🌎 Coal hard facts #241

Trump’s coal push ignores economic reality and attractive alternatives

Experiencing a climate disaster first-hand is one of the top factors drawing talent into climate tech

Happy Monday!

ICYMI: On Friday we dove into how tax equity investing works, the changes to clean energy tax credits in the Inflation Reduction Act, and why the nuances of US tax code are so important for climate tech deployment.

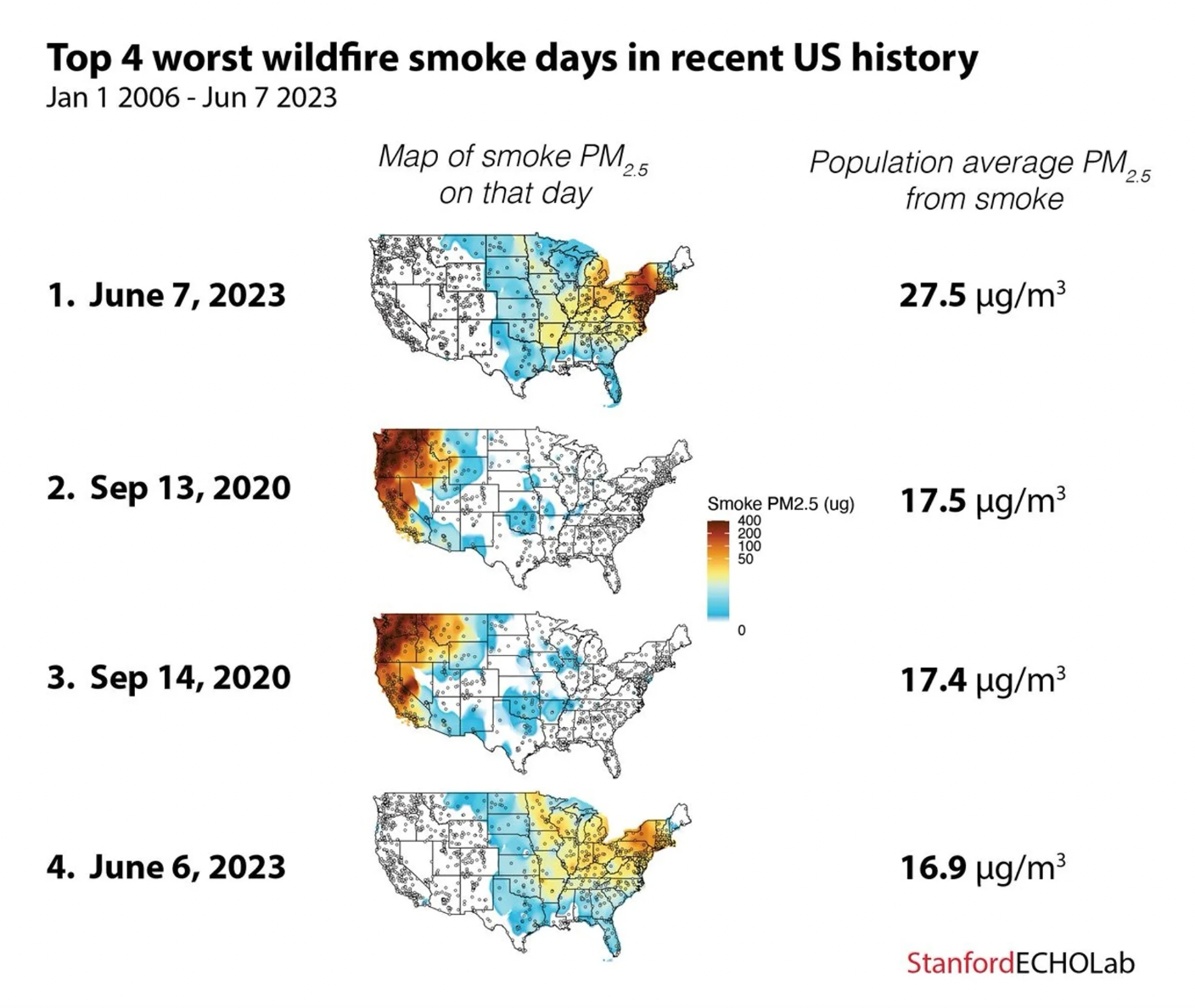

The East Coast of the US was choked by wildfire smoke last week, reminding many in the tech industry of San Francisco’s orange skies in September 2020. Fires on the West Coast were a catalyst for some climate tech. How will increasingly frequent and widespread climate events influence other regions?

Meanwhile, the UK bars fossil fuel companies from greenwashing ads. GM is the latest automaker to join the Tesla charging network, and ocean temperatures are starting from a warmer baseline than ever before as El Niño brings the heat.

In deals this week, carbon removal pulls in $100M. Lithium-ion battery tech attracts $50M for and mycelium-derived textiles raise $30M.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals, announcements, events & opportunities, or general curiosities for the newsletter at [email protected].💼

Find or share roles on our job board here.

The haze across much of the East Coast last Wednesday marked the worst day of wildfire pollution in US history—by far—and affected nearly one in five Americans.

The smoke rolled in from the 400+ wildfires in Quebec, which is already on track to break wildfire records this year. The West Coast may be all too accustomed to wildfires, but for the nation’s most densely populated corridors, the orange sky was an eerie shock that could become less and less novel.

The dangerously poor air quality in some regions made it clear that nowhere is “climate-proof.” Buffalo, NY, whose Mayor has tried to brand itself as a climate refuge, experienced some of the worst air pollution levels last week.

It can be difficult to fully wrap your head around the impacts of climate change when they are always happening somewhere else. Personal experiences with extreme weather events and climate disasters have spurred many into career-changing action.

Some of today’s climate tech startups can trace their inceptions to the September 2020 California wildfires, which turned San Francisco dark orange.

Even for those who had long been climate aware, the days of apocalyptic skies over their own seemingly safe haven became a turning point. Given SF’s density of tech talent, the wildfire wakeup call may have inadvertently been a bit of a recruiting event for climate tech. When we ask folks who’ve transitioned into climate tech about their motivation, The Day That SF’s Skies Turned Orange stands out near the top of the list alongside other climate-related disasters, and having a kid.

Whether founders lost everything to a fire themselves or watched loved ones fall victim to the flames, startups working on tech wildfire prevention, detection, management, and recovery have been concentrated on the West Coast over the last decade.

Innovators: Mast Reforestation , Frontline Wildfire Defense, Firemaps, Gridware, Earthforce, Kettle, Pano AI

New York and the rest of the East Coast are in for more frequent bouts of blanketing smoke, and the truth is nearly everyone will experience the effects of a warming climate more often in the coming years. As climate disasters become a more common part of life, expect more talent rallying to answer the call.

💨 Charm Industrial, a San Francisco, CA-based carbon removal company injecting bio-oil, raised $100M in Series B funding from Elad Gil, Exor, General Catalyst, Kinnevik, Lowercarbon Capital, and Thrive Capital.

🔋 Forge Nano, a Louisville, CO-based provider of nano-coating technology for lithium-ion batteries, raised $50M in Series C funding from Ascent Hydrogen Fund, Catalus Capital, Hanwha Solutions, and OIC.

🌱 SustainCERT, a Luxembourg, Luxembourg-based carbon emissions accounting and verification platform, raised $37M in Series B funding from Citizen Capital, Hartree Partners, Innovacom, Microsoft Climate Innovation Fund, and Partech.

👕 Ecovative Design, a Green Island, NY-based provider of mycelium technology, raised $30M in Series E funding from AiiM Partners, FootPrint Coalition, Standard Investments, and Viking Global Investors.

💨 OXCCU, an Oxford, United Kingdom-based developing technology to make fuels, chemicals and plastics from captured CO2, raised $23M in Series A funding from Aramco Ventures, Clean Energy Ventures, Aramco Ventures, Eni Next, United Airlines Ventures, Braavos Capital, Kiko Ventures, University of Oxford, Trafigura, TechEnergy Ventures, and Doral Energy-Tech Ventures.

🏠 Woltair, a Prague, Czech Republic-based heat pump installation and technician platform, raised $22M in Series A funding from ArcTern Ventures, Fifth Wall, Inven Capital, KAYA, and The Westly Group.

🌱 Sourcemap, a New York, NY-based developer of an end-to-end supply chain visibility platform, raised $20M in Series B funding from Energize Ventures and The E14 Fund.

🛵 River, a Bengaluru, India-based electric 2-wheel manufacturer, raised $15M in Series B funding from Al-Futtaim Group.

🥩 MyForest Foods, a Green Island, NY-based developer of plant-based meat from mycelium, raised $15M in Series A funding from Ecovative Design.

⚡ Amogy, a Brooklyn, NY-based developer of ammonia for heavy transportation, raised $11M in Series B funding from Mitsubishi Corporation, Mitsubishi Heavy Industries, Marunouchi, and Synergy Marine.

⚒️ Magrathea Metals, a San Francisco, CA-based producing carbon neutral magnesium metal from seawater and brines, raised $10M in Seed funding from Capricorn Investment Group, VoLo Earth Ventures, Counteract, EQT Foundation, Exor, Valor Equity Partners, and angel investors.

💨 Nori, a Seattle, WA-based soil carbon removal marketplace, raised $6M from Cargill, M13, Placeholder, and Toyota Ventures.

⚡ Oort Energy, a Bristol, United Kingdom-based hydrogen electrolyzer developer, raised $6M in Seed funding from Energy Revolution Ventures and TRIREC.

☀️ Solar Monkey, an Amsterdam, Netherlands-based solar panel installation software provider, raised $4M in Growth funding from Helen Ventures, Eneco, 4impact, and Innovation Quarter.

⚡ Nium, a Harwell, United Kingdom-based developer of on-site green ammonia, raised $3M in Seed funding from AgFunder, DCVC, and Carbon13.

🌱 sentra.world, a Bengaluru, India-based emissions management platform for industrials, raised $2M in Seed funding from Avaana Capital, RPG Ventures, and Golden Sparrow Ventures.

🔋 About:Energy, a London, UK-based battery testing intelligence platform, raised $2M from HighSage Ventures, Vireo Ventures, Plug and Play, and Electric Revolution Ventures.

🔋 TeraWatt Technology, a San Francisco, CA-based lithium-ion battery manufacturer, raised an undisclosed amount in Series C funding from Development Bank of Japan, GLIN Impact Capital, INPEX Corporation, JAFCO, JIC Venture Growth Investments, Khosla Ventures, Mori Trust, Rakuten Capital, and Temasek Holdings.

🏠 Flume, a San Luis Obispo, CA-based a residential water use monitoring platform, raised an undisclosed amount in funding from HCAP Partners.

🏭 Boston Metal, a Woburn, MA-based green steel producer, raised $20M from International Finance Corporation.

🚗 RevFin, a Delhi, India-based EV lending platform, raised $5M from U.S. International Development Finance Corp.

⚒️ American Battery Materials, a Greenwich, CT-based minerals exploration and development company focused on direct lithium extraction, announced a SPAC merger with Seaport Global Acquisition II Corp.

IrriWatch, a Netherlands-based provider of irrigation intelligence management software, was acquired by Hydrosat, a thermal data and satellite analytics company.

Just Climate, a London, UK-based climate investment fund established by Generation Investment Management, raised a $1.5B fund to invest in hard-to-abate sectors.

Positive Ventures, a Brazil-based investment firm, raised a $25M impact fund to invest in pre-seed and seed stages in Latin American founders building tech-driven solutions in climate change, education, healthcare and financial services.

IQ Capital, a Cambridge, UK-based investment firm, raised a $200M fund to invest in early-stage deeptech companies.

Share new deals and announcements with us at [email protected]

On Monday, the first US youth climate trial will make its way to the courtroom in a suit against the State of Montana that argues its support of fossil fuels threatens young people’s right to a “clean and healthful environment laid out in the state constitution..

In a big step for the city’s composting infrastructure, the New York City Council approved a bill requiring residents to compost their food waste. The mandate will begin rolling out in the fall and has strong potential to reduce methane emissions as roughly half of NYC’s waste is organic matter.

The flight of major home insurance companies continues. Allstate joined State Farm in ending homeowners insurance in California, due in part to the climate change-related weather catastrophes.

GM announced their EVs will gain access to the Tesla network, following Ford’s announcement last month. The company also shared plans to eventually produce EVs with charging ports made for Tesla chargers. With the three largest auto-OEMs in the US behind the plug, this essentially locks in Tesla chargers as the US standard moving forward.

In a win against greenwashing, the UK advertising regulation branch banned ‘misleading’ ads from fossil fuel companies. So far, the regulator has banned certain ads from large oil companies, including Shell, Repsol, and Petronas.

Summer in the Arctic is projected to be ice-free a decade earlier than previously predicted, according to a new report. The Arctic ice helps protect us from extreme weather events across the globe, so a speeding arctic decline would likely expedite related climate changes.

The heat continues as scientists confirmed El Niño has started and will likely contribute to additional heat across the globe. Currently, the ocean temperatures are warmer than any previous El Niño event, which is likely to intensify tropical storm activity and heat waves—both on land and in the sea.

BNEF’s new EV outlook report flags peak oil demand for road transport by 2030 as EV sales race ahead.

The wildfire smoke over NYC could be clearly seen even from space.

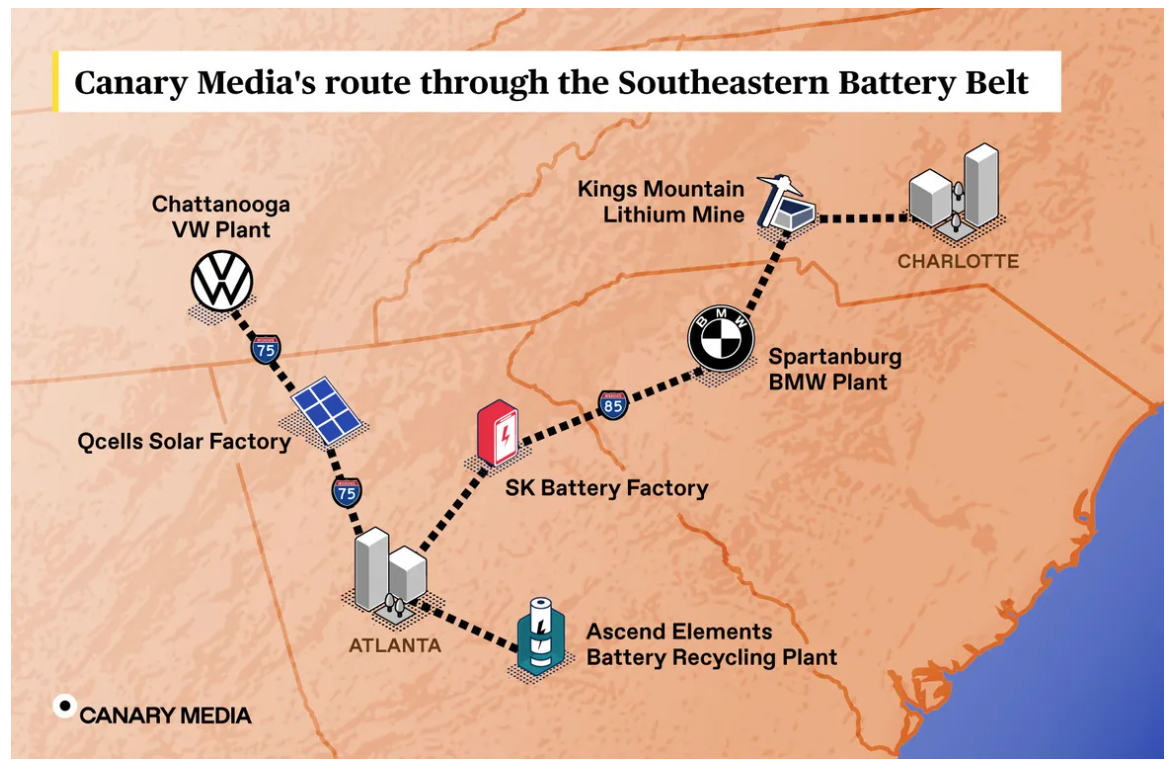

Georgia’s green machine: cultivating a cleantech workforce.

The Rust Belt is out of fashion and the Battery Belt is now in vogue.

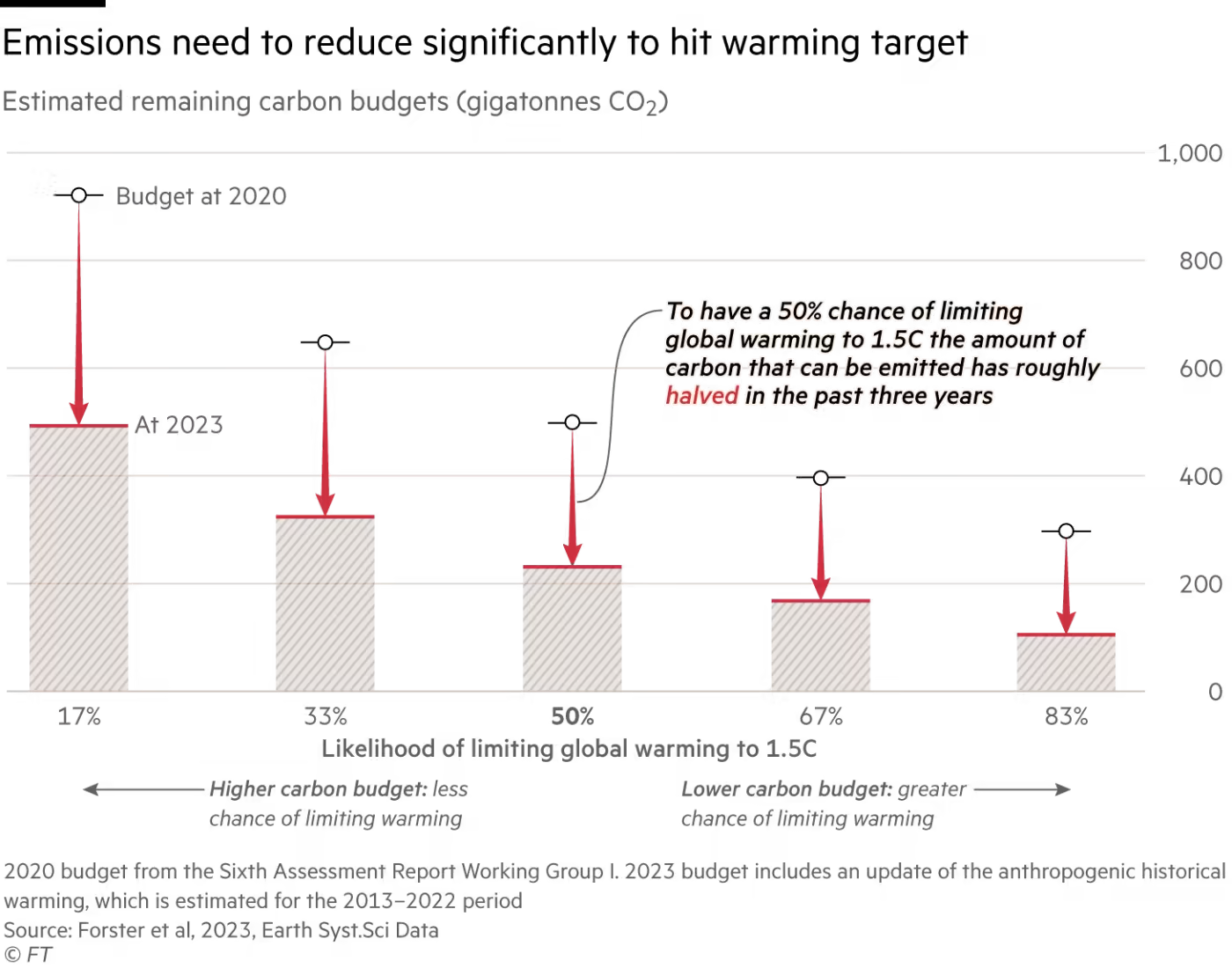

All of our extravagant carbon spending means that the remaining carbon budget to keep below the 1.5C target has halved in the past three years.

Look up “greenwashing” in the dictionary… COP28 host UAE hires PR firms in an attempt to improve climate image.

Ocean alkalinity enhancement research initiative, Carbon to Sea lifts off to sink carbon into the ocean.

Activate announces the fellowship’s newest cohort of 46 science entrepreneurs who are turning their breakthroughs into businesses including AI for climate tech training, cladding for steel life extension, and microbial rare earth element separations.

A guide to software in climate tech. Yes, those bits!

🗓️ Out in Climate: Join for a Pride Month happy hour on June 13th, hosted by Tishman Speyer at their gorgeous Studio space at Rockefeller Center!

🗓️ Demand Creation Playbook: Join Blackhorn Ventures, UTTR, and AWS on June 22nd for an interactive session on Go To Market for B2B climate tech companies, profiling Datch’s combination of Product Led Growth and Enterprise Sales to drive interest and awareness and close sales.

🗓️ GreenFin23: Despite its imperfections, ESG impacts billions of investments. Join on June 26-28th for a convening of influential finance, investment and sustainability professionals to share insights, address key challenges and showcase leading sustainable financial products and services.

💡 MENA Google for Startups Accelerator: Climate Change: Apply by July 7th to Google’s new clean-tech accelerator for startups in the Middle East and Africa, a 10-week, equity-free hybrid program for Seed to Series A startups.

Director of ABM & Demand Generation @ClimateAi

Climate Solutions Manager, @ClimateAi

Innovation Program Manager, @Urban Future Lab

Business Development - C&I Renewable Energy @InRange Energy

MBA Finance & Strategy Intern @InRange Energy

Founder In Residence, Zero Emission Steel @Deep Science Ventures

VP, Clean Energy Solar Manufacturing @Boundary Stone

Principal, Carbon Markets @RMI

Executive Assistant to the CIO @The Nature Conservancy

Investment Operations Manager @The Nature Conservancy

Investment Analyst @The Nature Conservancy

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

Trump’s coal push ignores economic reality and attractive alternatives

The tariffs' toll, explained sector-by-sector

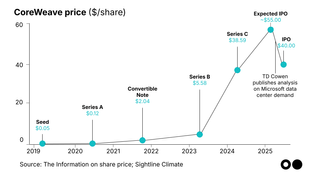

The AI company’s debut shows where the chips are falling