🌎 CTVC 2025 Wrapped #276

A look back at the stories that defined 2026

Happy Monday!

Hope you got some R&R after a wild week. (Amid all the chaos, we almost forgot it’s COP this week.) To help you make sense of it all, we’ve got a deep dive into the impact of the newly elected US government on climate tech.

In other news, Elon Musk's potential influence on environmental policy; clean energy stocks fell after the election news; and climate policy momentum in local and state elections.

In deals, $552m in renewable energy development, $340m in battery cell manufacturing, and $27m in mobile energy storage.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals and announcements for the newsletter at [email protected].

💼 Find or share roles on our job board here.

We know that there’s a certain news event trumping all others right now. We’ve always aimed to separate the signal from the noise — never to sugarcoat or doom-say, but to truth-tell — and this moment is no different. While the US election is about so much more than business and climate, to the degree that it’s still possible to separate politics from policy, we’re here to help you understand what Trump 2.0 means for climate tech.

The big picture

There’s no way around it: We expect a setback for the sector, but we don’t foresee a full stop. Who’s in the White House matters, but it’s not the only factor — more wind capacity was installed under Trump than any other presidential term, and coal capacity fell under Trump more than under Obama. We won’t “solve climate change” with more crisis response; we progress through fundamentals and focus. As the climate tech industry matures, real market dynamics are now driving progress in key sectors beyond policy incentives alone.

However, we're likely entering a period of increased skepticism toward climate initiatives, coupled with challenging market conditions. A Trump presidency will pull back on adaptation/resilience efforts and loss & damage funds, leaving those worst affected by climate change, who've contributed the least to it, more vulnerable. Meanwhile, the coming quarters could see a wave of bankruptcies among ZIRP-era climate companies — a market correction that was inevitable regardless of electoral outcomes. The time to raise a Series B has increased 2.5x compared to 2021, and many companies seeded at that time will face difficult transitions.

American manufacturing, energy resilience, and export market opportunities remain compelling regardless of political headwinds. But there’s no question that policy support will shift. This Trump administration has a so-called “energy dominance” agenda — particularly, bullish on fossil fuels and bearish on renewables and emerging climate tech, which could lead to an additional 4bn tonnes of US emissions by 2030.

The details

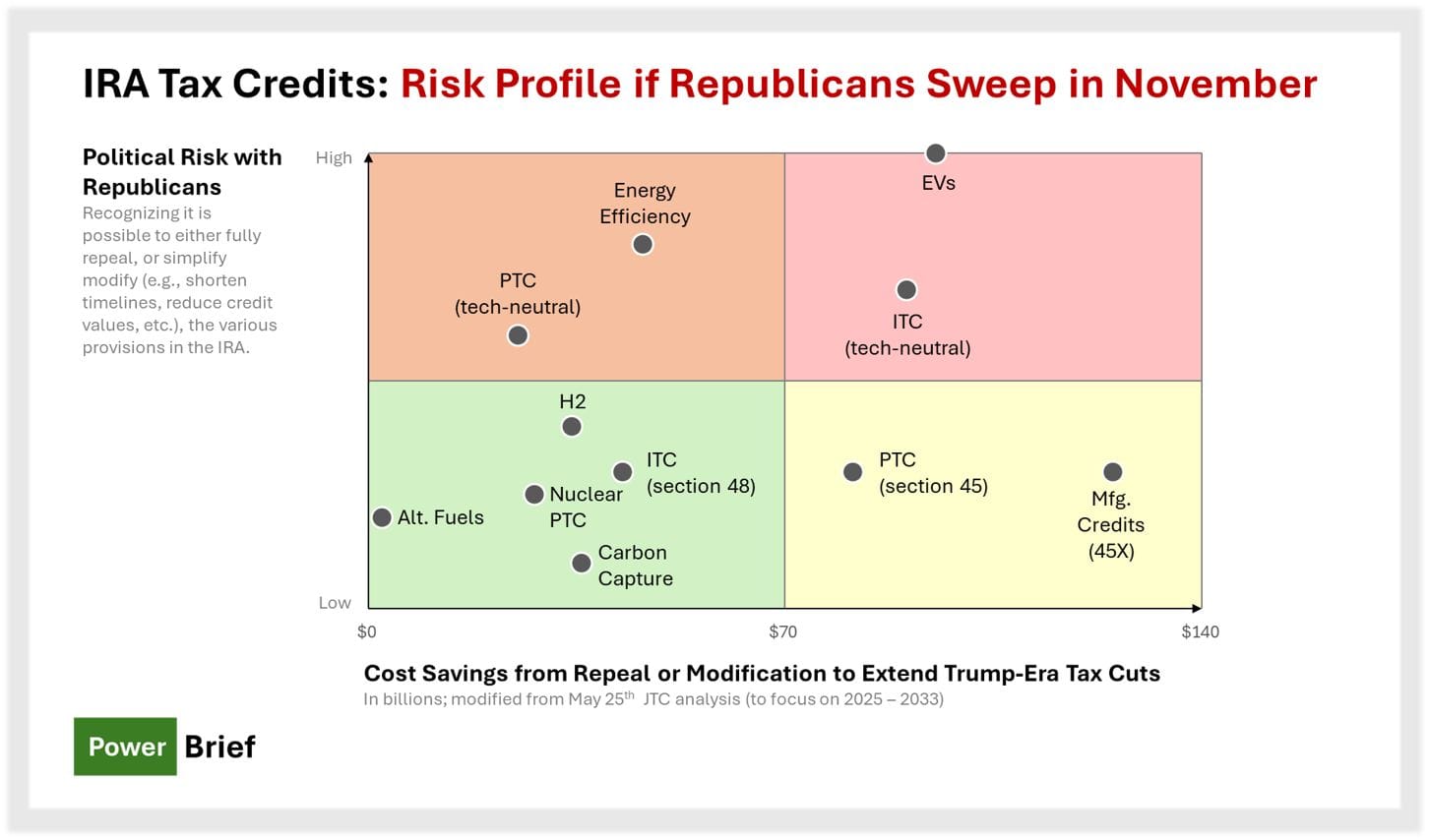

With a Republican president, at least 53 Republican senators, and likely Republican House control, the mechanisms for policy change exist, particularly through reconciliation (the way the Inflation Reduction Act was passed). The risk to the IRA is more tangible than ever before — and we previously explored this in our "climate tech on the ballot" features, part 1 and part 2, over the summer. Trump has labeled the IRA the "Green New Scam" and pledged to repeal it, although it will be difficult to do this wholesale, and likely opposed by Republican politicians whose states have benefited from its policies.

Trump will still likely remove certain policies and incentives, as well as reorganize key agencies, with broader implications on the sector. There are a range of levers he can pull, but three stand out: suppressing demand, cutting incentives, and reducing regulation. Broadly, ahead of a proposed tax cut, climate tech-related tax credits and programs could be on the chopping block to cover costs. Meanwhile, the most specific policy proposals come from Project 2025, the conservative Heritage Foundation's manifesto closely linked to the Trump campaign.

Here’s what both Trump’s political rhetoric and Project 2025 entail for key climate tech incentives and areas.

⚡ Clean firm power: neutral to positive. Many of the decisions here are out of Trump’s hands, either because states set energy mandates and state-level PUCs have final say in approving utility plans, or because the timescales are beyond a single presidency. In fact, lower regulatory hurdles and a focus on innovation in energy could help projects get built faster.

⛽ Clean fuels: neutral to negative. The industry is facing huge uncertainty, with the agricultural industry and the free market representing competing interests for the Republicans. Any changes to renewable subsidies, like the ITC or PTC, will have knock-on effects to e-fuels.

💨 Carbon: negative. Support for CCS and DAC could be on the chopping block, but powerful O&G interests tend to favor them. Demand was already largely driven by the private sector, so the outcome rests on whether companies double down on their climate commitments.

⛏️ Critical minerals: neutral. While Trump has no love for EVs, his donors and his party have an interest in selling US-made cars and critical minerals. This one will be fought over in the halls of power.

🏭 Industry: negative. Decarbonizing US industries relies on capex grants and opex subsidies. Without these, progress on greener steel, cement, and petrochemicals will slow.

🔋 Long-duration energy storage: negative. LDES’ fate is tied to variable renewables like wind and solar. Repealing key tax credits could also make the economics a tough pill to swallow.

Key takeaways

Thank you to James Prussing from Boundary Stone Partners.

🔋 Ampd Energy, a Sha Tin, Hong Kong-based battery energy storage provider, raised $27m in Series B funding from Kibo Invest, Openspace, 2150, MTR Labs, and Taronga Ventures.

🏭 Boston Materials, a Billerica, MA-based advanced materials for semiconductor manufacturing provider, raised $14m in funding from Accelr8, Diamond Edge Ventures, Collaborative Fund, Gatemore Capital Management, Valo Ventures, and other investor.

🍎 Kanpla, an Aarhus, Denmark-based food waste management for canteens platform, raised $9m in Series A funding from henQ.

🚗 Xavveo, a Berlin, Germany-based photonic sensors for autonomous vehicles service provider, raised $9m in Seed funding from Vsquared Ventures and imec.xpand.

⚡ Glint Solar, an Oslo, Norway-based solar projects identification platform, raised $8m in Series A funding from Smedvig Ventures, Antler, Futurum Ventures, and Momentum.

🏠 Transaera, a Somerville, MA-based ultra-efficient air conditioners manufacturer, raised $8m in Seed funding from Clean Energy Ventures, Energy Impact Partners, and MassMutual Ventures and $2m in Grant funding from the US Department of Energy (DOE).

📦 Earthodic, a Brisbane, Australia-based bio-based coatings developer, raised $6m in Seed funding from FTW Ventures, Branch Venture Group, Circulate Capital, Closed Loop Partners, Investible, and other investors.

💨 SeaO2, an Amsterdam, Netherlands-based carbon dioxide removal technology provider, raised $2m in Seed funding from CarbonFix, DOEN Participaties, Eduard Talman, Future Tech Ventures, Netherland Enabling Water Technology (NEW-TTT fund), and other investors.

💨 Ulysses Ecosystem Engineering, a Cork, Ireland-based oceanic carbon removal service provider, raised $2m in Pre-Seed funding from Lowercarbon Capital, Ciaran Lee, Eoghan McCabe, Intercom, ReGen Ventures, and other investors.

⚡ Beacon Power Services, a Lagos, Nigeria-based energy management software & analytics platform, raised an undisclosed amount in Series A funding from Partech, Clermount, Finnfund, GAIA Impact Fund, Global Brain, and other investors.

📦 Cambrium, a Berlin, Germany-based biomaterials discovery platform, raised an undisclosed amount in Seed funding from Gradient Ventures, DG Daiwa Ventures, Earth Venture Capital, Leblon Capital, and SeaX Ventures.

⚡ Nimbus Power Systems, a Groton, CT-based zero-emission fuel cell systems developer, raised an undisclosed amount in Pre-Seed funding from Connecticut Innovations.

⚡ Statera Energy, a London, UK-based renewable energy and assets developer, raised $327m in Debt funding from Lloyds Bank, NatWest Group, Natixis, Santander, Siemens Bank, and other investors.

⚡ Primergy, an Oakland, CA-based renewable energy developer, raised $225m in Project Finance funding from Rabobank.

👕 Spinnova, a Jyväskylä, Finland-based sustainable textiles manufacturer, raised $14m in Debt funding from Business Finland.

Pelican Energy Partners, a Houston, TX-based investment firm, held a $450m final close of their inaugural nuclear services fund that will invest in lower middle market companies.

Energize Capital, a Chicago, IL-based investment firm, raised $266m towards their third fund that will invest in climate-focused software companies.

Axeleo Capital, a Paris, France-based investment firm, held a $133m first close for their first fund that will invest across energy, chemicals and materials, and agriculture.

4impact Capital, a The Hague, Netherlands-based investment firm, held a $72m final close of their second fund that will invest in climate-focused software companies.

Can’t get enough deals? See full listings and deal analytics on Sightline Climate.

Elon Musk is poised to have significant influence on energy policy under Trump’s presidency. Despite Trump’s anti-EV stance and the pair’s past differences over climate issues, Musk's support for Trump's campaign is likely going to pay off. While Trump's return may lead to the rollback of Biden's EV subsidies, which could hinder broader EV adoption, it could also benefit Tesla by disadvantaging competitors still catching up.

Trump's victory has sent shockwaves through the clean energy market, with clean energy stocks experiencing drastic declines, and hedge funds piling up huge bets against the sector. Renewables companies now face uncertainty regarding potential new tax and spending policies that could maintain high interest rates. However, clean energy stocks have notably rebounded in the past, with the last recovery taking around two years, and it’s not the end for renewables stocks. Convincing investors of the financial viability of climate tech will be crucial to sustaining momentum in the energy transition.

Meanwhile, climate policy sees momentum in recent local elections across the nation, with Washington State upholding an ambitious emissions-cutting law and California approving a $10bn bond for climate resilience projects. These policies indicate that much of the progress on climate and environmental protection will be seen at the state and local level in the near-term.

The Biden administration has halted drilling leases in the Arctic National Wildlife Refuge, a reversal from policies in the Trump era that opened the region to fossil fuel extraction and an attempt to Trump-proof conservation. The fate of ANWR’s resource-rich expanse may hinge on political winds as the Trump administration pushes ahead on fossil fuel extraction.

Just days before COP29, the election of Donald Trump puts the US in a precarious place on the world stage for climate diplomacy. With the climate community already skeptical of this year’s COP, the election results only further diminish the credibility and leverage of the US delegation.

In non-Trump news, 9-year-old agtech startup Bowery Farming has ceased operations, closing the doors on its NY-based indoor farming enterprise. Despite once boasting a valuation of $2.3bn, Bowery struggled with the capital-intensive nature of indoor agriculture.

Meanwhile, green hydrogen and ammonia company Fuella has inked a $1.5bn deal to develop a green ammonia production facility in Brazil that can produce 400,000 tons of green ammonia annually. The project shows that internationally, demand for sustainable fertilizers and fuel alternatives is continuing to be one of the most promising use cases for green hydrogen.

Shipping giants Maersk, MAN, and Hyundai have made new announcements about methanol as a marine fuel, with new orders for dual-fuel methanol vessels and bulk methanol purchases. Methanol’s low-emission profile can help transition shipping industry decarbonization and meet global targets to reduce maritime emissions by 50% by 2050.

Duke Energy’s revised carbon plan has received regulatory approval in North Carolina, with 3.6GW of gas, 7GW renewables, and 1,100MW of battery storage. The plan includes ambitious targets to cut carbon emissions by 70% by 2030 and reach net zero by 2050, but shows that natural gas is still a significant part of utilities’ energy mixes.

In a landmark move for virtual power plants (VPPs), NRG Energy, Renew Home, and Google Cloud have announced a partnership to deliver 1GW of residential VPP capacity in Texas. The collaboration leverages Google Cloud’s AI to optimize distributed energy resources, a potential solution for balancing increasing power demand and intermittent renewable energy.

In the nuclear race, a new winner: the bees, thwarting Meta’s plan for a nuclear-powered AI data center.

Hannah Ritchie has a new podcast on climate solutions.

Deforestation in Brazil's Amazon fell 31% in just a year under President Lula da Silva.

FERC shocks Big Tech nuclear ambitions and rejects Amazon’s new power proposal.

Less than COPtimal: COP16 ended with little progress for a proposed $200bn nature fund or a monitoring system for the Global Biodiversity Framework.

A wooden satellite blasts off into space to limit space junk.

Sheep4solar: A study found that sheep grazing under solar panels produce higher-quality wool.

📅 Canary Live: Register to attend Canary Live on November 13th to hear from expert panelists from government, journalism, and advocacy backgrounds, including Richmond Mayor Eduardo Martinez and State Senator Nancy Skinner.

📅 Increase Portfolio Value with Climate Tech: RSVP to attend an event co-hosted by Fram Energy and Streetlife Ventures on November 13th to learn how emerging climate technology solutions can increase real estate value, decrease operating expenses, and address tenant issues.

💡 Scale For ClimateTech: Apply for the opportunity to join the 6th cohort of Scale for Climate Tech by November 30th and receive support ranging from manufacturing assistance to access to a vetted supplier network and help in commercializing your hardware product.

💡NextEra Energy Seed Competition: Apply to the NextEra Energy Investments Seed Competition by December 1st for a chance to receive a $1 million investment in your energy transition startup.

📅 Transition-AI 2024: Register to attend Transition-AI, hosted by Latitude Media, on December 3rd to learn about use cases and market opportunities for AI in the power sector, and take advantage of networking opportunities through a mix of keynotes, panels, and workshops.

📅 Scope 3 Innovation Forum: Register to attend the Scope 3 Innovation Forum on December 3-4th for a two-day conference focused on practical steps businesses can take to achieve net zero.

📅 Deploy 24: Register to attend Demonstrate Deploy Decarbonize 2024, hosted by the DOE from December 4-5th, to network with private and public sector leaders accelerating the deployment of critical energy and decarbonization technologies.

📅 Greentown Labs EnergyBar: RSVP to attend Greentown Labs' signature EnergyBar, co-sponsored by Siemens, on December 5th to join fellow entrepreneurs, investors, students, and climate tech enthusiasts in celebrating a year of progress and network with the community.

Senior Software Engineer, Data Manager, Product Manager @Sightline Climate

Climate Science Predictive Analytics Senior Specialist @Southern California Edison

Business Development Executive, Senior Associate, Business Development, Full Stack Engineer, Enterprise Marketing and Strategy, Analyst / Associate, Finance and Transactions @Reunion

Associate, Operations Manager @Aiga Capital Partners

Full-Time Venture Capital Analyst @G2 Venture Partners

Energy Market Analyst @Grid Status

Investment Manager @Sabanci Climate Ventures

Project Finance Valuation Analyst @New Leaf Energy

Chief of Staff @Inspiration Mobility

📩 Feel free to send us deals, announcements, or anything else at [email protected]. Have a great week ahead!

A look back at the stories that defined 2026

Large data center loads are going federal

What CTVC readers got right and wrong about 2025