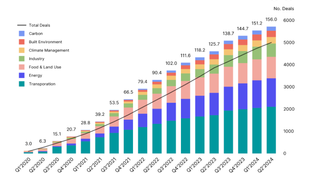

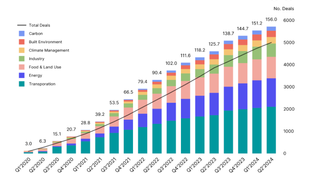

🌎 A weak $11.3bn start to 2024

Poor performance this half as investment falls to 2020 levels, but some strong plays.

We’ve created a comprehensive list of climate tech accelerators and incubators relevant for companies targeting general climate tech challenges as well as specific verticals in energy and food.

Starting a company is hard. Starting a company in the climate tech space is even harder.

Not only do entrepreneurs have to traverse the valley of death common to all startups, but there are a series of valleys of death specific to climate tech startups on the path to scale. Climate tech entrepreneurs face systematic barriers such as longer pathways to market, greater capital needs, and complicated regulatory and scientific risks. When competing with typical Silicon Valley software startups and their high margin business models, climate tech ventures feel these additional hurdles acutely. Yet, we all need climate innovations to succeed to achieve the scale and pressing timeline necessary to meet climate goals.

Some climate tech startups seek community and support on the bumpy journey to scale by joining startup incubators and accelerators. We’ve created a comprehensive list of climate tech accelerators and incubators relevant for companies targeting general climate tech challenges as well as specific verticals in energy and food. Eligible venture stages range from a founder with an idea to companies with demonstrated traction looking to jumpstart their growth. We also chatted with Bryan Hassin from Third Derivative and Hannah Davis from Techstars Sustainability Accelerator to dig into the specific value proposition and differentiation of climate tech accelerators, outlined below.

What unique hurdles do climate tech ventures face?

One of the significant reasons that climate tech startups flounder in the valley of death is a mismatch between startups’ commercialization pathways and the timelines of key stakeholders along the way. Climate tech startups face extended pathways to market and need significant upfront capital, inherent to their hardware and science-centric business models. All of these challenges sit on top of an uncertain and often chaotic political and regulatory environment which are frequently dealmakers or dealbreakers for these technologies’ business models. Climate tech is an interconnected space, and faces risks from all sides of deep tech, corporate strategy, market analytics, and policy, etc.

How should an accelerator for climate tech companies be structured vs the structure of a traditional software accelerator?

Techstars Sustainability Accelerator and Third Derivative have both directly partnered with climate organizations in order to directly integrate climate-specific expertise into their programs. Techstars, which is known for its diverse global offering of accelerators, has partnered with The Nature Conservancy to pair conservation experts with entrepreneurs addressing issues in food, water, and climate. Third Derivative is a joint venture between the Rocky Mountain Institute (RMI) and New Energy Nexus, a perspective which CEO Bryan Hassin explains, “the 250+ deep subject matter experts and unparalleled market insights that RMI is able to provide are unbelievable market guides to help [climate tech entrepreneurs] understand what they need and tap the resources to get there.”

Who should be around the table?

Such partnerships are just one critical piece of the support network needed to enable climate tech startups’ disruption through the multiple valleys of death. Said another way, climate tech accelerators must solve for the needs of multiple parties, not just the entrepreneurs. “We use an integrated approach to tackle the world’s toughest climate and energy problems. We don’t look at this as a startup accelerator with token corporate partners and a demo day. We look at this as a program for startups, investors, corporates, market and policy analysts – all are stakeholders under the same roof involved from the start,” added Hassin.

Third Derivative is actively seeking applications from entrepreneurs all over the world for its first cohort (apply by June 30). The program offers an optional $100K convertible note with privileged access to over $100mm in follow-on funding, strategic partnerships with global corporations, peer-to-peer networking with fellow startups, and access to RMI’s unprecedented insights into market, regulatory, and policy contexts so crucial for climate and energy innovation.

The Techstars Sustainability Accelerator, in partnership with The Nature Conservancy, connects entrepreneurs, conservationists, corporate partners, and investors to deliver products that can put the world on a path to sustainability. Startups that are selected for the accelerator program will each receive seed funding up to $120K. Additionally, startups get exposure to The Nature Conservancy’s programs, projects and partners, as well as Techstars’ network mentors.

Interested in more content like this? Subscribe to our weekly newsletter on Climate Tech below!

Poor performance this half as investment falls to 2020 levels, but some strong plays.

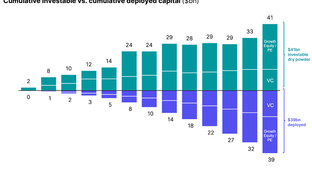

$82bn of new capital for climate tech in the past 6 months

A new interactive Climate Capital Stack Map