🌎 Coal hard facts #241

Trump’s coal push ignores economic reality and attractive alternatives

Happy Monday!

The Olympics may be over, but we’re still getting ready for the next big fun and games: New York Climate Week next month. Have you checked out our CTVC x NYCW event tracker and submitted yours yet?

This week, we’re diving into the bankruptcy of residential solar power player Sunpower, to explore the macro trends hitting the sector and what's next.

In other news, fresh DOE grid projects, controversy over a new SAF advertisement, and Glencore’s backtracking on coal.

In deals, $180m for EV charging, $150m for electric flying cars, and $57m for satellite monitoring.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals and announcements for the newsletter at [email protected].

💼 Find or share roles on our job board here.

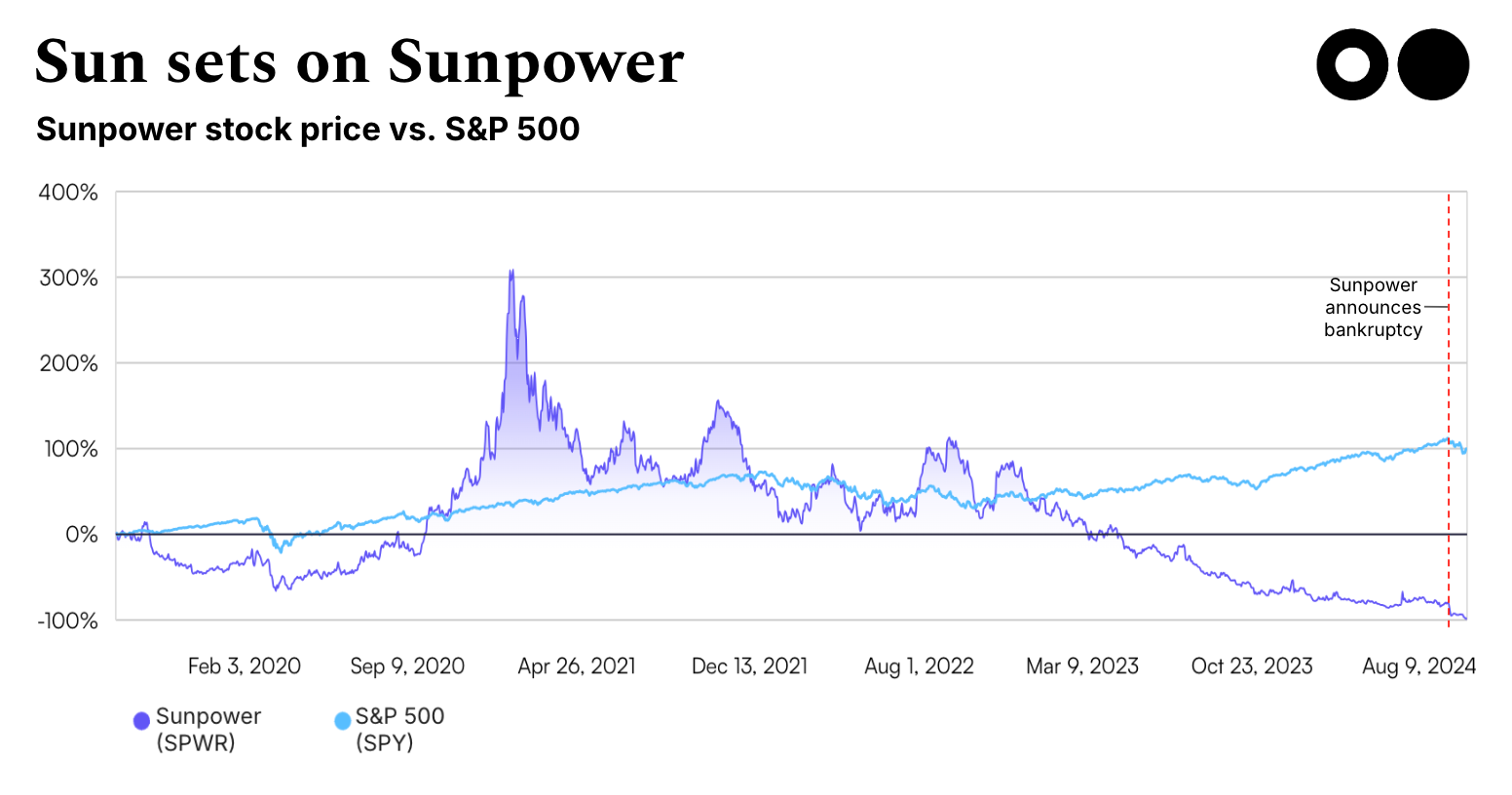

The sun has set for residential solar heavyweight Sunpower, as the company announced it was filing for bankruptcy last week.

The former renewable energy darling joined a list of high-profile bankruptcies in clean tech this year, including EV maker Fisker, long-duration battery maker Ambri, cultivated meat startup SciFi Foods, ocean carbon-capture startup Running Tide, and more. But as we covered in our H1’24 investment trends report, each company has faced unique challenges plaguing its specific vertical, from cost of production to regulation risk to consumer skepticism.

What happened?

Founded in 1985, Sunpower switched to focus on rooftop solar in 2020 — capitalizing on low interest rates and high incentives for residential solar installations. The company’s share price soared to an over $9bn market cap in January 2021.

But those sunny days seem like the calm before the storm, as dark clouds began to emerge in the solar sector the next year.

Sunpower faced not only these macro-level challenges, but also had to grapple with the recent departure of its CEO, a subpoena from the U.S. Securities and Exchange Commission about its accounting practices, and a debt default in December 2023.

As of last Tuesday, the company announced it was selling some business assets, including Blue Raven Solar, to Complete Solaria for $45 million (acquired for $165 million in 2021), under a stalking horse bid. And amid the broader stock market downturn, SunPower's shares plummeted by 45% to 44 cents in premarket trading.

Setting aside Sunpower’s possible financial mismanagement, these headwinds are being felt across the sector. Other solar companies, including Titan Solar Power and Sunworks, have also recently filed for bankruptcy.

But if the solar industry flew too close to the sun, it’s due for a market correction, not a total flameout. The high cost of capital and reduced incentives are forcing companies to recalibrate their business models and compete — Sunrun has reportedly already hired from SunPower, and its shares jumped 11% by last Wednesday.

What’s next?

🚗 Xpeng Aeroht, a Guangzhou, China-based electric flying car manufacturer, raised $150m in Series B funding.

🛰 Muon Space, a Mountain View, CA-based satellite for earth monitoring platform, raised $57m in Series B funding from Activate Capital Partners, ACME Capital, Congruent Ventures, Costanoa Ventures, and Radical Ventures.

⚡ 3V Infrastructure, a New York, NY-based level 2 EV charging operator, raised $40m in Growth funding from Greenbacker Capital Management.

⚡ SYSO Technologies, a Cambridge, MA-based energy asset management platform and operator, raised $14m in Series B funding from Kimmeridge and Lacuna Sustainable Investments.

🚗 H3X Technologies, a Louisville, CO-based high power density electric motors manufacturer, raised $20m in Series A funding from Infinite Capital, Cubit Capital, Hanwha, Industrious Ventures, Liquid 2 Ventures, and other investors.

⚡ Datch, a Brooklyn, NY-based AI-based grid asset management platform, raised $15m in Series A funding from Third Prime, Blackhorn Ventures, Blue Bear Capital, and Susquehanna International Group (SIG).

🥩 Plonts, an Oakland, CA-based plant-based cheese developer, raised $12m in Seed funding from Lowercarbon, Litani Ventures, Accelr8, Pillar, and Ponderosa Ventures.

⚡ Branch Energy, a Houston, TX-based battery storage system platform, raised $11m in Series A funding from Prelude Ventures and Zero Infinity Partners.

🌾 Agrizy, a Bengaluru, India-based agribusiness digital marketplace, raised $10m in Series A funding from Accion Venture Lab, Omnivore, Ankur Capital, Capria Ventures, and Thai Wah Ventures.

🏭 GreenIron, a Stockholm, Sweden-based fossil free mining developer, raised $9m from Almi Invest GreenTech and FAM AB.

🏭 VSPARTICLE, a Delft, Netherlands-based nanoparticle generators for rare minerals platform, raised $7m in Series A funding from Hermann Hauser Investment, NordicNinja, and Plural Platform.

🏠 Cala Systems, a Boston, MA-based intelligent heat pump water heater, raised $6m in Seed funding from Clean Energy Ventures, Massachusetts Clean Energy Center, Burnt Island Ventures, Leap Forward Ventures, CapeVista Capital, and other investors.

🧱 Cocoon Carbon, a London, UK-based carbon capture and low-carbon materials platform, raised $5m in Pre-Seed funding from Gigascale Capital, SOSV, and Wireframe Ventures.

🔋 Neuron Energy, a Mumbai, India-based EV batteries for micromobility developer, raised $2m in Series A funding from Capri Family Office and Chona Family Office.

🌾 Secai Marche, a Petaling Jaya, Malaysia-based farm-to-table platform, raised $2m in Series A funding from Beyond Next Ventures, Future Food Fund, Mitsubishi UFJ Capital, and Spiral Ventures Asia.

💨 CarbonQuest, a New York, NY-based turnkey carbon capture solutions provider, raised an undisclosed amount in Series A funding from Riverbend Energy Group.

☀️ GraphEnergyTech, a Lausanne, Switzerland-based highly conductive graphene electrodes developer, raised an undisclosed amount in Seed funding from Aramco Ventures.

☀️ Qcells, Seoul, South Korea-based photovoltaic cell manufacturer, announced a $1.5bn conditional loan guarantee from the US Department of Energy.

🚗 Lucid Motors, a Newark, CA-based electric vehicle manufacturer, raised $1.5bn in Post-IPO debt and equity funding from Ayar Third Investment Company.

⚡ Powerdot, a Lisbon, Portugal EV charge point operator, raised $180m in funding from ABN Amro, BNP Paribas, ING, MUFG, Santander, and other investors.

🚗 London Electric Vehicle Company (LEVC), a Coventry, UK-based electric taxi manufacturer, raised $154m in Corporate funding from Geely.

🚗 Twelve, a Berkeley, CA-based CO2 into chemicals platform, raised $45m in Debt funding from Fundamental Renewables and Sumitomo Mitsui Banking Corporation.

⚡ HIF Global, a Houston, TX-based e-fuel project developer, raised $36m in funding from the Japan Organization for Metals and Energy Security (JOGMEC).

⚡ General Fusion, a Richmond, Canada-based Magnetized Target Fusion (MTF) developer, raised $15m from Business Development Bank of Canada and Canadian Nuclear Laboratories.

⚡ Ageto, a Fort Collins, CO-based microgrid control solutions provider, was acquired by Generac for an undisclosed amount.

☀️ SunPower, a San Jose, CA-based residential solar manufacturing and development provider, filed for bankruptcy.

Can’t get enough deals? See full listings and deal analytics on Sightline Climate

The DOE announced $2.2bn in conditional grants to eight projects through its Grid Resilience and Innovation Partnerships Program, ranging from deploying grid-enhancing technologies to building brand-new high-voltage transmission cables. This includes funding for a new 8.5GWh Form Energy 100-hour battery in Maine, which would become one of the largest long-duration energy storage projects ever built.

US Democratic presidential nominee Kamala Harris chose Minnesota governor Tim Walz as her VP, and you can take a look at his climate record, which includes energy permitting reform and plans for 100% clean energy by 2040.

Meanwhile, 18 House Republicans have asked Speaker Mike Johnson to not to get rid of IRA clean energy tax credits, if they expand their House majority come November, because the credits have spurred investment in their districts. In other US political news, a bipartisan group of Senators introduced a bill to impose Foreign Entity of Concern (FEOC) restrictions on the 45X Advanced Manufacturing tax credit to stop non-US companies from using this IRA tax credit. Additionally, battery supply chain companies have formed a new lobbying group, seeking stronger support for projects in the space.

In a positive signal for hydrogen, Woodside acquired OCI Global’s ‘blue’ ammonia project in Texas for $2.3bn, which aims to be producing blue ammonia by 2026. On the flip side, however, Plug Power continues to report heavy losses, losing $2.6bn in Q2’24.

In a reversal, Glencore canceled its plans to de-merge its coal business from its core metal business. Just last November, CEO Gary Nagle had made the case for spinning off its heavily polluting coal division in the lead-up to acquiring Canada Teck’s steelmaking coal unit, but key shareholders wanted to prioritize the cashflow from its fossil fuel units.

The UK’s Advertising Standards Authority (ASA) banned Virgin Atlantic’s ad showcasing its use of Sustainable Aviation Fuels. The regulatory agency says some consumers could be misled to believe that “100% sustainable aviation fuel” meant no negative environmental impact, which is not the case.

Qatar announced a $180m investment in U.S.-backed TechMet, an Irish mineral company, in part of a broader US-Middle East push to counter China's dominance in critical minerals. With China controlling much of the market for key minerals like lithium and cobalt, essential for electric vehicle batteries, this collaboration between the US and Gulf states shows the importance of the global race for sustainable energy resources.

Italy enacted new permitting reform for renewable projects, reducing the number of procedures required for plant approvals and no longer requiring small plants below 10 MW to have permits. This is part of a nation-wide push to increase green power production.

Amid all the hot air in the carbon removal space, industry veterans announced a new push for quantitative measurements, the Carbon Removal Standards Initiative.

How hybrids are plugging in to climate impact globally, amid dropping vehicle battery prices in China.

A visual explainer digs deep into geothermal energy.

The UK’s Royal Mint is striking gold by making new coins with e-waste.

REDD+ is going atmospheric with new satellites to track deforestation.

Carbon removal project developer Deep Sky is building a new innovation hub for DAC startups.

China’s building bust is helping lower its emissions.

📅 Climate Tech Capital Stack: Register to attend the Climate Tech Capital Stack webinar, hosted by Newlab on August 15th, to hear from a panel of speakers from Engine Ventures, the DOE Loan Programs Office, Elemental Excelerator, and more.

💡 5050 Accelerator: Apply to the 5050 Accelerator by August 15th to receive mentorship and support building your breakthrough research and science into a successful deep tech startup.

💡 Building Tech Lab: Apply for the inaugural cohort of the Buildings Tech Lab by September 20th to pilot your growth stage building decarbonization startup with the DOB and improve how it regulates construction and development throughout New York City’s five boroughs.

📅 Female Founders and Funders: RSVP to join Sophie for the third FFF rendition and a networking lunch with other women building and investing in climate tech on September 24th!

📅 C3 Summit: Register to attend the C3 Summit on October 1st to network with industry leaders in cleantech. To waive registration fees, cleantech investors can participate at no charge by using the code C3FREE at checkout.

Associate, Energy Systems @Marble

Chief Growth Officer @M-RETS

Chief of Staff; Sr. Financial Analyst; Market Development Strategy Analyst @WeaveGrid

Finance and Accounting Associate @Energize Capital

Business Operations @Mill

Head of Strategic Partnerships; VP of Business Development @Jaro Fleet Technologies

Strategic Venture Capital Investor @WIND Ventures

Vice President, Energy; Investment Associate @Builders Vision

Senior Innovation Associate; Finance Senior Associate @New York Climate Exchange

📩 Feel free to send us deals, announcements, or anything else at [email protected]. Have a great week ahead!

Trump’s coal push ignores economic reality and attractive alternatives

The tariffs' toll, explained sector-by-sector

The AI company’s debut shows where the chips are falling