🌎 Q1 2025 roundup: top deals, exits, and new funds

Investors hope to set off a chain reaction with new nuclear funding

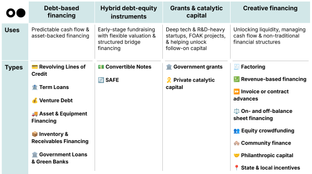

We’ve said it before, and we’re saying it again: the climate capital stack is getting more sophisticated. Founders who can leverage the capital stack wield a major advantage — strategically, financially, and commercially. But let’s not get ahead of ourselves. First things first, who are these sophisticated investors, and how can founders navigate to a match?

To support, we’ve been tracking the who’s who of the climate capital stack for the past few years. And now, we’re excited to announce the launch of our new tool to help founders and investors navigate the evolving landscape: an interactive climate capital stack market map.

The Climate Capital Stack tool makes exploring and understanding climate tech investors easier than ever before. Now, you can visualize who sits where across the stack, from early-stage venture capitalists to the heavy hitters in private equity and more. The clickable interface allows you to filter the investor list based on investor type and geographical location. You can also quickly search for specific investors to learn more about them.

We’ve refreshed our list and methodology for 2024, but those included remain the most active supporters of climate tech deals, quantitatively speaking. Whether you’re a founder looking for investors, an LP identifying potential fund investments, or even an investor searching for potential co-investors, this tool is for you.

👉 See the The Climate Capital Stack market map here and use it to:

Want to see your name in lights? Click ‘Submit or Edit Profile’ on the page, or click here. Fill-out the form, the Sightline team will then check that you meet the criteria, et voila!

And to be sure, this is a public version of what is available to Sightline clients. It only includes investors that have submitted their profile for consideration. On the Sightline Climate platform, clients will find a full Market Map showing all climate tech investors and clicks take the user to an Investor Profile that shows their deal history, investment preferences for stage and technology, portfolio companies, co-investors, rankings, and more.

To see this coverage or explore Sightline data and analysis on climate tech sector commercialization and projects, request a demo today.

Here’s how we defined investor types, and keep scrolling for more on our methodology.

Venture Capital: Investing in early-stage companies

Growth: Investing in growth-stage or mature private companies

Infrastructure: Investing in assets or projects

Corporate VC: Venture arm or fund associated with a corporation

Listed investment firms included in 2024’s Climate Capital Stack have submitted a profile to Sightline Climate via the link on this page, and meet the following requirements:

See a fund that’s missing? Have a tweak for an existing profile? Now you can directly edit and submit new profiles for consideration using your valid fund email address.

Other feedback? Musings? Favorite emojis? Reach out, we’d love to hear from you! As our venture namesake brethren like to say… let us know how we can be helpful 😉.

Want to go further? Request a demo for Sightline Climate, or reach out directly to [email protected] to dive deeper into markets and players, and behind-the-scenes data cuts.

Shoutout to John Tan, William Tate, and Alice Chan for their help updating the climate capital stack.

Investors hope to set off a chain reaction with new nuclear funding

A Q&A with Precursor's David Yeh and Mark1's Julian Ryba-White, new strategic partners in the ecosystem

What’s actually working while the rest of the climate capital stack stutters