash for decades.

European battery recycler Ecobat is building its third lithium-ion battery recycling facility—its first in North America—while Cirba Solutions plans to expand its recycling capacity in Ohio to meet rising demand for recycled metals and minerals.

Houston-based startup Fervo Energy is now engineering a direct air capture (DAC) system, using geothermal energy to power its operations. The project is supported by a grant from Facebook founder Mark Zuckerberg and his wife Priscilla Chan’s philanthropy.

Texas will soon have more utility-scale solar than California. Though CA was ahead of Texas by about 1,000 MW at the start of 2023, Texas is simply building solar faster than any other state. It essentially doubled its capacity from 2019 to 2020 and again from 2020 to 2021.

The U.S. Department of the Interior shared more information about the first federal auction of offshore wind leases in the Gulf of Mexico. A proposed sale notice identified thousands of acres for potential leasing off Texas and Louisiana, but an official sale date hasn’t been set.

The Biden administration nominated Ajay Banga, former Mastercard CEO, to be the next president of the World Bank, though odds are on Rockefeller Foundation head Rajiv Shah. Whoever is chosen will be tasked with reforming the 1944 institution to meet the challenges of a 21st-century economy dealing with the climate crisis and sovereign debt.

The UN is negotiating a biodiversity treaty for the high seas, aiming to create a way to designate and enforce marine protected areas outside national waters.

The U.S. National Park Service is cleaning up ∼2,000 abandoned oil wells on agency-managed land thanks to Biden’s Bipartisan Infrastructure Law which released $4.7B to state and federal agencies to plug O&G projects known as “orphan wells.” Each leaky well could pose a grave environmental danger to surrounding areas in the form of methane plumes or groundwater contamination, yet closing a single one can cost tens of thousands of dollars.

Deloitte released its latest report on global oil and gas M&A activity. Overall spending is down, but clean energy deals reached a record high of $32B in 2022. O&G giants Shell and BP were two of the most acquisitive companies in our analysis of climate tech exits.

Billionaires are obsessed with cloud concealer and other forms of geoengineering. Learn more about solar radiation management on this week's Volts podcast.

Come get your foot-long EV charging oasis. Sandwich giant Subway is planning to build electric car-charging "oases" with green spaces, bathrooms, and playgrounds.

Pick your power plant. PG&E dabbles in two different virtual power plant models, emergency demand response, and permanent load shift.

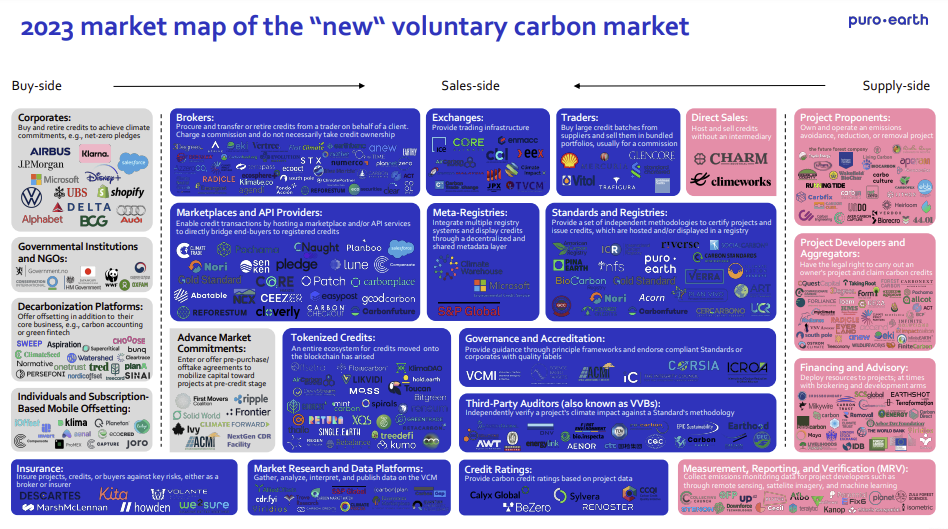

The Where’s Waldo of the Voluntary Carbon Market is here. Find your logo, in 3, 2, 1… go.

Miss Hugh Manity grapples with dropping her toxic friend Mx. Coal in a Philly-based drag-on-ice show—except on warm winter days that shut down the rink.

AI may help protect whales from offshore wind farms. The technology is already being used to alert ship captains of possible collisions with the marine mammals.

Where is all that federal battery funding going? Here’s a breakdown of ~$3B the US government has provided to domestic battery production projects so far from the Bipartisan Infrastructure Law.

Indian youth activist Disha Ravi on climate activism and getting arrested on charges typically reserved for terrorists for organizing an email campaign.

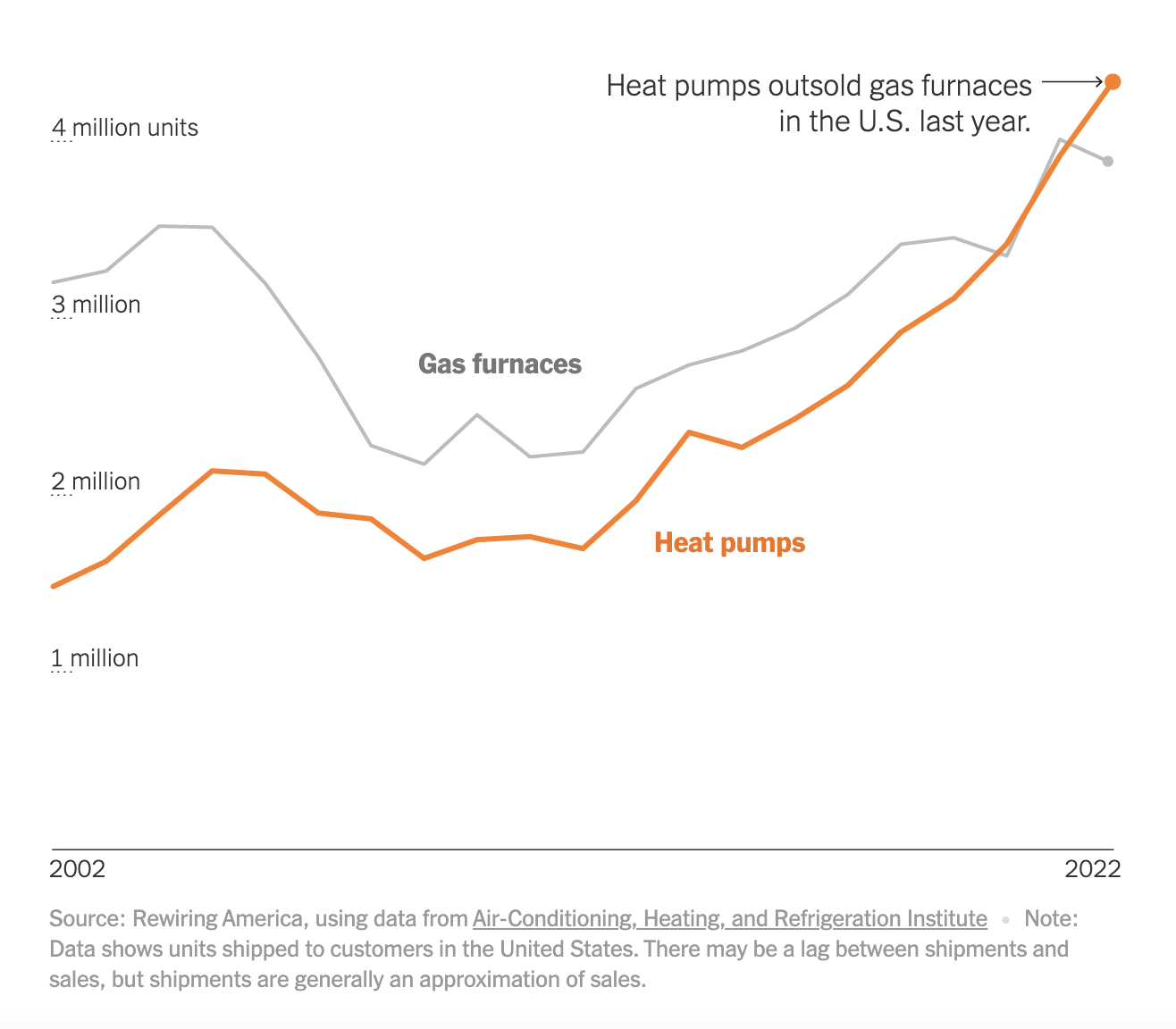

Heat pumps work harder in cold weather climates, but they work. That’s good for the owners of the 4 million units sold in 2022—the first year heat pumps outsold gas furnaces in the U.S.

From gray to green to… gold hydrogen? A few exploratory wells point to the existence of naturally occurring hydrogen underground. Here’s how gold fits into the rest of the hydrogen rainbow.

Rising sea levels are turning coastal homes across the U.S. into sticks of dynamite, passed on to less and less wealthy owners. At some point, writes Jake Bittle, they will blow.

🗓️World Agri-tech Innovation Summit: Register by Feb 27th to attend the World Agri-tech Innovation Summit in San Francisco, from Mar 14th-15th. The event includes over 2000 participants, 140 speakers, and 400 businesses.

💡Cleantech Open: Apply to Cleantech Open, an accelerator program providing resources to innovators develop cleantech businesses. Apply by Feb 28th for a discounted fee, and register to attend numerous kickoff events throughout March.

💡IES Program: Apply for Connecticut’s Innovative Energy Solutions Program to receive up to $5m in funding for projects that enable a decarbonized electric grid for Connecticut. Applications are due by Mar 1st.

🗓️MCJ: Register for MCJ’s networking event on Mar 9th to interact with fellow people within climate tech!

💡Green IT Challenge: Apply by Mar 20th to Orange Silicon Valley’s Green IT Challenge to receive resources and business development expeditions for your decarbonization solutions.

Investment Associate @ Avesta Fund

Head of Market Intelligence @ Rumin8

Climate VC Associate @ At One Ventures

Director of Marketing & Comms @ Evergreen Climate Innovations

Analyst/Associate, Private Credit Funds @ Closed Loop Partners

Vice President, Impact Measurement @ Galvanize Climate Solutions

Investor @ Orion Resource Partners

Front End Software Engineer @ Crosswalk Labs

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

Hot takes (and our new survey!) from SF Climate Week

The International Maritime Organization's first carbon tax ships out

Trump’s coal push ignores economic reality and attractive alternatives