🌎 IMO sets sail for net-zero #242

The International Maritime Organization's first carbon tax ships out

The voluntary carbon market navigates an integrity impasse

Happy Monday!

ICYMI, our H1 2023 funding report dropped at the end of June. With a 40% decrease in climate tech venture investments compared to the first six months of 2022—and growth-stage activity experiencing the greatest decline, even as early-stage deals increased—the data could indicate a reshuffling of the ecosystem.

New standards for the voluntary carbon market (VCM) released last month are intended to help investors assess the soundness of companies' claims about their contribution to climate goals. The framework and a partnership between two organizations focused on carbon offset integrity aim to combat credibility issues in the VCM.

Meanwhile, last week included the hottest day on record. Nearly half of US tap water may contain “forever chemicals" and Norway discovers a phosphate motherlode.

In deals, a Chinese energy storage company attracts $621M. Battery swapping in India raises $33M and Icelandic green fuels production draws $30M.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals, announcements, events & opportunities, or general curiosities for the newsletter at [email protected].

💼 Find or share roles on our job board here.

As the voluntary carbon market (VCM) reckons with transparency and verification challenges, an initiative backed by the British government released new standards to help investors evaluate the credibility of companies’ carbon offset claims.

Lack of standardization and transparency is one of the biggest challenges in the ~$2B voluntary carbon market (VCM). In recent months, the largest verification body has been accused of certifying “worthless” credits and geopolitical uncertainty has placed a question mark over the future of the market.

Improving the trustworthiness of credit quality is essential to increasing effectiveness—ensuring a more accurate measure of progress toward corporate climate goals and an opportunity to continue growing the carbon credit market.

The new framework from VCMI arrives ahead of anticipated regulations around corporate climate strategies. Rules proposed by the Securities and Exchange Commission in March 2022 would require companies to disclose more information about climate risk. While those regulations seem stalled this year, many businesses are already making decisions with the rules in mind.

Even if implemented, the proposed SEC rule is likely to face court battles. At the state level, oil lobbyists are currently working to stall two new California bills that would crack down on bogus carbon offset claims. Creating more agreed-upon VCM standardization now could help reduce time-consuming legal challenges down the line.

⚡ Battery Smart, a New Delhi, India-based battery swapping network, raised $33M in pre-Series B funding from Tiger Global Management, Ecosystem Integrity Fund, British International Investment, and Blume Ventures.

💨 Carbon Recycling International, a Reykjavík, Iceland-based CO2-to-methanol producer, raised $30M from Equinor Ventures, Sjova, Jöklar-Securities, and Value - Pension fund.

⚒️ GeologicAI, a Calgary, Canada-based provider of scanning robots and software for mining, raised $20M in Series A funding from Breakthrough Energy Ventures.

🧱 Material Evolution, a Dover, DE-based low-carbon cement producer, raised $19M in Series A funding from Kompas VC, Norrsken VC, Circle Rock, and SigmaRoc.

📦 Woodio, a Helsinki, Finland-based sustainable wood composite products developer, raised $18M in Growth funding from European Innovation Council and United Bankers.

🥩 Bluu Seafood, a Berlin, Germany-based cultivated seafood platform, raised $18M in Series A funding from Delivery Hero Ventures, Dr.Oetker, Hannes Ametsreiter, LBBW VC, Manta Ray Ventures, Norrsken VC, SeaX Ventures, and Sparkfood.

⚡ WasteFuel, a Los Angeles, CA-based developer of low-carbon fuels from waste, raised $16M in Series B funding from BP Ventures, Aileen Getty, Guy Oseary, i(x) Net Zero, Maersk Growth, NetJets, Prime Infrastructure Capital, and Time Ventures.

🏭 VSPARTICLE, a Delft, The Netherlands-based developer of nanoparticle generators for rare minerals, raised $16M in Venture funding from Plural Platform and BlueYard Capital and a $4M grant from NXTGEN HIGHTECH.

♻️ DePoly, a Sion, Switzerland-based PET recycling platform, raised $14M in Series A funding from BASF Venture Capital, Wingman Ventures, Zürcher Kantonal Bank, Angel Invest, Beiersdorf, ACE & Company, Ciech Ventures, and Infinity Recycling.

⚡ ChargeX, a Munich, Germany-based EV charging system operator, raised $13M in Series B funding from UVC Partners, Bayern Kapital, Ponooc, Verve Ventures, Smart Energy Innovations Fond, and BonVenture.

⚡ EX-Fusion, an Osaka, Japan-based laser-based nuclear fusion developer, raised $12M in Seed funding from ANRI, Nissay Capital, Delight Ventures, Mitsui Sumitomo Insurance Venture Capital, and other investors.

⚡ Service4Charger, a Berlin, Germany-based EV charging infrastructure developer, raised $11M in Series A funding from BP Ventures and SmartEnergy Innovation Fund.

🚚 BillionElectric, a Vadodara, India-based e-Mobility-as-a-Service (eMaaS) platform, raised $10M in Seed and asset lease funding.

🏠 Gradient, a San Francisco, CA-based climate-friendly air conditioner with heat pump developer, raised $9M in Series A funding from Climate Investment.

🔋 Ampd Energy, a Sha Tin, Hong Kong-based mobile energy storage systems company, raised $8M in Series A funding from 2150 and Taronga Ventures.

🏠 AtmosZero, a Fort Collins, CO-based low-carbon industrial steam provider, raised $8M in Seed funding from Energy Impact Partners, AENU, and Starlight Ventures.

☔ Raincoat, a San Juan, Puerto Rico-based climate resilience insurance provider, raised $7M in Seed funding from Two Sigma Ventures, Alma Mundi Ventures, Elefund, Revolution’s Rise of the Rest Seed Fund.

🌾 eAgronom, a Tartu, Estonia-based online farm management provider developing a carbon credit program, raised $6M in Series A funding from ICOS Capital, Soulmates Ventures, and SmartCap Green Fund.

🏠 vilisto, a Hamburg, Germany-based commercial building heat management platform, raised $5M in Series A funding from SET Ventures and E.R. Capital Holdings.

⚡ Bluedot, a San Francisco, CA-based EV charging payments platform, raised $5M in Seed funding from Y Combinator, Leap Forward Ventures, Samsara Ventures, Operator Stack, LACI, Ford Driventure, and ScaleX.

⚡ EVOS Energy, a Brisbane, Australia-based EV fleet management and charging platform, raised $5M in Seed funding from Autostrada.

🛵 Vegh, a Bhatinda, India-based electric two wheelers manufacturer, raised $5M in Seed funding.

💨 Greenlyte Carbon Technologies, a Dedham, United Kingdom-based low temperature Direct Air Capture developer, raised $5M in Pre-Seed funding from Earlybird Capital.

⚡ Turn2x, a Munich, Germany-based RNG from methanation producer, raised $5M in Seed funding from LEA Partners, Verve Ventures, and First Momentum Ventures.

🐄 Dalan Animal Health, an Athens, GA-based bee vaccine developer, raised $5M in Seed funding from Prime Movers Lab and At One Ventures.

🛵 Vok Bikes, a Tallinn, Estonia-based heavy-duty electric cargo bikes developer, raised $4M in Seed funding from SmartCap Metaplanet Holdings, Specialist VC, and Sunly and Grant funding from Enterprise Estonia.

⚡ Maxem, an Amsterdam, Netherlands-based B2B charging and energy management platform, raised $4M in Series A funding from Breesaap Green Link and SHIFT Invest.

♻️ NEU Battery Materials, a Singapore, Singapore-based lithium-ion battery recycling platform, raised $4M in Seed funding from SGInnovate, ComfortDelGro, Paragon Capital Management Singapore, and other investors.

🔋 Planckian, a Pisa, Italy-based quantum batteries developer, raised $3M in Pre-Seed funding from CDP Venture Capital, Eureka Venture, and Exor.

⚡ Steady Energy, an Espoo, Finland-based nuclear residential heating developer, raised $2M in Seed funding from VTT Technical Research Centre of Finland, Lifeline Ventures, and Yes VC.

♻️ Urbyn, a Paris, France-based SaaS waste management platform, raised $2M in Seed funding from Asterion Ventures.

🔋 Pess Energy, a Marseille, France-based mobile battery energy storage provider, raised $2M in Series A funding from Rise Partners, BioHomeTech, and IODA Consulting.

🛰️ Airmo, a Weßling, Germany-based satellite technology for GHG emissions provider, raised $2M in Pre-Seed funding from Findus Venture.

☀️ Glowb, a London, UK-based solar and battery solutions marketplace, raised $2M in Seed funding from Ada Ventures, Active Partners, Volta Circle, and Voyagers.

⚡ Renewabl, a London, UK-based hourly-matched renewable energy certificates platform, raised $1.4M in Pre-Seed funding from South Pole, QVentures, Portfolion, and other investors.

⚡ Veckta, a San Diego, CA-based onsite C&I energy marketplace, raised an undisclosed amount in Seed funding from Tech Square Ventures, VoLo Earth Ventures, Worley, and Cove Fund.

🔋 Hithium, a Xiamen, China-based lithium-ion battery manufacturer, raised $621M in funding led be China Life Private Equity Investment and Beijing Financial Street Capital Operation Group.

🚗 Faraday Future, a Gardena, CA-based electric sports cars developer, raised $105M in Debt from ATW Partners and Senyun International.

✈️ Joby Aviation, a Santa Cruz, CA-based electric vertical take-off and landing aviation company, raised $100M from SK Telecom.

🚗 e.GO Mobile, an Aachen, Germany-based electric vehicles manufacturer, raised $75M in Debt from Western Asset Management.

🚗 Nikola, a Phoenix, AZ-based heavy-duty EV manufacturer, received a $42M grant from The California Transportation Commission.

♻️ Apeiron Bioenergy, a Singapore, Singapore-based producer of bioenergy products from feedstock, raised $37M in Debt financing from the Credit Guarantee and Investment Facility.

🚆 Hardt Hyperloop, a Delft, The Netherlands-based hyperloop network, raised $13M from European Innovation Council, InnovationQuarter, Posco, and Urban Impact Ventures.

🚗 Lordstown Motors, an Ohio, OH-based electric pickup truck manufacturer, filed for bankruptcy.

⚡ Anderson Optimization, a Boulder, CO-based renewable siting and grid modeling software provider, was acquired by PVcase for an undisclosed amount.

The Carlyle Group, a Washington, D.C.-based investment firm, raised $592M for its second renewables and sustainable energy fund.

Omnivore, a Mumbai, India-based investment firm, held a first close of its $150M fund that will invest in agritech startups.

Public Ventures, a Toronto, Canada-based investment firm, launched a $100M impact fund to invest in life-science and climate companies.

BlueOrchard, a Zurich, Switzerland-based investment firm, raised $50M for its second InsuResilience Fund that invests in climate adaptation in emerging markets.

Octopus Investments, a London, UK-based investment firm, launched a new $50M fund that will invest in sustainable deeptech startups.

Innova Memphis, a Memphis, TN-based investment firm, held a first close of its $40M fund that will invest in agritech startups working on automation and digitization technologies.

Joyful Ventures, a Sacramento, CA-based investment firm, held a first close of its debut $23M fund that will invest in alternative protein startups.

Share new deals and announcements with us at [email protected]

Canada’s wildfires, which have scorched 20 million acres and filled Canadian and U.S. skies with smoke, carried significant economic impacts from disrupting oil and gas operations, reducing available timber harvests, chilling the tourism industry, and imposing uncounted costs on the national health system.

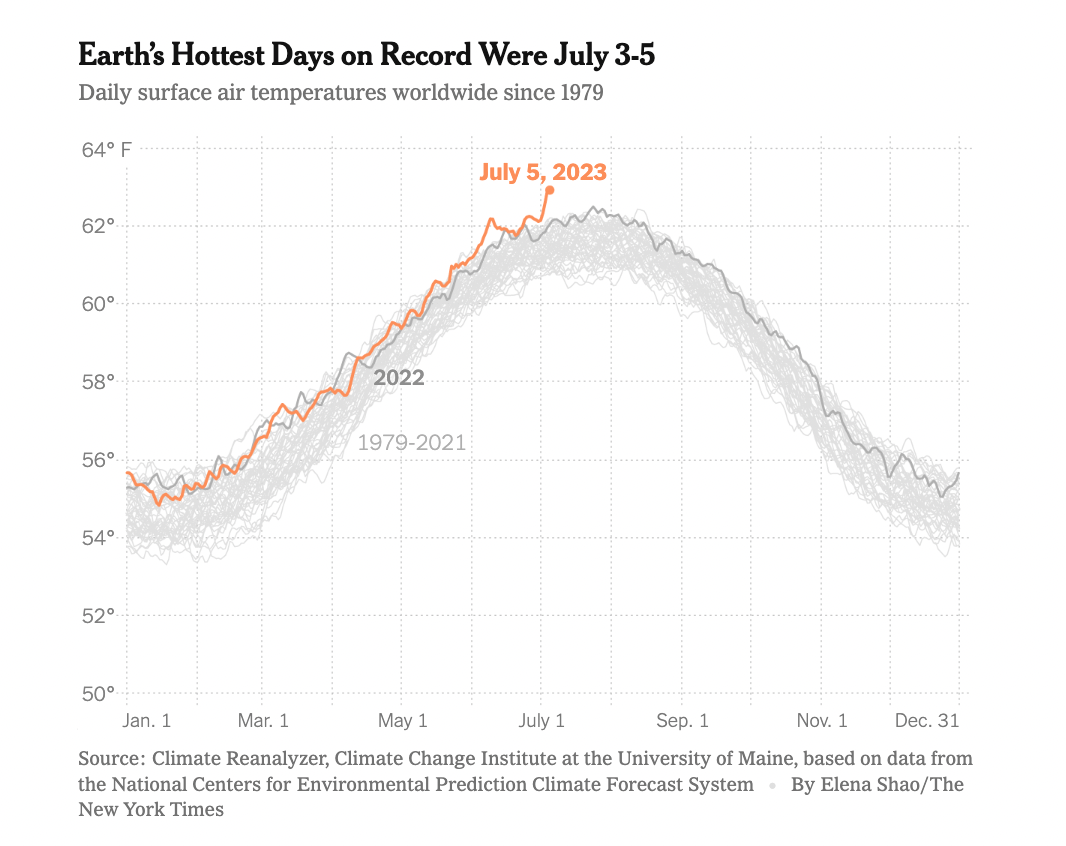

Climate change combined with this year’s El Niño set a new record for worldwide heat. Global temperatures reached 62.92 degrees Fahrenheit or 17.18 degrees Celsius last Tuesday—nearly a full degree Celsius above the average between 1979 and 2000 and a sign that the Earth is heating up more rapidly than anticipated.

The International Maritime Organization (IMO), the UN body that regulates global shipping, gathered last week for a highly anticipated set of negotiations about curtailing the industry’s emissions. The talks resulted in an agreement to reach net-zero shipping “by or around” 2050—a compromise harshly criticized by the international climate community for remaining too lax to meet emissions reduction goals and failing to include firm interim targets.

The White House published a congressionally mandated report on solar geoengineering. The Biden administration outlined a potential research program on solar radiation modification (SRM), a controversial idea that involves blocking out a portion of sunlight to cool the atmosphere.

The UK is grappling with its commitment to spend $14.8B on climate finance. Officials refuted claims that it is dropping this pledge after a government report found that meeting the climate funding goal would “squeeze out room” for supporting other humanitarian work.

Ford, General Motors, and other Western car companies are committing billions of dollars in deals with lithium mining companies, bypassing traditional suppliers and in an effort to avoid raw material shortages that could hamper electric vehicle goals.

The Biden administration's green hydrogen plans face challenges due to inadequate water supply as drought-prone Corpus Christi, Texas, a proposed site for a clean hydrogen hub, would also require the installation of seawater desalination plants.

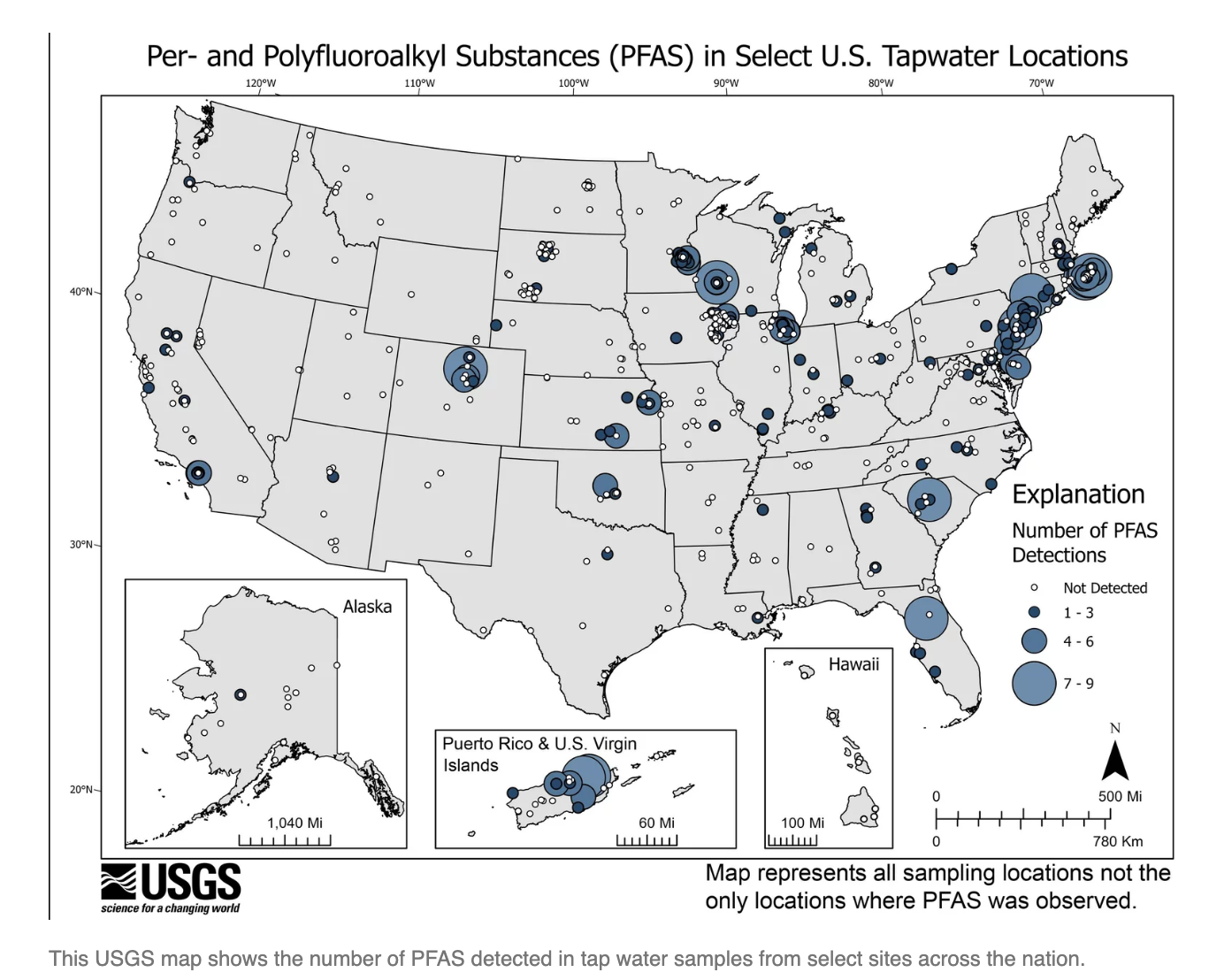

At least 45% of tap water in the US could be contaminated with some form of PFAS. The study from the U.S. Geological Survey is the first broad-scale attempt to compare levels of these”forever chemicals” in both public and private supplies of tap water.

In the Bering Sea, the disappearance of 10 billion snow crabs over the past few years is threatening Indigenous communities, local government functions, and fishing operations in Alaska.

New research casts doubt on the emissions-reduction potential of diesel alternatives made from phytoplankton. Microalgae-derived biodiesel may actually emit more carbon during production and use than petroleum-based diesel. The life cycle assessment comes after Exxon began quietly withdrawing from its highly-publicized, 14-year algae research efforts in December 2022.

U.S. truck manufacturers reached an agreement to accept California’s plan to ban sales of new diesel big rigs by 2036. The deal aims to avoid costly litigation by major industry players and maintain a nationwide standard for truck pollution rules.

Norge Mining in Norway discovered a huge phosphate rock deposit which contains enough minerals to meet the global demand for batteries and solar panels for the next 100 years.

Cambridge gets smart on energy, becoming the first city to require net zero emissions

Scaling new heights or hitting a wall? The unsettling reality of vertical farming

No more (natural) gas-lighting—extreme weather challenges the reliability of gas

Searing South: Deadly 'heat dome' punishes US south and Mexico, amplifying heat hazards as 1 in 4 US households are at risk of power shut-offs even amid extreme temperatures

Shah's green-energy gambit: Juggling $400 billion amid shadows of “Solyndra PTSD”

Ezra Klein Show unpacks the complexities of the Inflation Reduction Act with green energy expert, Robinson Meyer

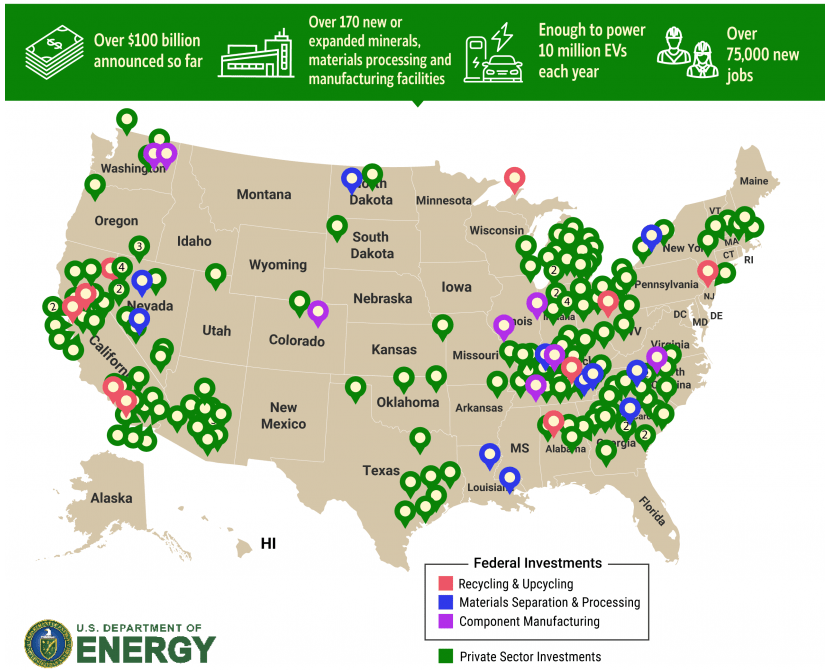

Plot Biden's green programs with this map of the billions invested in American-made batteries, EVs, solar, and wind

Human evolution vs. climate change: How our unique heat-fighting abilities may not be enough to combat escalating global temps

💡 Global ClimateTech Bootcamp: Apply by the end of the day today, July 10, to this unique program designed to help founders take the next step toward bringing impactful, innovative climate solutions to the climate tech ecosystem.

🗓️ AWS State of Climate Tech VC: Register to join Sophie, Lowercarbon, Amogy, and more at this panel and happy hour on July 13 in NYC on the state of climate tech investment and tips for founders who are fundraising.

💡 ClimateHack Meetups Ambassadors: Apply to ClimateHack’s ambassador program, which brings founders, investors, and professionals together to accelerate investment and collaboration within climate tech across 11 cities, by Aug 15.

💡 Environmental Tech Lab: Apply by Aug 23 to the NYC DEP and Partnership Fund of NYCs’ inaugural lab for a chance to pitch an early or growth stage tech startup idea focused on helping the DEP utilize data to improve water operational efficiency.

💡 Climate Change Investment Initiative (2c2i): Apply by Sept 15th to Freshwater Advisors and the Exelon Foundations’ 2c2i initiative for promising climate tech early startups for a chance to win to $300,000 in equity funding.

Business Development & Platform Associate @Keyframe

Founder in Residence, Post CO2 Capture Value Chain @Deep Science Ventures

Founder in Residence, CO2 Capture Process @Deep Science Ventures

Credit/Lending Business Development Consultant @Pearl Certification

Principal @The Ad Hoc Group

Executive Assistant/Operations Manager @The Ad Hoc Group

Director, Public Policy @Carbon Cure Technologies

Clean Energy Engineering Intern @Bloc Power

Environmental and Social Impact Analyst Intern @Bloc Power

Sustainability Specialist @Earthjustice

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

The International Maritime Organization's first carbon tax ships out

Trump’s coal push ignores economic reality and attractive alternatives

The tariffs' toll, explained sector-by-sector