🌎 Coal hard facts #241

Trump’s coal push ignores economic reality and attractive alternatives

The Little Engine That Could elects three climate candidates to Exxon board

Happy Monday! Hope you had a good MDW. In this week’s issue, we break down how a small hedge fund made big moves by forcing oil & gas major Exxon to change stance on future production.

We’ve got an absolute rig of deals with Bird SPACing at $2.3b, Bowery Farming raising $300m, and NCX sweeping in $20m plus a name change from SilviaTerra.

Also in the news this week - lots of coalition building including big tech’s new Business Alliance to Scale Climate Solutions, meanwhile Ford ups its EV spending by $8b, and Stripe releases its second batch of carbon removal projects. Plus some standout strategy jobs on that Stripe Climate team and at Remora.

Not a subscriber yet?

Concern over climate change from shareholders, customers, and the court sent a series of extraordinary blows to the oil industry – all in the span of a few hours that trickled over into a no good very bad week for big oil.

⛽️ Exxon, which had planned to continue doubling down on O&G production, lost a coup to activist hedge fund Engine No. 1. While controlling just 0.02% of Exxon’s shares, Engine No. 1 managed to elect three climate-conscious candidates to Exxon’s board.

🚧 Shell was ordered by a Dutch court to cut GHG emissions 45% by 2030. The company is going to have to make some tough decisions to reach compliance vs their prior commitment to cut the intensity of GHG emissions 20% by 2030.

🛢 Chevron also faced investor pressure when 61% of shareholders voted for a resolution that the company reduce its Scope 3 emissions in production process and products.

⚡ Total joined the party, rebranding as “TotalEnergies” after a unanimously-passed shareholder resolution to demonstrate its strategic transformation as a broad energy company.

While the oil runs slick, we note several key takeaways from these boardroom showdowns:

🗳️ Shareholder activism has been a central part of the ESG conversation from back in the days of mission driven “responsible investing”, but it took until last week’s showdown for voting to seriously shake up Big Oil’s board room. Other corporate laggards dragging their feet on decarbonization should take heed or they’ll be next.

🥔 It’s all a game of hot potato. When public companies clean up their balance sheet under the shareholder spotlight, private equity firms frequently swoop in under the radar to acquire firesale “dirty” assets – ultimately making it more difficult to monitor and manage. The EPA found 5 out of the top 10 methane emitters are from little-known O&G producers backed by obscure investment firms. Divesting does not mean that the dirty assets disappear.

🎲 O&G majors who genuinely transform into broader energy companies can play a pivotal role in accelerating the energy transition. There’s a massive opportunity for Big Oil to clean up their operations and leverage their project development expertise towards scaling critical clean technologies like solar, wind, geothermal, hydrogen, renewable fuels, and CCS.

🌱 Bowery Farming, a New York, NY-based vertical farming company, raised $300m in Series C funding from Fidelity, Amplo, Gaingels and insiders GV, General Catalyst, GGV Capital, Temsek, Groupe Artémis.

⚡ Aurora Solar, a San Francisco, CA-based solar panel installation startup, raised $250m in Series C funding from Coatue, Iconiq, Energize Ventures and Fifth Wall.

☔ Climavision, a Louisville, KY-based weather services and intelligence platform, raised $100m in funding from The Rise Fund.

🌱 Invaio Sciences, a Cambridge, MA-based startup focused on agriculture, nutrition and environmental challenges, raised $89m in Series C funding from Flagship Pioneering, Stage 1 Ventures, Bluwave Capital, and Alexandria Venture Investments.

🔋 24M, a Cambridge, MA-based startup revolutionizing the lithium-ion cell manufacturing process and platform, raised $57m in Series E funding from ITOCHU Corporation, Fujifilm Corporation, Mirai Creation Fund II, Kyocera Corporation, Global Power Synergy Public Company Ltd (GPSC) and North Bridge Venture Partners.

🌱 One Concern, a Menlo Park, CA-based company selling resilience-as-a-service, raised $45m in funding from SOMPO Holdings.

🍎 ProducePay, a Los Angeles, CA-based financing and marketplace platform for the fresh produce market, raised $43m in Series C funding from G2VP, International Finance Corp., IDB Invest, Anterra Capital, Coventure, Astanor Ventures, IGNIA and Finistere.

🚗 Infinitum Electric, an Austin, TX-based air-core motor maker, raised $40m in Series C funding from Energy Innovation Capital, Cottonwood Technology Fund, Chevron Technology Ventures, and Ajax Strategies.

🚗 Beep, an Orlando, FL-based provider of multi-passenger, autonomous EVs, raised $20m in Series A funding from Intel Capitaland Blue Lagoon Capital.

💨 NCX (formerly SilviaTerra), a San Francisco, CA-based data-driven forest carbon marketplace, raised $20m in Series A funding from Time Ventures, Microsoft, Union Square Ventures, and Version One Ventures.

🏍️ Voltz, a Brazil-based electric motorcycle company, raised $18m in funding from Creditas.

⚡ GridX, a Milpitas, CA-based provider of operations support solutions to utilities and energy suppliers, raised $12m in Series B funding from Energy Impact Partners.

🌱 Kula Bio, a Boston, MA-based company focused on sustainable nitrogen fertilizers, raised $10m in Seed funding from Collaborative Fund, The Nature Conservancy, Lowercarbon Capital, and the Grantham Environmental Trust’s Neglected Climate Opportunities Fund.

🌱 Novisto, a Canada-based software platform for ESG data, management, and reporting, raised $8m in Series A funding from White Star Capital and Diagram Ventures.

🌲 OroraTech, a Germany-based provider of wildfire detection and monitoring services, raised $7.1m in Series A funding from Findus Venture, Ananda Impact Ventures, APEX Ventures and BayernKapital.

⚡ Gridware, a Sacramento, CA-based startup focused on protecting electric grids from wildfires, raised $5.3m in Seed funding from True Ventures and Fifty Years.

🚗 Faction Technology, a San Francisco, CA-based maker of 3 wheeled, driverless EVs, raised $4.3m in Seed funding from Trucks Venture Capital and Fifty Years.

♻️ Treet, a San Francisco, CA-based retail resale platform, raised $2.8m in Seed funding from Bling Capital, BAM Ventures, BBG Ventures, Interlace Ventures, and V1.VC.

⚡ 60Hertz Energy, an Anchorage, AK-based platform improving microgrids and backup generators, raised $1.3m in Pre Series A funding from Factor[e], Climate Impact Capital, SeaChange Fund, Clean Energy Venture Group angels, and the Alaska Investor Network.

☀️ BlueDot Photonics, a Seattle, WA-based innovator in new applications of perovskite materials, raised $1m in Seed funding from VoLo Earth Ventures, Clean Energy Ventures, and E8.

⚡ Energy Vault, a Switzerland-based developer of gravitational energy storage solutions, raised an undisclosed amount in funding from Saudi Aramco Energy Ventures.

💨 Heirloom Carbon Technologies, a San Francisco, CA-based startup using carbon mineralization for carbon removal, raised an undisclosed amount of Seed funding from Breakthrough Energy Ventures, Lowercarbon Capital, and Prelude Ventures.

Bird, a shared micro-EV service company, will go public through a merger with Switchback II at a $2.3b valuation.

Tritium, an EV fast charger developer, will go public through a reverse merger with Decarbonization Plus Acquisition Corp. II, at a $1.2b valuation.

Toyota Ventures (previously Toyota AI Ventures), invested an additional $300m in emerging technologies and carbon neutrality via two early-stage funds: the Toyota Ventures Frontier Fund and the Toyota Ventures Climate Fund.

Closed Loop Partners launched a $25m Circular Plastics Fund with Dow, Lyondell Basell, and NOVA Chemicals to accelerate investment in plastics recycling infrastructure.

Nasdaq acquired Puro.earth, a B2B marketplace for carbon removals, for an undisclosed amount.

Eight large companies – Amazon, Google, Microsoft, Salesforce, Disney, Netflix, Unilever, and Workday – joined the Business Alliance to Scale Climate Solutions. The collective, which includes environmental groups and the UN, will serve as a knowledge-sharing network for scaling emissions reduction efforts.

Mission Innovation 2.0, an initiative made up of 23 governments responsible for 90%+ of clean energy investment, is launching a decades-long initiative to catalyze public-private action and clean energy investment through a series of sector-specific Missions starting with power systems, clean hydrogen, and shipping.

The European Commission is partnering with Breakthrough Energy Catalyst on mobilizing $1b for critical climate technologies such as green hydrogen, SAFs, direct air capture, and long-duration energy storage.

Ford has upped its EV spending from $22b to $30b by 2025 and aims to have EVs make up 40% of its production by 2030. Might have something to do with the 70,000+ electric F-150 reservations after the first week…

From across the political aisle, united by threat of floods and wildfire, Sen. Bennet (D-Colo.) and Portman (R-Ohio), introduced the Carbon Capture Improvement Act, to support the financing of power plants and industrial facilities’ CCS projects using tax-exempt private activity bonds issued by local or state governments.

Climate Vault, a nonprofit formed at UChicago, was launched by economist Michael Greenstone to address the credibility challenge in carbon offset markets. The group purchases offsets from the regulated cap and trade markets and “vaults” or retires them to prevent polluters from using them.

Stripe Climate announced its second batch of carbon removal projects, including CarbonBuilt, Heirloom, Running Tide, Seachange, Mission Zero, and The Future Forest Company, which will receive $2.75m from Stripe and 2,000 Stripe Climate users.

A Bill Gates’-backed advanced nuclear company, TerraPower, will develop a 345MW molten salt reactor in place of a retired Wyoming coal plant.

Attempting to claw back Trump’s legacy, the Biden administration suspended drilling leases temporarily in the Arctic National Wildlife Refuge, a high-profile move juxtaposing recent clashes about the future of LNG.

Shipping produces as much carbon dioxide as all of America’s coal plants combined, and the International Maritime Organization (IMO), a secretive UN agency, doesn’t mind keeping it that way. Meanwhile, Maersk, the world’s largest container shipping line, is calling for a $150/ ton carbon tax on shipping fuel which they say would force faster adoption of clean fuels.

This will go down in history as the poster child of 2021. Introducing: EV by day, crypto mining rig by night.

Activate’s new class of fellows includes batteries from table salt, fat-producing CO2-eating microbes, and pheromone pest control.

Y’all love lists, so get ready to click! (1) SOSV’s Climate Tech 100 from over 1,000 biotech and hardtech portfolio companies and (2) BNEF’s 150 pioneering climate tech startups across sustainable freight, materials, and measurement - with clever graphics.

Vegetarian, pescetarian, vegan - now meet the climatarian!

Live in your own 3D printed sand castle.

The height of the Covid mask era may be over, but the bovine edition has just begun. Cargill backs Zelp, which makes methane-zapping masks for cow snouts.

A well-written primer on N2O, the “forgotten greenhouse gas” that also happens to be the third most common GHG. Well timed, ICYMI last week’s feature on fixing N for the climate!

If a tree falls in the forest, does it get double-counted as an offset? A forest ecologist says that forest carbon offset credits “provide no real offset to greenhouse gas emissions at all.”

The time is now to build in climate tech! Our friend Nat Bullard reminds entrepreneurs that “you are still not late”.

Things are heating up. The World Meteorological Organization is projecting a 40% chance that at least 1 out of the next 5 years will temporarily push past the 1.5 degrees mark.

Animal Crossing IRL!

💡 Climate Change for VCs: Apply by June 9th to Terra.do and Techstar’s 6-week online climate course for venture investors. Also check out Terra.do’s other courses on Climate Action and Electric Vehicles.

💡 MIT Resilient Ecosystems Challenge: Apply by June 16th to access +$2m in funding for technology solutions that protect, manage, and restore local ecosystems.

🗓️ The Next Frontier of Community Solar: Register for Clean Energy Trust’s June 15th webinar on the evolution of community solar.

Strategy & Operations @Stripe Climate

Strategy & Operations @Remora

Sales Operations Manager @Pachama

Director, Product Development @AES

Sustainable Finance Business Analyst @4 Earth Intelligence

Carbon Analyst and Program Specialist @XPRIZE

Product Manager @Therma

Product Manager @ClearTrace

Head of Sales; Director of People @Climate AI

Director of R&D @NYSERDA

Frontend Developer @CarbonCure

Project Engineer @PowerTech Water

Data Scientist @Yard Stick

Alternative Protein Sr Associate Investor @Synthesis Capital

Responsible Investing Project Coordinator @Apollo

Feel free to send us new ideas, recent fundings, or general curiosities. Have a great week ahead!

Trump’s coal push ignores economic reality and attractive alternatives

The tariffs' toll, explained sector-by-sector

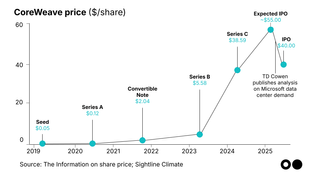

The AI company’s debut shows where the chips are falling